Banking - Recent Advancements in Banking Sector | 12th Economics : Chapter 6 : Banking

Chapter: 12th Economics : Chapter 6 : Banking

Recent Advancements in Banking Sector

Recent Advancements in Banking Sector

1. E- Banking

Online banking, also known as internet banking, is an electronic

payment system that enables customers of a bank or other financial institution

to conduct a range of financial transactions through the financial

institution’s website. The online banking system typically connects to or be

part of the core banking system operate by a bank and is in contrast to branch

banking which was the traditional way customers accessed banking services.

Today, “virtual banks” (or “direct banks”) have only an internet

presence, which enables them to lower costs than traditional brick-and-mortar

banks.

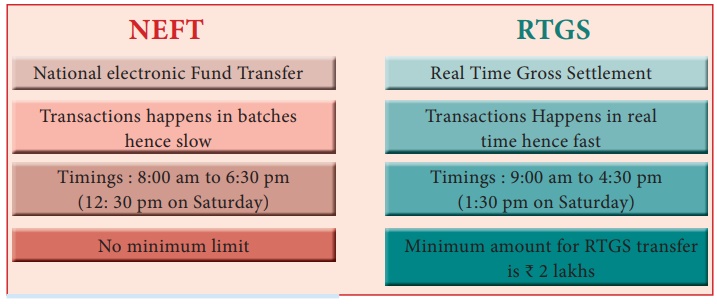

2. RTGS and NEFT

Inter Bank Transfer enables electronic transfer of funds from the

account of the remitter in one Bank to the account of the beneficiary

maintained with any other Bank branch. There are two systems of Inter Bank

Transfer - RTGS and NEFT. Both these systems are maintained by RBI. NEFT

operates in half hourly batches. Currently there are twenty three settlements

from 8 am to 7 pm on all working days including working Saturdays. Therefore,

the beneficiary can expect to get the credit for the transactions put through

between 8 am to 5.30 pm on all working days including working Saturdays on the

same day.

For transactions settled in the 6.30 and 7 pm batches on all working

days including working Saturdays, the credit will be afforded either on the

same day or on the next working day.

3. ATM (Automated Teller Machine)

ATMs transformed the bank tech system when they were first

introduced in 1967. The next revolution in ATMs is likely to involve

contactless payments. Much like Apple Pay or Google Wallet, soon we will be

able to conduct contactless ATM transactions using a smartphone.

Some ATM innovations are already available overseas. For example,

biometric authentication is already used in India, and its recognition is in

place at Qatar National Bank ATMs. These technologies can help overall bank

security by protecting against ATM hacks.

4. Paytm

Payments Bank. In August 2015, Paytm received a license from RBI

to launch a payments bank. The Paytm Payments Bank is a separate entity in

which founder Vijay Shekhar Sharma will hold 51% share, One97 Communications

holds 39% and 10% will be held by a subsidiary of One97 and Sharma.

5. Debit card and Credit Card

A Debit card is a card allowing the holder to transfer money

electronically from their bank account when making a purchase.

A credit card is a payment card issued to users (cardholders) to enable

the cardholder to pay a merchant for goods and services based on the

cardholder’s promise to the card issuer to pay them for the amounts so paid

plus the other agreed charges. The card issuer (usually a bank) creates a

revolving account and grants a line of credit to the cardholder, from which the

cardholder can borrow money for payment to a merchant or as a cash advance. In

other words, credit cards combine payment services with extensions of credit.

Complex fee structures in the credit card industry may limit customers’ ability

to shopping.![]()

6. Recent Issues

Once the borrower fails to make interest or principal payments for

90 days the loan is considered to be a non-performing asset (NPA). NPAs are

problematic for financial institutions since they depend on interest payments

for income. As on now the size of NPAs is estimated to be around 10 lakh

crores. As a result, the banks do not have adequate capital. Hence the

Government (of India) is forced to infuse capital to the banks by using poor

tax – payers money. Already more than a sum of ₹ 2 lakh crores have been

injected. During 2018 - 19, the GOI has infused ₹ 68,000 crores into the

banking system. Thus the NPAs ultimately affect the common people.

7. Merger of Banks

Union Cabinet decided to merge all the remaining five associate

banks of State Bank Group with State Bank of India in 2017. After the

Parliament passed the merger Bill, the subsidiary banks have ceased to exist.

Five associates and the Bharatiya Mahila Bank have become the part

of State Bank of India (SBI) beginning April 1, 2017. This has placed State

Bank of India among the top 50 banks in the world. The five associate banks

that were merged are State Bank of Bikaner and Jaipur (SBBJ), State Bank of

Hyderabad (SBH), State Bank of Mysore (SBM), State Bank of Patiala (SBP) and

State Bank of Travancore (SBT). The other two Associate Banks namely State Bank

of Indore and State Bank of Saurashtra had already been merged with State Bank

of India. After the merger, the total customer base of SBI increased to 37

crore with a branch network of around 24,000 and around 60,000 ATMs across the

country.

Related Topics