Economics - Commercial banks | 12th Economics : Chapter 6 : Banking

Chapter: 12th Economics : Chapter 6 : Banking

Commercial banks

Commercial banks

Commercial bank refers to a bank, or a division of a large bank,

which more specifically deals with deposit and loan services provided to

corporations or large/ middle-sized business - as opposed to individual members

of the public/small business. They do not provide, long-term credit, as

liquidity of assets is to be maintained.

1. Functions of Commercial Banks:

Commercial banks are institutions that conduct business with

profit motive by accepting public deposits and lending loans for various

investment purposes.

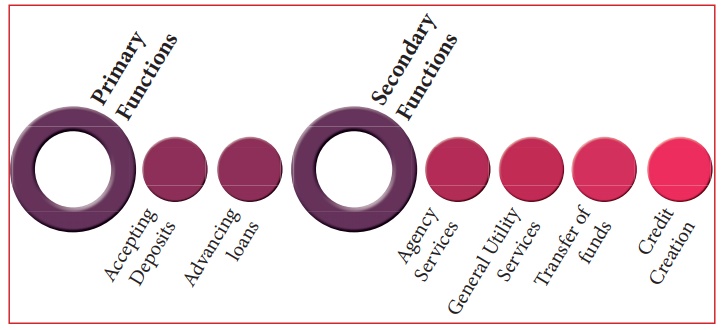

The functions of commercial banks are broadly classified into

primary functions and secondary functions, which are shown in the picture

Functions of Commercial Banks

(a) Primary Functions:

1. Accepting Deposits

It implies that commercial banks are mainly dependent on public

deposits.

There are two types of deposits, which are discussed as follows

(i) Demand Deposits

It refers to deposits that can be withdrawn by individuals without

any prior notice to the bank. In other words, the owners of these deposits are

allowed to withdraw money anytime by writing a withdrawal slip or a cheque at

the bank counter or from ATM centres using debit card.

(ii) Time Deposits

It refers to deposits that are made for certain committed period

of time. Banks pay higher interest on time deposits. These deposits can be

withdrawn only after a specific time period by providing a written notice to

the bank.

2. Advancing Loans

It refers to granting loans to individuals and businesses.

Commercial banks grant loans in the form of overdraft, cash credit, and

discounting bills of exchange.

(b) Secondary Functions

The secondary functions can be classified under three heads,

namely, agency functions, general utility functions, and other functions.

1. Agency Functions: It implies that commercial banks act as

agents of customers by performing various functions.

(i) Collecting Cheques

Banks collect cheques and bills of exchange on the behalf of their

customers through clearing house facilities provided by the central bank.

(ii) Collecting Income

Commercial banks collect dividends, pension, salaries, rents, and

interests on investments on behalf of their customers. A credit voucher is sent

to customers for information when any income is collected by the bank.

(iii) Paying Expenses

Commercial banks make the payments of various obligations of

customers, such as telephone bills, insurance premium, school fees, and rents.

Similar to credit voucher, a debit voucher is sent to customers for information

when expenses are paid by the bank.

2. General Utility Functions: It implies that commercial banks provide

some utility services to customers by performing various functions.

(i) Providing Locker Facilities

Commercial banks provide locker facilities to its customers for

safe custody of jewellery, shares, debentures, and other valuable items. This

minimizes the risk of loss due to theft at homes. Banks are not responsible for

the items in the lockers.

(ii) Issuing Traveler’s Cheques

Banks issue traveler’s cheques to individuals for traveling

outside the country. Traveler’s cheques are the safe and easy way to protect

money while traveling.

(iii) Dealing in Foreign Exchange

Commercial banks help in providing foreign exchange to businessmen

dealing in exports and imports. However, commercial banks need to take the

permission of the Central Bank for dealing in foreign exchange.

3. Transferring Funds

It refers to transferring of funds from one bank to another. Funds

are transferred by means of draft, telephonic transfer, and electronic

transfer.

4. Letter of Credit

Commercial banks issue letters of credit to their customers to

certify their creditworthiness.

(i) Underwriting Securities

Commercial banks also undertake the task of underwriting

securities. As public has full faith in the creditworthiness of banks, public

do not hesitate in buying the securities underwritten by banks.

(ii) Electronic Banking

It includes services, such as debit cards, credit cards, and

Internet banking.

(c) Other Functions:

(i) Money Supply

It refers to one of the important functions of commercial banks

that help in increasing money supply. For instance, a bank lends ₹5 lakh to an

individual and opens a demand deposit in the name of that individual. Bank

makes a credit entry of ₹5 lakh in that account. This leads to creation of

demand deposits in that account. The point to be noted here is that there is no

payment in cash. Thus, without printing additional money, the supply of money

is increased.

(ii) Credit Creation

Credit Creation means the multiplication of loans and advances.

Commercial banks receive deposits from the public and use these

deposits to give loans. However, loans offered are many times more than the

deposits received by banks. This function of banks is known as ‘Credit Creation’.

(iii) Collection of Statistics:

Banks collect and publish statistics relating to trade, commerce

and industry. Hence, they advice customers and the public authorities on

financial matters.

2. Mechanism / Technique of Credit Creation by Commercial Banks

Bank credit refers to bank loans and advances. Money is said to be

created when the banks, through their lending activities, make a net addition

to the total supply of money in the economy. Likewise, money is said to be

destroyed when the loans are repaid by the borrowers to the banks and

consequently the credit already created by the banks is wiped out in the

process.

Banks have the power to expand or contract demand deposits and

they exercise this power through granting more or less loans and advances and

acquiring other assets. This power of commercial bank to create deposits

through expanding their loans and advances is known as credit creation.

Primary / Passive Deposit and Derived / Active Deposit

The modern banks create deposits in two ways. They are primary

deposit and derived deposit. When a customer gives cash to

the bank and the bank creates a book debt in his name called a deposit, it is

known as a “primary deposit’. But when such a deposit is created, without there

being any prior payment of equivalent cash to the bank, it is called a ‘derived

deposit’.

Primary Deposits

It is out of these primary deposits that the bank makes loans

and advances to its customers.

The initiative is taken by the customers themselves. In this

case, the role of the bank is passive.

So these deposits are also called “Passive deposits”.

Credit Creation literally means the multiplication of loans and

advances. Every loan creates its own deposits. Central Bank insists the banks

to maintain a ratio between the total deposits they create and the cash in

their possession.

For the purpose of understanding, it is assumed that all banks are

obliged to keep the ratio between cash and its deposits at a minimum of 20

percent.

1. The banks do not keep any excess reserves, in other words, it

would exhaust possible avenues of income earning activities like giving loans

etc. up to the maximum extent after attaining the minimum cash reserves.

2. There are no drains in the supply of money i,e., the public do

not suddenly want to hold more ideal currency or withdraw from the time

deposits.

Under the above assumptions, when a customer deposits a sum of

₹1000 in a bank, the bank creates a deposit of ₹ 1000 in his favor. Bank

deposits (Bank Money) have increased by ₹1000. But, at this stage, there is no

increase in the total supply of money with the public, because the above extra

bank money of ₹1000 is offset by the cash of ₹1000 deposited in the bank.

The bank has now additional cash of ₹1000 in its custody. Since it

is required to keep only a cash reserve of 20 per cent, this means that ₹ 800

is excess cash reserve with it. According to the above assumption, the bank

should lend out this ₹ 800 to the public. Suppose, it does so, and the debtor

deposits the money in his own account with another bank B, Bank is creating a

deposit of ₹ 800. Bank B then has also excess cash reserve of 640(800-160). It

could, in its turn, lend out ₹ 640. This ₹ 640 will, in its turn find its way

with, say Bank C; it will create a deposit of ₹ 640and so on.

The total deposits will now grow into 1000+800+640+…….till

ultimately the excess cash reserve peters out. It can be shown that when that

stage is reached the total of the above will be ₹ 5000.

Money Multiplier = 1/20% =1/20/100=1/20x100=5 Credit creation is

1000x5 = ₹ 5000.

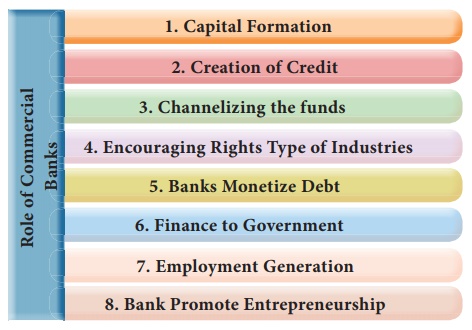

3. Role of Commercial Banks in Economic Development of a Country

1. Capital Formation

Banks play an important role in capital formation, which is

essential for the economic development of a country. They mobilize the small

savings of the people scattered over a wide area through their network of

branches all over the country and make it available for productive purposes.

Now -a-days, banks offer very attractive schemes to induce the

people to save their money with them and bring the savings mobilized to the

organized money market. If the banks do not perform this function, savings

either remains idle or used in creating other assets,(eg.gold) which are low in

scale of plan priorities.

2. Creation of Credit

Banks create credit for the purpose of providing more funds for

development projects. Credit creation leads to increased production,

employment, sales and prices and thereby they bring about faster economic

development.

3. Channelizing the Funds towards Productive Investment

Banks invest the savings mobilized by them for productive

purposes. Capital formation is not the only function of commercial banks.

Pooled savings should be allocated to various sectors of the economy with a

view to increase the productivity. Then only it can be said to have performed

an important role in the economic development.

4. Encouraging Right Type of Industries

Many banks help in the development of the right type of industries

by extending loan to right type of persons. In this way, they help not only for

industrialization of the country but also for the economic development of the

country. They grant loans and advances to manufacturers whose products are in

great demand. The manufacturers in turn increase their products by introducing

new methods of production and assist in raising the national income of the

country. Sometimes, sub-prime lending is also clone. That is how there was an

economic crisis in the year 2007-08 in the US.

5. Banks Monetize Debt

Commercial banks transform the loan to be repaid after a certain

period into cash, which can be immediately used for business activities.

Manufacturers and wholesale traders cannot increase their sales without selling

goods on credit basis. But credit sales may lead to locking up of capital. As a

result, production may also be reduced. As banks are lending money by

discounting bills of exchange, business concerns are able to carryout the

economic activities without any interruption.

6. Finance to Government

Government is acting as the promoter of industries in

underdeveloped countries for which finance is needed for it. Banks provide long

-term credit to Government by investing their funds in Government securities

and short-term finance by purchasing Treasury Bills. RBI has given ₹ 68,000

crores to the government of India in the year 2018-19, this is 99% the RBI's

surplus.

7. Employment Generation

After the nationalization of big banks, banking industry has grown

to a great extent. Bank’s branches are opened frequently, which leads to the

creation of new employment opportunities.

8. Banks Promote Entrepreneurship

In recent days, banks have assumed the role of developing

entrepreneurship particularly in developing countries like India by inducing

new entrepreneurs to take up the well-formulated projects and provision of

counseling services like technical and managerial guidance.

Banks provide 100% credit for worthwhile projects, which is also

technically feasible and economically viable. Thus commercial banks help for

the development of entrepreneurship in the country.

Related Topics