Chapter: Operations Research: An Introduction : Modeling with Linear Programming

Selected LP Applications: Production Planning and Inventory Control

SELECTED LP APPLICATIONS

This section presents realistic LP models in which the definition of the variables and the construction of the objective function and constraints are not as straight-forward as in the case of the two-variable model. The areas covered by these appli-cations include the following:

1. Urban planning.

2. Currency arbitrage.

3. Investment.

4. Production planning and inventory control.

5. Blending and oil refining.

6. Manpower planning.

Each model is fully developed and its optimum solution is analyzed and interpreted.

4 .Production Planning and Inventory Control

There is

a wealth of LP applications to production and inventory control, ranging from

simple allocation of machining capacity to meet demand to the more complex case

of using inventory to "dampen" the effect of erratic change in demand

over a given planning horizon and of using hiring and firing to respond to

changes in workforce needs. This section presents three examples. 'The first

deals with the scheduling of products using common production facilities to

meet demand during a single period, the second deals with the use of inventory

in a multiperiod production system to fill future demand, and the third deals

with the use of a combined inventory and worker hiring/firing to

"smooth" production over a multiperiod planning horizon with

fluctuating demand.

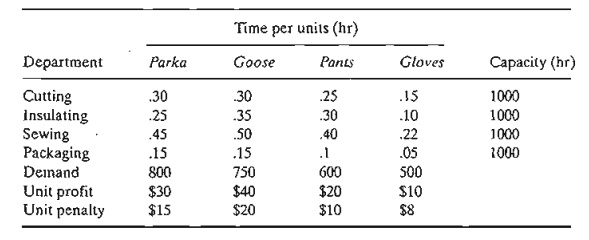

Example

2.3-4 (Single-Period Production Model)

In

preparation for the winter season, a clothing company is manufacturing parka

and goose overcoats, insulated pants, and gloves. All products are manufactured

in four different departments: cutting, insulating, sewing, and packaging. The

company has received firm orders for its products. The contract stipulates a

penalty for undelivered items. The following table provides the pertinent data

of the situation.

Devise an

optimal production plan for the company.

Mathematical Model: The definition of the variables is

straightforward. Let

x1 = number

of parka jackets

x2 = number of goose jackets

x3 = number of pairs of pants

x4

= number of pairs of gloves

The

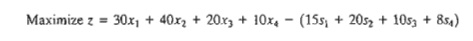

company is penalized for not meeting demand. This means that the objective of

the problem is to maximize the net receipts, defined as

Net

receipts = Total profit - Total penalty

The total

profit is readily expressed as 30x1 + 40x2 + 20x3 + 10x4 The total penalty is a function of the

shortage quantities (= demand - units supplied of each product). These

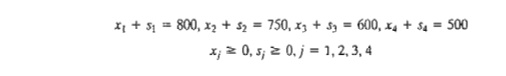

quantities can be determined from the following demand limits:

x1

≤ 800, x2≤ 750, x3≤

600, x4 ≤500

A demand

is not fulfilled if its constraint is satisfied as a strict inequality. For

example, if 650 parka jackets are produced, then x1 = 650, which

leads to a shortage of 800 - 650 = 150

parka jackets. We can express the shortage of any product algebraically by

defining a new nonnegative variable-namely,

Sj = Number of shortage units of

product j, j = 1,2,3,4

In this

case, the demand constraints can be written as

We can

now compute the shortage penalty as 15s1 + 20s2 + 10s3 + 8s4. Thus, the objective func-tion

can be written as

To

complete the model, the remaining constraints deal with the production capacity

restric-tions; namely

.30x1 + .30x2 + .25x3 + .15x4 ≤ 1000 (Cutting)

.25x1 + .35x2 + .30x3 + .lox4 ≤ 1000 (Insulating)

.45x1 + .50x2 + aox3 + .22x4 ≤ 1000 (Sewing)

.15x1 + .15x2 + .10x3

+ .05X4

≤ 1000 (Packaging)

The

complete model thus becomes

subject

to

.30x1 + .30x2 + .25x3 + .15x4

≤ 1000

.25x1 + .35x2 + .30x3 + .10x4

≤ 1000

.45x1 + .50x2 + .40x3 + .22x4 ≤ 1000

.15x1

+ .15x2

+ .10x3 + .05x4 ≤ 1000

x1 + s1 = 800, x2 + s2

= 750, x3

+ s3

= 600, x4 + s4 = 500

xj ≥ 0, sj ≥ 0, j = 1, 2, 3,

4

Solution:

The

optimum solution is z = $64,625,

xl = 850, x2 = 750, x3 = 387.5, x4 = 500, s1 = s2 = s4 = 0, s3 = 212.5.

The solution satisfies all the demand for both types of jackets and the gloves. A shortage of 213 (rounded up

from 212.5) pairs of pants will result in a penalty cost of 213 X $10 = $2130.

Example

2.3-5 (Multiple Period Production-Inventory Model)

Acme

Manufacturing Company has contracted to deliver horne windows over the next 6

months. The demands for each month are 100,250,190,140,220, and 110 units,

respectively. Production cost per window varies from month to month depending

on the cost of labor, material, and utilities. Acme estimates the production

cost per window over the next 6 months to be $50, $45, $55, $48, $52, and $50,

respectively. To take advantage of the fluctuations in manufacturing cost, Acme

may elect to produce more than is needed in a given month and hold the excess

units for delivery in later months. This, however, will incur storage costs at

the rate of $8 per window per month assessed on end-of-month inventory. Develop

a linear program to determine the optimum production schedule.

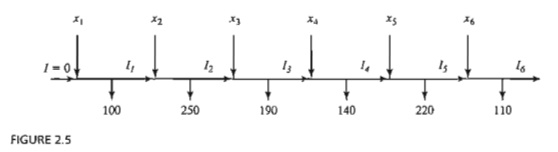

Mathematical Model: The

variables of the problem include the monthly production amount and the end-of-month inventory. For i = 1,2,

... , 6, let

xi= Number

of units produced in month i

1i = Inventory

units left at the end of month i

The

relationship between these variables and the monthly demand over the six-month

horizon is represented by the schematic diagram in Figure 2.5. The system

starts empty, which means that

10

= 0.

The

objective function seeks to minimize the sum of the production and end-of-month

in-ventory costs. Here we have,

Total

production cost = 50x1 + 45x2 + 55x3 + 48x4 + 52xs + 50x6

Total

inventory cost = 8(I1 + l2 + I3 + 14 + 15 + I6 )

Thus the

objective function is

Minimize z = 50x1 + 45x2 + 55x3 + 48x4 + 52xs + 50x6+ 8( I1 + 12 + I3 + 14 + Is + I6 )

Schematic

representation of the production-inventory system

The

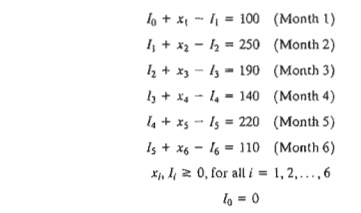

constraints of the problem can be determined directly from the representation

in Figure 2.5. For each period we have the following balance equation:

Beginning

inventory + Production amount - Ending

inventory = Demand

This is

translated mathematically for the individual months as

For the

problem, 10 = 0

because the situation starts with no initial inventory. Also, in any optimal

solution, the ending inventory h will be zero, because it is not logical to end

the horizon with positive inventory, which can only incur additional inventory

cost without serving any purpose.

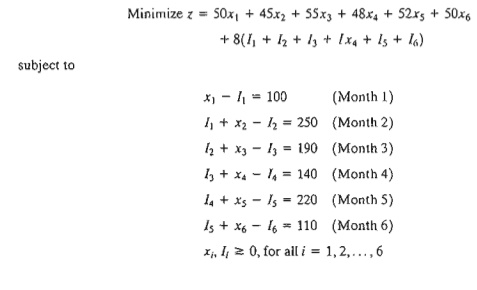

The complete

model is now given as

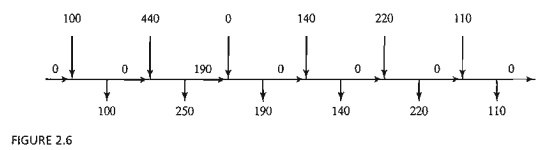

Optimum

solution of the production.inventory problem

Solution:

The

optimum solution is summarized in Figure 2.6. It shows that each month's demand

is satis-fied directly from the month's production, except for month 2 whose

production quantity of 440 units covers the demand for both months 2 and 3. The

total associated cost is z = $49,980.

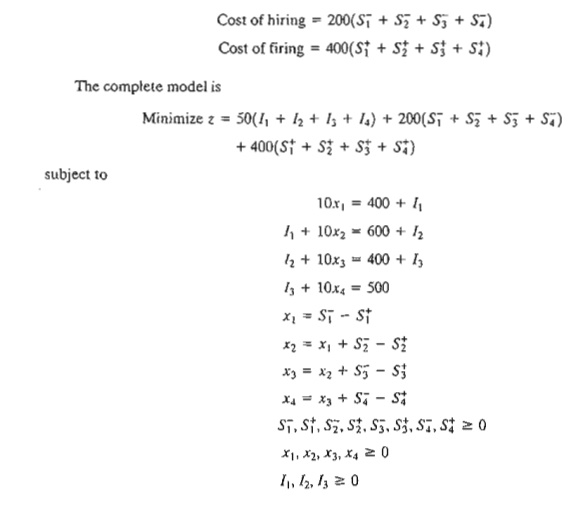

Example

2.3-6 (Multiperiod

Production Smoothing Model)

A company

will manufacture a product for the next four months: March, April, May, and

June. The demands for each month are 520,

720, 520, and 620 units,

respectively. The company has a steady workforce of 10 employees but can meet

fluctuating production needs by hiring and fir-ing temporary workers, if

necessary. The extra costs of hiring and firing in any month are $200 and $400

per worker, respectively. A permanent worker can produce 12 units per month, and

a temporary worker, lacking comparable experience, only produce 10 units per

month. TIle com-pany can produce more than needed in any month and carry the

surplus over to a succeeding month at a holding cost of $50 per unit per month. Develop an optimal hiring/firing policy for

the company over the four-month planning horizon.

Mathematical Model: This

model is similar to that of Example 2.3-5 in the general sense that each month

has its production, demand, and ending inventory. There are two exceptions: (1)

ac-counting for the permanent versus the temporary workforce, and (2)

accounting for the cost of hiring and firing in each month.

Because

the permanent 10 workers cannot be fired, their impact can be accounted for by

subtracting the units they produce from the respective monthly demand. The

remaining demand, if any, is satisfied through hiring and firing of temps. From

the standpoint of the model, the net demand for each month is

Demand

for March = 520 - 12 X 10 = 400 units

Demand

for April = 720 - 12 X

10 = 600 units

Demand

for May = 520 - 12 X 10 = 400 units

Demand

for June = 620 - 12

X

10 = 500 units

For i = 1,2,3,4, the variables of the model

can be defined as

xi = Net

number of temps at the start of month i

after any hiring or firing

Si =

Number of

temps hired or fired at the start of month

i

Ii = Units of ending inventory for month i

The

variables xi and Ii, by definition, must assume

nonnegative values. On the other hand, the variable Si can be positive when new temps

are hired, negative when workers are fired, and zero if no hiring or firing

occurs. As a result, the variable must be unrestricted

in sign, This is the first instance in this chapter of using an

unrestricted variable. As we will see shortly, special substitu-tion is needed

to allow the implementation of hiring and firing in the model.

The

objective is to minimize the sum of the cost of hiring and firing plus the cost

of holding inventory from one month to the next. The treatment of the inventory

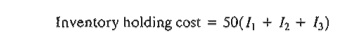

cost is similar to the one given in Example 2.3-5-namely,

(Note

that I4 = 0 in the optimum solution.) The cost of hiring and firing is a bit

more involved. We know that in any optimum solution, at least 40 temps (= 400/10) must be hired at the start of

March to meet the month's demand. However, rather than treating this situation

as a special case, we can let the optimization process take care of it

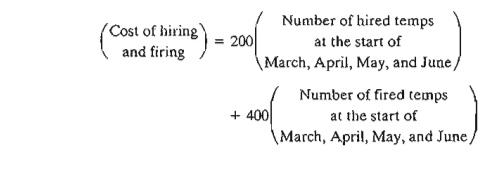

automatically. Thus, given that the costs of hiring and firing a temp are $200

and $400, respectively, we have

To

translate this equation mathematically, we will need to develop the constraints

first.

The

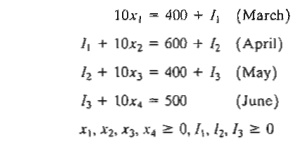

constraints of the model deal with inventory and hiring and firing. First we

develop the inventory constraints. Defining xi as the number of temps available

in month i and given that the

productivity of a temp is 10 units per month, the number of units produced in

the same month is lOXi' Thus the

inventory constraints are

Next, we

develop the constraints dealing with hiring and firing. First, note that the

temp work-force starts with x1 workers at the beginning of

March. At the start of April, x1 will be adjusted (up or down) by

S2 to generate x2. The same

idea applies to x3 and x4. These observations lead to the

following equations

The

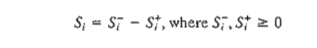

variables S1, S2, S3, and S4 represent hiring when they are

strictly positive and firing when they are strictly negative. However, this

"qualitative" information cannot be used in a mathematical

expression. Instead, we use the following substitution:

The

unrestricted variable Si is now the difference between two nonnegative

variables Si- and Si+.

We can think of Si- as the number of temps hired and Si+

as the number of temps fired. For example,

if Si- = 5 and Si+ = 0 then Si

= 5 - 0 = +5, which represents hiring. If Si-

= 0 and Si+ = 7

then Si =

0 - 7 = -7, which represents firing. In the first

case, the corresponding cost of

hiring is 200 Si+

= 200 X 5 =

$1000 and in the second case the corresponding cost of firing is 400 Si+

= 400 X 7 =

$2800. This idea is the basis for the development of the objective function.

First we

need to address an important point: What if both Si-

and Si+ are positive? The answer is that this cannot

happen because it implies that the solution calls for both hiring and firing in

the same month. Interestingly, the theory of linear programming (see Chapter 7)

tells us that Si- and Si+ can never be positive simultaneously, a result

that confirms intuition.

We can

now write the cost of hiring and firing as follows:

Solution:

The

optimum solution is z = $19,500, x1

= 50, x2 = 50, x3 = 45, x4 = 45, 5, Si-

= 50, Si+

= 5, I1 = 100, I3 = 50. All

the remaining variables are zero. The solution calls for hiring 50 temps in March (Si- = 50) and holding the workforce steady till

May, when 5 temps are fired (Si+ = 5). No further hiring or firing is

recommended until the end of June, when, presumably, all temps are terminated.

This solution requires 100 units of inventory to be carried into May and 50

units to be carried into June.

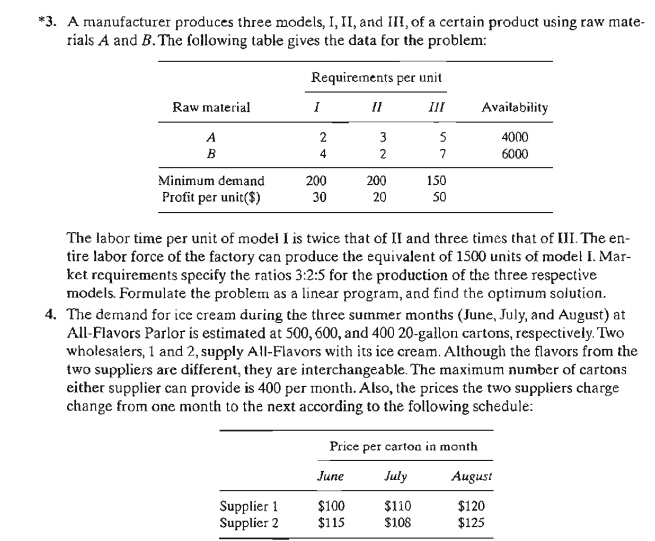

PROBLEM SET 2.30

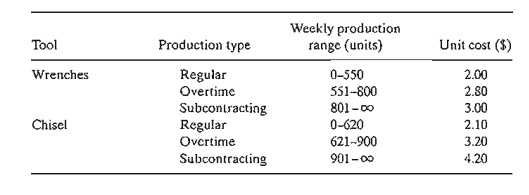

Tooleo

has contracted with AutoMate to supply their automotive discount stores with

wrenches and chisels. AutoMate's weekly demand consists of at least 1500

wrenches and 1200 chisels. Tooleo cannot produce all the requested units with

its present one-shift capacity and must use overtime and possibly subcontract

with other tool shops. The result is an increase in the production cost per

unit, as shown in the following table. Market de-mand restricts the ratio of

chisels to wrenches to at least 2:1.

a. Formulate the problem as a linear program, and

determine the optimum production schedule for each tool.

b. Relate the fact that the production cost

function has increasing unit costs to the va-lidi ty of the modeL

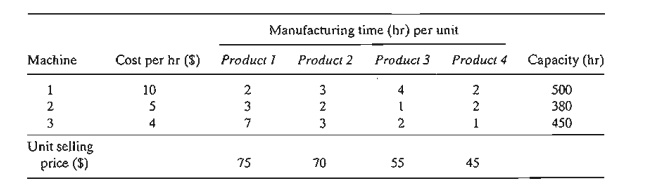

2. Four

products are processed sequentially on three machines. The following table

gives the pertinent data of the problem.

Formulate

the problem as an LP model, and find the optimum solution.

The

production rates in units per hour are 1.25 and 1 for products A and B,

respec-tively. All demand must be met. However, demand for a later month may be

filled from the production in an earlier one. For any carryover from one month

to the next, holding costs of $.90 and $.75 per unit per month are charged for

products A and B, respectively. The unit

production costs for the two products are $30 and $28 for A and B,

respectively. Determine the optimum production schedule for the two products.

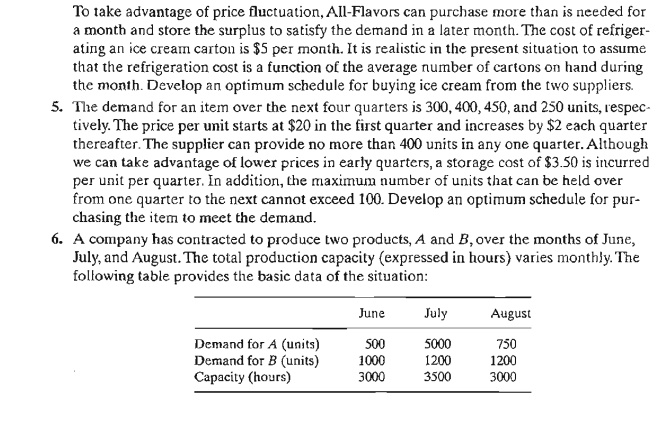

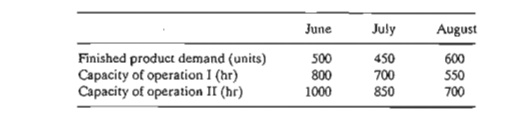

*7. The

manufacturing process of a product consists of two successive operations, I and

II. The following table provides the pertinent data over the months of June,

July, and August:

Producing

a unit of the product takes .6 hour on operation I plus .8 hour on operation

II. Overproduction of either the semifinished product (operation I) or the

finished product (operation II) in any month is allowed for use in a later

month. The corre-sponding holding costs are $.20 and $.40 per unit per month.

The production cost varies by operation

and by month. For operation 1, the unit production cost is $10, $12, and $11 for June, July, and August.

For operation 2, the corresponding unit production cost is $15, $18, and $16.

Determine the optimal production schedule for the two operations over the

3-month horizon.

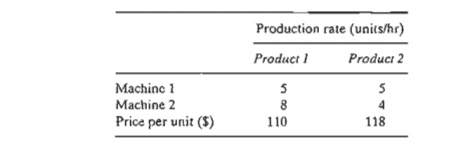

8. Two

products are manufactured sequentially on two machines. The time available on

each machine is 8 hours per day and may be increased by up to 4 hours of

overtime, if necessary, at an additional cost of $100 per hour. The table below

gives the production rate on the two machines as well as the price per unit of

the two products. Determine the optimum production schedule and the recommended

use of overtime, if any.

Related Topics