Banking - NABARD and its role in Agricultural credit | 12th Economics : Chapter 6 : Banking

Chapter: 12th Economics : Chapter 6 : Banking

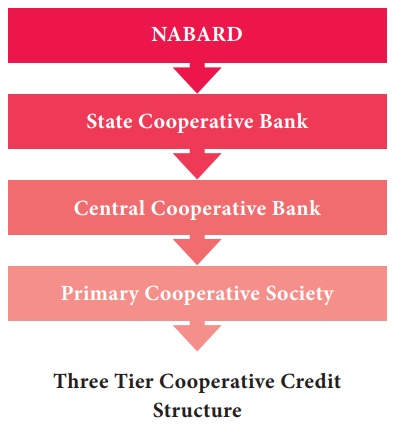

NABARD and its role in Agricultural credit

NABARD and its role in Agricultural credit

Since its inception, RBI has shown keen interest in agricultural

credit and maintained a separate department for this purpose. RBI extended

short-term seasonal credit as well as medium-term and long-term credit to

agriculture through State level co-operative banks and Land Development banks.

At the same time, RBI has also set up the Agricultural Refinance

Development Corporation (ARDC) to provide refinance support to the banks to

promote programmes of agricultural development, particularly those requiring

term credit. With the widening of the role of bank credit from “agricultural

development” to “rural development” the Government proposed to have a more

broad-based organization at the apex level to extend support and give guidance

to credit institutions in matters relating to the formulation and

implementation of rural development programmes.

A National Bank for Agriculture and Rural Development (NABARD),

was therefore, set up in July 1982 by an Act of parliament to take over the

functions of ARDC and the refinancing functions of RBI in relation to

co-operative banks and RRBs. NABARD is linked organically with the RBI by the

latter contributing half of its share capital the other half being contributed

by the Government of India(GOI). GOI nominates three of its Central Board

Directors on the board of NABARD.A Deputy Governor of RBI is appointed as

Chairman of NABARD.

Functions of NABARD

NABARD has inherited its apex role from RBI i.e, it is performing

all the functions performed by RBI with regard to agricultural credit.

(i) NABARD acts as a refinancing institution for all kinds of

production and investment credit to agriculture, small-scale industries,

cottage and village industries, handicrafts and rural crafts and real artisans

and other allied economic activities with a view to promoting integrated rural

development.

(ii) It provides short-term, medium-term and long-term credits to

state co-operative Banks (SCBs), RRBs, LDBs and other financial institutions

approved by RBI.

(iii) NABARD gives long-term loans (upto 20 Years) to State

Government to enable them to subscribe to the share capital of co-operative

credit societies.

(iv) NABARD gives long-term loans to any institution approved by

the Central Government or contribute to the share capital or invests in

securities of any institution concerned with agriculture and rural development.

(v) NABARD has the responsibility of co-ordinating the

activities of Central and State

Governments, the Planning Commission (now NITI Aayog) and other all India

and State level institutions entrusted with the development of small scale

industries, village and cottage industries, rural crafts, industries in the

tiny and decentralized sectors, etc.

(vi) It has the responsibility to inspect RRBs and co-operative

banks, other than primary co-operative societies.

(vii) It maintains a Research and Development Fund to promote

research in agriculture and rural development

Related Topics