Definition, Solved Example Problems | Applied Statistics - Test of adequacy for an Index Number | 12th Business Maths and Statistics : Chapter 9 : Applied Statistics

Chapter: 12th Business Maths and Statistics : Chapter 9 : Applied Statistics

Test of adequacy for an Index Number

Test

of adequacy for an Index Number

Index numbers are

studied to know the relative changes in price and quantity for any two years

compared. There are two tests which are used to test the adequacy for an index

number. The two tests are as follows,

(i) Time Reversal Test

(ii) Factor Reversal

Test

The criterion for a good

index number is to satisfy the above two tests.

Time Reversal Test

It is an important test

for testing the consistency of a good index number. This test maintains time

consistency by working both forward and backward with respect to time (here

time refers to base year and current year). Symbolically the following

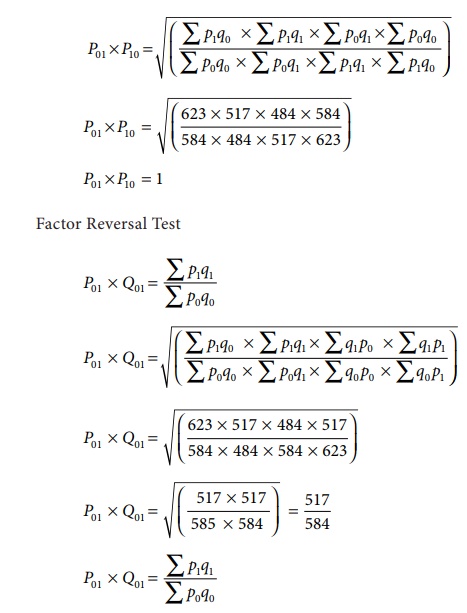

relationship should be satisfied, P01 × P10 =1

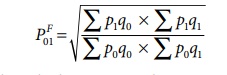

Fisher’s index number

formula satisfies the above relationship

when the base year and current year

are interchanged, we get

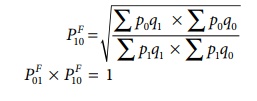

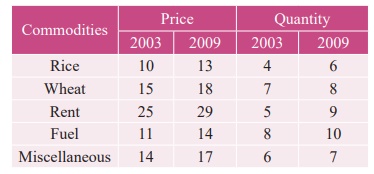

Factor Reversal Test

This is another test for

testing the consistency of a good index number. The product of price index

number and quantity index number from the base year to the current year should

be equal to the true value ratio. That is, the ratio between the total value of

current period and total value of the base period is known as true value ratio.

Factor Reversal Test is given by,

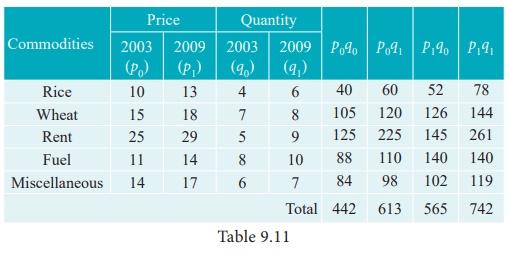

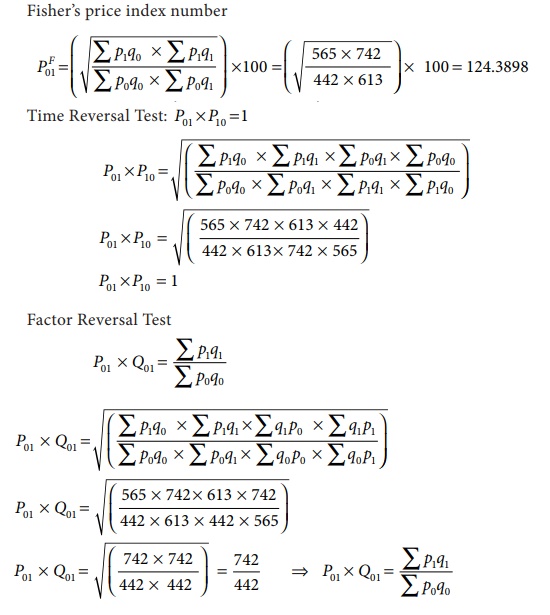

Example

9.12

Calculate Fisher’s price

index number and show that it satisfies both Time Reversal Test and Factor

Reversal Test for data given below.

Solution

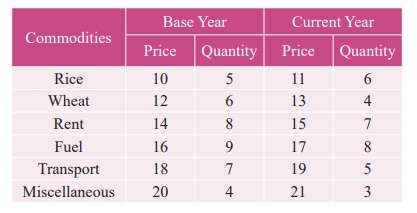

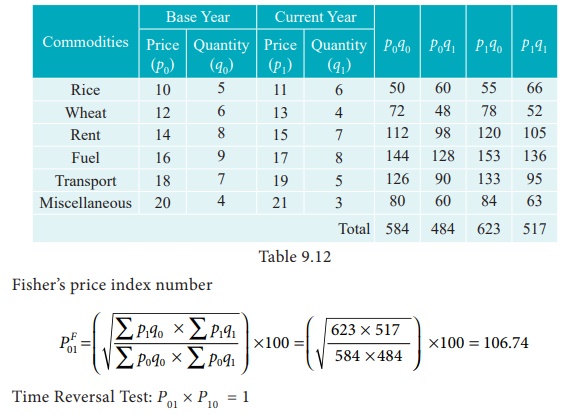

Example

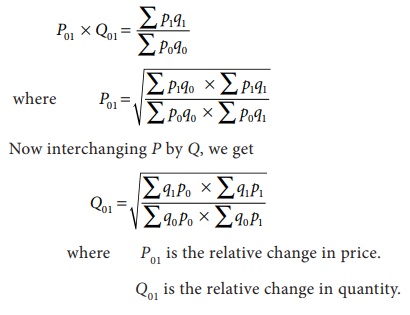

9.13

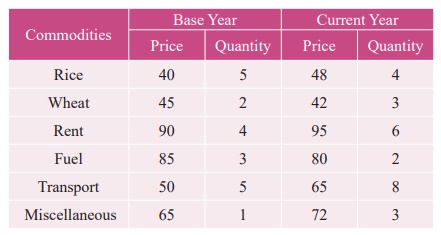

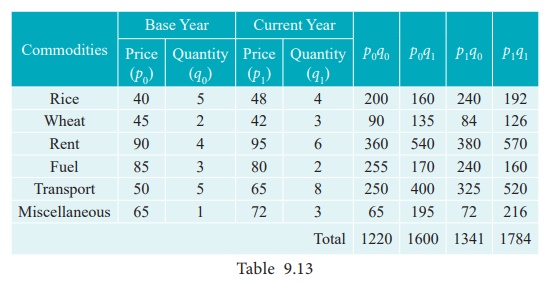

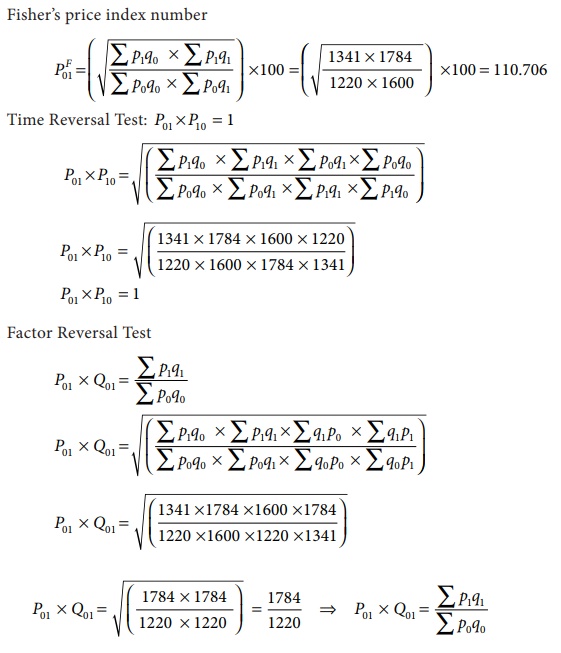

Calculate Fisher’s price

index number and show that it satisfies both Time Reversal Test and Factor

Reversal Test for data given below.

Solution

Example

9.14

Construct Fisher’s price

index number and prove that it satisfies both Time Reversal Test and Factor

Reversal Test for data following data.

Solution

Related Topics