Banking - Central Bank: Methods of Credit Control | 12th Economics : Chapter 6 : Banking

Chapter: 12th Economics : Chapter 6 : Banking

Central Bank: Methods of Credit Control

Methods of Credit Control

I. Quantitative or General Methods:

1. Bank Rate Policy:

The bank rate is the rate at which the Central Bank of a country

is prepared to re-discount the first class securities. It means the bank is

prepared to advance loans on approved securities to its member banks. As the

Central Bank is only the lender of the last resort the bank rate is normally

higher than the market rate. For example: If the Central Bank wants to control

credit, it will raise the bank rate. As a result, the deposit rate and other

lending rates in the money-market will go up. Borrowing will be discouraged,

and will lead to contraction of credit and vice versa.

2. Open Market Operations:

In narrow sense, the Central Bank starts the purchase and

sale of Government securities in the money market.

In Broad Sense, the Central Bank purchases and sells not

only Government securities but also other proper eligible securities like bills

and securities of private concerns. When the banks and the private individuals

purchase these securities they have to make payments for these securities to

the Central Bank.

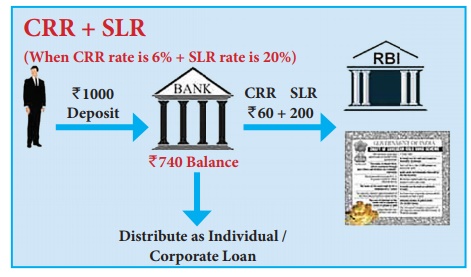

3. Variable Reserve Ratio:

a) Cash Reserves Ratio:

Under this system the Central Bank controls credit by changing the

Cash Reserves Ratio. For example, if the Commercial Banks have excessive cash

reserves on the basis of which they are creating too much of credit,this will

be harmful for the larger interest of the economy. So it will raise the cash

reserve ratio which the Commercial Banks are required to maintain with the

Central Bank.

Similarly, when the Central Bank desires that the Commercial Banks

should increase the volume of credit in order to bring about an economic

revival in the economy. The central Bank will lower down the Cash Reserve Ratio

with a view to expand the lending capacity of the Commercial Banks.

Variable Cash Reserve Ratio as an objective of monetary policy was

first suggested by J.M. Keynes. It was first followed by Federal Reserve System

in United States of America. The commercial banks as per the statute has to

maintain reserves based on their demand deposit and fixed deposit with central

bank is called as Cash Reserve Ratio.

If the CRR is high, the commercial bank’s capacity to create

credit will be less and if the CRR is low, the commercial bank’s capacity to

create credit will be high.

b) Statutory Liquidity Ratio:

Statutory Liquidity Ratio (SLR) is the amount which a bank has to

maintain in the form of cash, gold or approved securities. The quantum is specified

as some percentage of the total demand and time liabilities (i.e., the

liabilities of the bank which are payable on demand anytime, and those

liabilities which are accruing in one month’s time due to maturity) of a bank.

II. Qualitative or Selective Method of Credit Control:

The qualitative or the selective methods are directed towards the

diversion of credit into particular uses or channels in the economy. Their

objective is mainly to control and regulate the flow of credit into particular

industries or businesses. The following are the frequent methods of credit

control under selective method:

1.

Rationing of Credit

2.

Direct Action

3.

Moral Persuasion

4.

Method of Publicity

5.

Regulation of Consumer’s Credit

6.

Regulating the Marginal Requirements on Security Loans

1. Rationing of Credit

This is the oldest method of credit control. Rationing of credit

as an instrument of credit control was first used by the Bank of England by the

end of the 18th Century. It aims to control and regulate the purposes for which

credit is granted by commercial banks. It is generally of two types.

a) The variable portfolio ceiling: It refers to the

system by which the central bank fixes ceiling or maximum amount of loans and

advances for every commercial bank.

b) The variable capital asset ratio: It refers to the

system by which the central bank fixes the ratio which the capital of the

commercial bank should have to the total assets of the bank.

2. Direct Action

Direct action against the erring banks can take the following

forms.

a) The central bank may refuse to altogether grant discounting

facilities to such banks.

b) The central bank may refuse to sanction further financial

accommodation to a bank whose existing borrowing are found to be in excess of

its capital and reserves.

c) The central bank may start charging penal rate of interest on

money borrowed by a bank beyond the prescribed limit.

3. Moral Suasion

This method is frequently adopted by the Central Bank to exercise

control over the Commercial Banks. Under this method Central Bank gives advice,

then requests. and persuades the Commercial Banks to co-operate with the

Central Bank in implementing its credit policies.

4. Publicity

Central Bank in order to make their policies successful, take the

course of the medium of publicity. A policy can be effectively successful only

when an effective public opinion is created in its favour.

5. Regulation of Consumer’s Credit:

The down payment is raised and the number of installments reduced

for the credit sale.

6. Changes in the Marginal Requirements on Security Loans:

This system is mostly followed in U.S.A. Under this system, the

Board of Governors of the Federal Reserve System has been given the power to

prescribe margin requirements for the purpose of preventing an excessive use of

credit for stock exchange speculation.

This system is specially intended to help the Central Bank in

controlling the volume of credit used for speculation in securities under the

Securities Exchange Act, 1934.

The Repo Rate and the Reverse Repo Rate are the frequently used

tools with which the RBI can control the availability and the supply of money

in the economy. RR is always greater than RRR in India

Repo Rate: (RR)

The rate at which the RBI is willing to lend to commercial banks

is called Repo Rate. Whenever banks have any shortage of funds they can borrow

from the RBI, against securities. If the RBI increases the Repo Rate, it makes

borrowing expensive for banks and vice versa. As a tool to control inflation,

RBI increases the Repo Rate, making it more expensive for the banks to borrow

from the RBI. Similarly, the RBI will do the exact opposite in a deflationary

environment.

Reverse Repo Rate: (RRR)

The rate at which the RBI is willing to borrow from the commercial

banks is called reverse repo rate. If the RBI increases the reverse repo rate,

it means that the RBI is willing to offer lucrative interest rate to banks to

park their money with the RBI. This results in a decrease in the amount of

money available for banks customers as banks prefer to park their money with

the RBI as it involves higher safety. This naturally leads to a higher rate of

interest which the banks will demand from their customers for lending money to

them.

Related Topics