Banking - Reserve bank of India and industrial finance | 12th Economics : Chapter 6 : Banking

Chapter: 12th Economics : Chapter 6 : Banking

Reserve bank of India and industrial finance

Reserve bank of India and industrial finance

Though industries get finance from commercial banks, the quantum

and the term will be very much limited generally. Commercial banks lend for

short term only, as they get only short-term deposits from the public. Further

lending to industries is only a fragment of the total lending by the banks.

Hence, there is a need and urgency of establishing long-term

credit facilities to industries.The institutional set-up in India for financing

and promoting industries are as follows

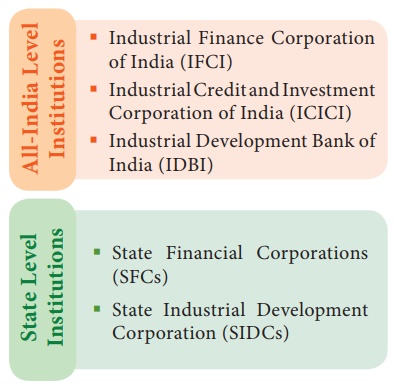

1. Institutional Set-up:

2. All-India Level Institutions:

1. Industrial Finance Corporation of India (IFCI)

This was first in the chain of establishment of financial

corporations to provide financial assistance for industrial development. This

was established on July 1, 1948 under the Act of the Parliament. IFCI provides

assistance to the industrial concerns in the following ways:

i) Long-term loans; both in rupees and foreign currencies.

ii) Underwriting of equity, preference and debenture issues.

iii) Subscribing to equity, preference and debenture issues.

iv) Guaranteeing the deferred payments in respect of

machinery imported from abroad or purchased in India; and

v) Guaranteeing of loans raised in foreign currency from

foreign financial institutions.

Financial assistance of IFCI can be availed by any Limited Company

in the public, private or joint sector, or by a co-operative society

incorporated in India, which is engaged or proposes to be engaged in the

specified industrial activities. Such financial assistance will be available

for the setting up of new industrial projects and also for the expansion

diversification, renovation or modernisation of existing ones. The IFCI also

provides financial assistance on concessional terms for setting up industrial

projects in industrially less developed districts in the States or Union

Territories notified by the Central Government,

The IFCI raises its resources by way of (a) issue of bonds in the

market; (b) borrowing from Industrial Development Bank of India and the Central

Government; (c) foreign credit secured from foreign financial institutions and

borrowings in the international capital markets.

2. Industrial Credit and Investment Corporation of India (ICICI)

This was set up on 5th January 1955 as a joint- stock company on

the advice given by a three-man mission sponsored by the World Bank and The

Government of USA to the Government of India. The principal purpose of this

institution is to channelize the World Bank funds to industry in India and also

to help build up a capital market. Initially the capital of ICICI was held by

private companies, institutions and individuals. But now, a very large part of

its equity capital is held by public sector institutions, such as banks, LIC,

GIC and its subsidiaries, as ‘this private institution was nationalized.

The significant feature of the operations of ICICI is the foreign

currency loans sanctioned by this institution to industries. Since its

inception, nearly 50 per cent of its disbursement had been in foreign currencies.

This is possible because of the facility it enjoys of raising funds in foreign

currencies. The World Bank has been the single largest source of such funds.

Since 1973, the ICICI has entered the international capital markets also for

raising foreign currency loans.

The major portion of its rupee resources is raised by way of

debentures in the capital market. The ICICI also borrows from the Industrial

Development Bank of India and the Government. The major portion of its

assistance has gone to the private sector.

3. Industrial Development Bank of India (IDBI)

The Industrial Development Bank of India has been conceived with

the primary object of creating an apex institution to co- ordinate the

activities of other financial institutions, including banks. The Development

Bank was a wholly owned subsidiary of the Reserve Bank of India upto February

15, 1976. It was delinked from the RBI with effect from February 16, 1976 and

made an autonomous corporation fully owned by the Government of India.

Functions of IDBI: The functions of IDBI fall into two

groups (i) Assistance to other financial institutions; and (ii) Direct

assistance to industrial concerns either on its own or in participation with

other institutions. The IDBI can provide refinance in respect of term loans to

industrial concerns given by the IFC, the SFCs, other financial institutions

notified by the Government, scheduled banks and state cooperative banks.

A special feature of the IDBI is the provision for the creation of

a special fund known as the Development Assistance Fund. The fund is intended

to provide assistance to industries which require heavy investments with low

anticipated rate of return. Such industries may not be able to get assistance

in the normal course. The financing of exports was also undertaken by the IDBI

till the establishment of EXIM BANK in March, 1982.

3. State Level Institutions

1. State Financial Corporation (SFCs)

The government of India passed in 1951 the State Financial

Corporations Act and SFCs were set up in many states. The SFCs are mainly

intended for the development of small and medium industrial units within their

respective states. However, in some cases they extend to neighboring states as

well.

The SFCs provide loans and underwriting assistance to industrial

units having paid-up capital and reserves not exceeding ₹ 1 crore. The maximum

amount that can be sanctioned to an industrial concern by SFC is ₹ 60 lakhs.

SFCs depend upon the IDBI for refinance in respect of the term

loans granted by them. Apart from these, the SFCs can also make temporary

borrowings from the RBI and borrowings from IDBI and by the sale of bonds.

2. State Industrial Development Corporations (SIDCOs)

The Industrial Development Corporations have been set up by the

state governments and they are wholly owned by them. These institutions are not

merely financing agencies; they are entrusted with the responsibility of

accelerating the industrialization of their states.

SIDCOs provide financial assistance to industrial concerns by way

of loans guarantees and underwriting of or direct subscriptions to shares and

debentures. In addition to these, they undertake various promotional

activities, such as conducting techno-economic surveys, project identification,

preparation of feasibility studies and selection and training of entrepreneurs.

They also promote joint sector projects in association with private promoter in

such type of projects. SIDCOs take 26 percent, private co -promoter takes 25 percent

of the equity, and the rest is offered to the investing public. SIDCOs

undertake the development of industrial areas by providing all infrastructural

facilities and initiation of new growth centers. They also administer various

State government incentive schemes. SIDCOs get refinance facilities form IDBI.

They also borrow through bonds and accept deposits.

Related Topics