Banking - Functions of Commercial Banks | 12th Economics : Chapter 6 : Banking

Chapter: 12th Economics : Chapter 6 : Banking

Functions of Commercial Banks

Functions of Commercial Banks:

Commercial banks are institutions that conduct business with

profit motive by accepting public deposits and lending loans for various

investment purposes.

The functions of commercial banks are broadly classified into

primary functions and secondary functions, which are shown in the picture

Functions of Commercial Banks

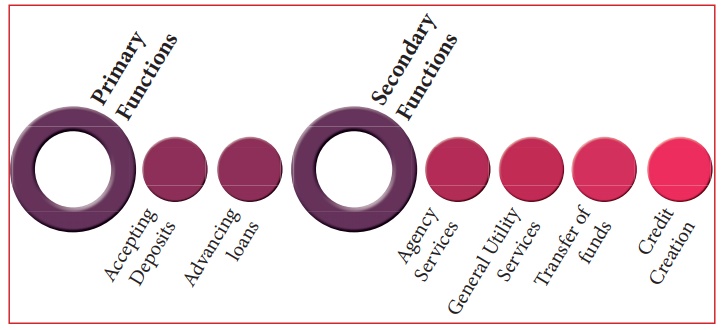

(a) Primary Functions:

1. Accepting Deposits

It implies that commercial banks are mainly dependent on public

deposits.

There are two types of deposits, which are discussed as follows

(i) Demand Deposits

It refers to deposits that can be withdrawn by individuals without

any prior notice to the bank. In other words, the owners of these deposits are

allowed to withdraw money anytime by writing a withdrawal slip or a cheque at

the bank counter or from ATM centres using debit card.

(ii) Time Deposits

It refers to deposits that are made for certain committed period

of time. Banks pay higher interest on time deposits. These deposits can be

withdrawn only after a specific time period by providing a written notice to

the bank.

2. Advancing Loans

It refers to granting loans to individuals and businesses.

Commercial banks grant loans in the form of overdraft, cash credit, and

discounting bills of exchange.

(b) Secondary Functions

The secondary functions can be classified under three heads,

namely, agency functions, general utility functions, and other functions.

1. Agency Functions: It implies that commercial banks act as

agents of customers by performing various functions.

(i) Collecting Cheques

Banks collect cheques and bills of exchange on the behalf of their

customers through clearing house facilities provided by the central bank.

(ii) Collecting Income

Commercial banks collect dividends, pension, salaries, rents, and

interests on investments on behalf of their customers. A credit voucher is sent

to customers for information when any income is collected by the bank.

(iii) Paying Expenses

Commercial banks make the payments of various obligations of

customers, such as telephone bills, insurance premium, school fees, and rents.

Similar to credit voucher, a debit voucher is sent to customers for information

when expenses are paid by the bank.

2. General Utility Functions: It implies that commercial banks provide

some utility services to customers by performing various functions.

(i) Providing Locker Facilities

Commercial banks provide locker facilities to its customers for

safe custody of jewellery, shares, debentures, and other valuable items. This

minimizes the risk of loss due to theft at homes. Banks are not responsible for

the items in the lockers.

(ii) Issuing Traveler’s Cheques

Banks issue traveler’s cheques to individuals for traveling

outside the country. Traveler’s cheques are the safe and easy way to protect

money while traveling.

(iii) Dealing in Foreign Exchange

Commercial banks help in providing foreign exchange to businessmen

dealing in exports and imports. However, commercial banks need to take the

permission of the Central Bank for dealing in foreign exchange.

3. Transferring Funds

It refers to transferring of funds from one bank to another. Funds

are transferred by means of draft, telephonic transfer, and electronic

transfer.

4. Letter of Credit

Commercial banks issue letters of credit to their customers to

certify their creditworthiness.

(i) Underwriting Securities

Commercial banks also undertake the task of underwriting

securities. As public has full faith in the creditworthiness of banks, public

do not hesitate in buying the securities underwritten by banks.

(ii) Electronic Banking

It includes services, such as debit cards, credit cards, and

Internet banking.

(c) Other Functions:

(i) Money Supply

It refers to one of the important functions of commercial banks

that help in increasing money supply. For instance, a bank lends ₹5 lakh to an

individual and opens a demand deposit in the name of that individual. Bank

makes a credit entry of ₹5 lakh in that account. This leads to creation of

demand deposits in that account. The point to be noted here is that there is no

payment in cash. Thus, without printing additional money, the supply of money

is increased.

(ii) Credit Creation

Credit Creation means the multiplication of loans and advances.

Commercial banks receive deposits from the public and use these

deposits to give loans. However, loans offered are many times more than the

deposits received by banks. This function of banks is known as ‘Credit Creation’.

(iii) Collection of Statistics:

Banks collect and publish statistics relating to trade, commerce

and industry. Hence, they advice customers and the public authorities on

financial matters.

Related Topics