Life Mathematics | Chapter 4 | 8th Maths - Profit, Loss, Discount, Overhead Expenses and GST | 8th Maths : Chapter 4 : Life Mathematics

Chapter: 8th Maths : Chapter 4 : Life Mathematics

Profit, Loss, Discount, Overhead Expenses and GST

Profit,

Loss, Discount, Overhead Expenses and GST

1. Profit

and Loss

Try these

• If the selling price of an article is less than the cost price

of the article, then there is a ________.

Solution: Loss

• An article costing ₹5000 is sold for ₹4850. Is there a profit or

loss? What percentage is it?

Solution: Loss

Percentage of Loss = [ (C.P – S.P) / C.P ] × 100

= [(5000 – 4850) / 5000] × 100

= [150 / 5000] × 100 = 3%

• If the ratio of cost price and the selling price of an article

is 5:7, then the profit/ gain is_________%.

Solution:

C.P = 5x

S.P = 7x

Profit = 7x – 5x = 2x

Profit Percentage = 7x – 5x = [ 2x / 5x

] × 100 = 40%

Cost Price (C.P)

The amount

for which an article is bought is called its Cost Price

(C.P).

Selling Price (S.P)

The amount

for which an article is sold is called its Selling Price

(S.P).

Profit or Gain

When the

S.P is more than the C.P, then there is a profit or gain.

Therefore,

Profit/Gain = S.P − C.P

Loss

When the

S.P is less than the C.P, then there is a loss.

Therefore,

Loss = C.P − S.P

It is to

be noted that the profit or loss is always calculated on the cost price.

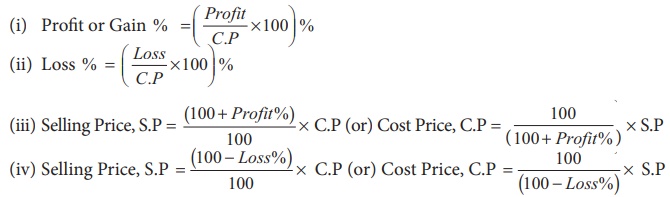

Formulae:

2. Discount

During the

month of Aadi and festival seasons, shopkeepers offer a certain percentage of rebate

on the marked price of the articles in order to increase the sales and also to clear

the old stock. This rebate is known as discount.

Marked price

In big shops

and departmental stores, we see that every product is tagged with a card and a price

marked on it. This price marked on the card is called the marked

price.

Based on

this marked price, the shopkeeper offers a certain percentage of discount. The price

payable by the customer after deduction of discount is called the selling price.

That is,

Selling Price = Marked Price – Discount

3. Overhead

Expenses

Traders,

retailers and shopkeepers are involved in the buying and selling of goods. Sometimes,

when articles like machinery, furniture, electronic items etc., are bought, a few

expenses may happen on their repairs, transportation and labour charges etc., These

expenses are included in the cost price and are called as overhead

expenses.

Total Cost Price = Cost Price + Overhead Expenses

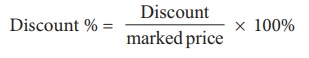

Discount

% = [ Discount / marked price ] × 100%

4. Goods

and Services Tax (GST)

The goods and services tax (GST) is the only common tax

in India levied on almost all the goods and the services meant for domestic consumption.

The GST is remitted by the traders and the consumers alike and is also one of the

main sources of income to both the Central and State Governments.There are 3 types

of GST namely Central GST (CGST), State GST (SGST) and Integrated GST (IGST). For

union territories, there is UTGST.

The GST is

shared by the Central and the State Governments equally. There are also many products

like Egg, Honey, Milk, Salt etc., which are exempted from GST. Products like Petrol,

Diesel etc., do not come under GST and they are taxed separately. The GST council

has fitted over 1300 goods and 500 services under four tax slabs namely 5%, 12%,

18% and 28%.

Related Topics