Questions with Answers, Solution | Life Mathematics | Chapter 4 | 8th Maths - Example Problems on Profit, Loss, Discount, Overhead Expenses and GST | 8th Maths : Chapter 4 : Life Mathematics

Chapter: 8th Maths : Chapter 4 : Life Mathematics

Example Problems on Profit, Loss, Discount, Overhead Expenses and GST

Example

Problems on

Profit,

Loss, Discount, Overhead Expenses and GST

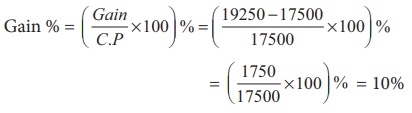

Example 4.6

Ranjith bought

a washing machine for ₹16150 and paid ₹1350 for its transportation.

Then, he

sold it for ₹19250. Find his gain or loss percentage.

Solution:

Total C.P

of the washing machine

= C.P + Overhead Expenses

= 16150 + 1350 = ₹17500

S.P = ₹19250

Here, S.P

> C.P. Hence, there is a gain.

Gain % = (Gain/C.P ×100) % = { [19250 −17500]/17500 × 100 }% = ( [1750/17500] × 100 ) % =10%

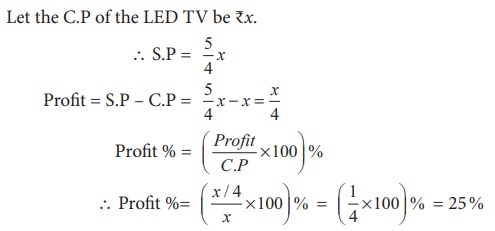

Example 4.7

If the selling

price of an LED TV is equal to 5/4 of its cost price, then find the gain / profit

percentage.

Solution 1:

Solution 2:

Let the C.P

of the LED TV be ₹x.

∴ S.P

= 5/4 = x

Profit =

S.P – C.P = 5/4 x − x = x/4

Profit %

= (Profit/C.P ×100) %

∴

Profit % = ( x / 4 ×100) % = (1/4 ×100)

% = 25%

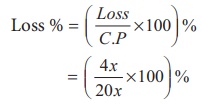

Example 4.8

The cost

price of 16 boxes of strawberries is equal to the selling price of 20 boxes of strawberries.

Find the gain or loss percentage.

Solution:

Let the C.P

of one strawberry box be ₹ x .

C.P of 20

strawberry boxes = 20 x and

S.P of 20 strawberry boxes = C.P of 16 strawberry boxes = 16 x (given)

Here, S.P < C.P, hence there is a loss.

Loss = C.P

–S.P = 20 x - 16 x =4 x

Loss % =

( [Loss/ C . P] ×100 ) %

= ([4x/20x] ×100) %

∴

Loss % = 20 %

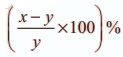

If the cost price of x

articles = selling price of y articles,

then profit % =  = ( [x-y/y] ×100) % . If the answer

is negative, then it is treated as loss. Check and verify this

= ( [x-y/y] ×100) % . If the answer

is negative, then it is treated as loss. Check and verify this for Example

4.8.

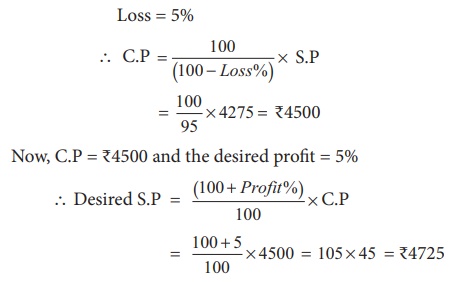

Example 4.9

By selling

a bicycle for ₹4275, a shopkeeper loses 5%. For how much should he sell it to have

a profit of 5%?

Solution:

S.P of the

bicycle = ₹4275

Loss = 5%

To have a

profit of 5%, he should sell the bicycle for ₹4725.

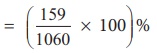

Example 4.10

The price

of a rain coat was slashed from ₹1060 to ₹901 by a shopkeeper in the rainy season

to boost the sales. Find the rate of discount given by him.

Solution:

Discount

= Marked Price –Selling Price

= 1060 – 901

= ₹159

∴

Discount %  = ( [159/1060] × 100) %

= ( [159/1060] × 100) %

= 15%

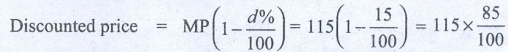

Think

A shopkeeper marks the price of a marker board 15% above the cost

price and then allows a discount of 15% on the marked price. Does he gain or lose

in the transaction?

Solution:

Let cost price of marker board be 100

CP = 100 Marks it 15% above CP

∴ Marked price = MP = ( [15/100]

× CP ) + CP

= ( [15/100] × 100 ) + 100 = 15 + 100 = 115

Discount % = 15%

Discounted price = MP (1 – (d%/100)) = 115 (1 – (15/100))

= 115 × (85/100) = 97.75

∴ He sells it 97.75 which is less than his cost price. Therefore

he loses

Loss = 97.75 − 100 = −2.25

Example 4.11

Find the

single discount in percentage which is equivalent to two successive discounts of

25% and 20% given on an article.

Solution:

Let the marked

price of an article be ₹100.

First discount

of 25% = 100 × (25/100) = ₹25

Price after

first discount = 100 - 25 = ₹75

Second discount

of 20% = 75 × (20/100) = ₹15

Price after

second discount = 75 - 15 = ₹60

Net selling

price = ₹60

Single discount

in percentage equivalent to two given successive discounts = (100–60)% = 40%.

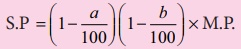

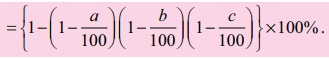

Note

• If there are 2 successive discounts of a % and b % respectively,

then

• Single discount in % equivalent to 3 successive discounts of a

%, b % and c % respectively =

(Use this formula for the Example 4.11 and check the answer).

Example 4.12

A water heater

is sold by a trader for ₹10502 including GST at 18%. Find the marked price of the

water heater and GST.

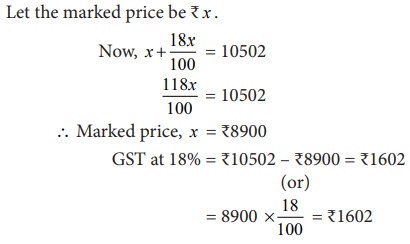

Solution 1:

Solution 2:

Let the marked

price be ₹ x .

Now, x + (18x/100) = 10502

118x / 100 = 10502

Marked price, x = ₹8900

GST at 18%

= ₹10502 – ₹8900 = ₹1602

(or)

= 8900 × (18/100) = ₹1602

Example 4.13

A family

went to a hotel and spent ₹350 for food and paid extra 5% as GST. Calculate the

CGST and SGST.

Solution:

Cost of food

= ₹350

Extra 5%

paid as GST is equally shared by the Central and the State Governments at 2.5% each.

CGST = SGST

= 350 ×

(2.5/100) = ₹8.75

Related Topics