Chapter: Operations Research: An Introduction : Modeling with Linear Programming

Selected LP Applications: Blending and Refining

SELECTED LP APPLICATIONS

This section presents realistic LP models in which the definition of the variables and the construction of the objective function and constraints are not as straight-forward as in the case of the two-variable model. The areas covered by these appli-cations include the following:

1. Urban planning.

2. Currency arbitrage.

3. Investment.

4. Production planning and inventory control.

5. Blending and oil refining.

6. Manpower planning.

Each model is fully developed and its optimum solution is analyzed and interpreted.

5. Blending and Refining

A number

of LP applications deal with blending different input materials to produce

products that meet certain specifications while minimizing cost or maximizing

profit. The input materials could be ores, metal scraps, chemicals, or crude

oils and the output products could be metal ingots, paints, or gasoline of

various grades. This section pre-sents a (simplified) model for oil refining.

The process starts with distilling crude oil to produce intermediate gasoline

stocks and then blending these stocks to produce final gasolines. The final

products must satisfy certain quality specifications (such as octane rating).

In addition, distillation capacities and demand limits can directly affect the

level of production of the different grades of gasoline. One goal of the

modeLis deter-mine the optimal mix of final products that will maximize an

appropriate profit func-tion. In some cases, the goal may be to minimize a cost function.

Example

2.3-7 (Crude

Oil Refining and Gasoline Blending)

Shale Oil, located on the island of

Aruba, has a capacity of 1,500,000 bbl of crude oil per day. The final products

from the refinery include three types of unleaded gasoline with different

octane numbers (ON): regular with ON = 87, premium with ON = 89, and super with

ON = 92. The refining process encompasses three stages: (1) a distillation tower that produces feedstock (ON = 82) at the rate of .2 bbl per bbl of crude oil, (2) a

cracker unit that produces gasoline stock (ON = 98) by using a portion of the

feedstock produced from the distillation tower at the rate of .5 bbl per bbl of

feedstock, and (3) a blender unit that blends the gasoline stock from the

cracker unit and the feedstock from the distillation tower. The company

estimates the net profit per barrel of the three types of gasoline to be $6.70,

$7.20, and $8.10, respectively. The input capacity of the cracker unit is

200,000 barrels of feedstock a day. The demand limits for regular, premium, and

super gasoline are 50,000,30,000, and 40,000 barrels per day. Develop a

model for determining the optimum production schedule for the refinery.

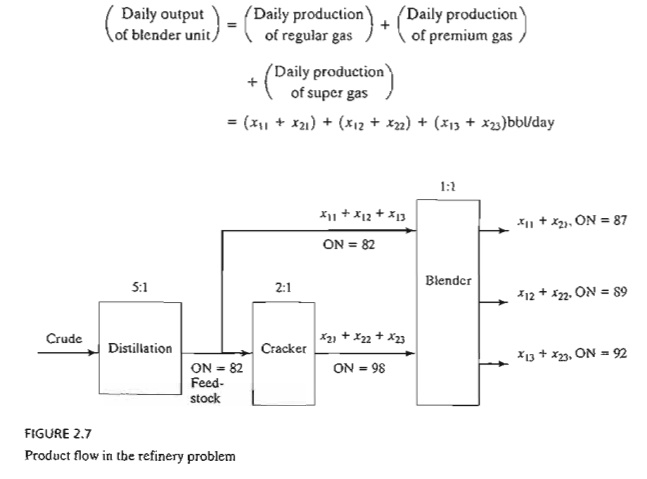

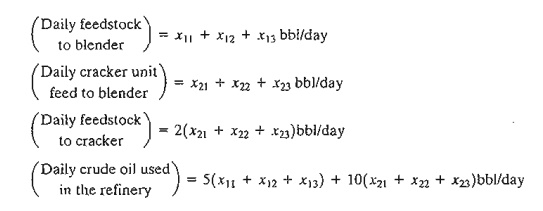

Mathematical Model: Figure

2.7 summarizes the elements of the model. The variables can be defined in terms

of two input streams to the blender (feedstock and cracker gasoline) and the

three final products. Let

xij = bbl/day of input stream i used to blend final product j, i

= 1,2; j = 1,2,3

Using this definition, we have

Daily production of regular gasoline

= x11 + x21

bbl/day

Daily production of super gasoline =

x13 + x23 bbl/day

The objective of the model is to

maximize the total profit resulting from the sale of all three grades of

gasoline. From the definitions given above, we get

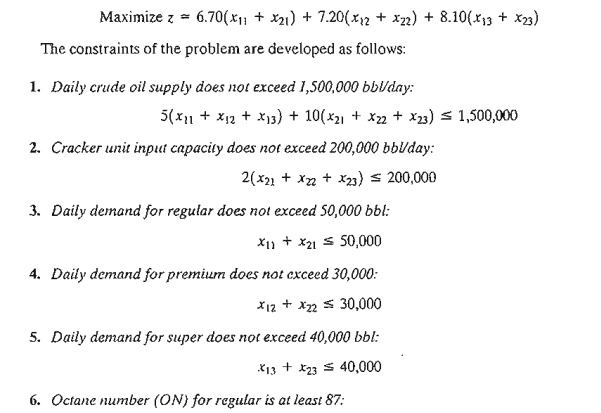

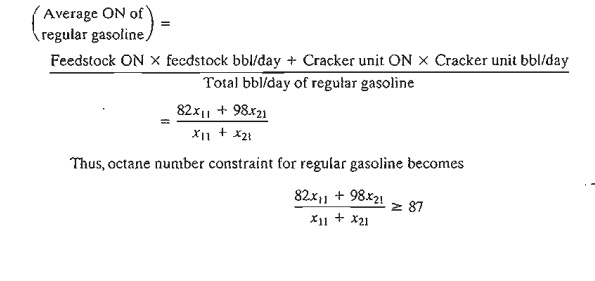

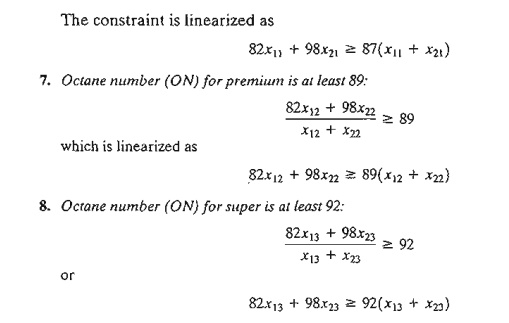

The octane number of a gasoline

product is the weighted average of the octane numbers of the input streams used

in the blending process and can be computed as

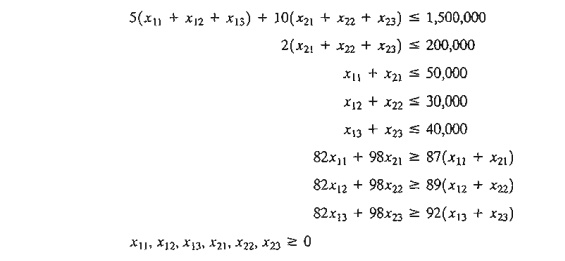

The

complete model is thus summarized as

Maximize

z = 6.70(x11 + x21 + 7.20(xl2 + x22) + 8.10(xl3 + x23)

subject

to

The last

three constraints can be simplified to produce a constant right-hand side.

Solution:

The

optimum solution (using file amplEx2.3-7.txt) is z = 1,482,000, x11 = 20,625, x21 == 9375, xI2

=' 16,875, x22 = 13,125,

x13 = 15,000, x23 = 25,000. This translates to

Daily

profit = $1,482,000

Daily

amount of regular gasoline = x11 + x21 = 20,625 + 9375 = 30,000 bbl/day

Daily

amount of premium gasoline = x12 + x22 = 16,875

+ 13,125 = 30,000 bbl/day

Daily

amount of regular gasoline = xI3 + x23 =

15,000 + 25,000 = 40,000 bbl/day

The

solution shows that regular gasoline production is 20,000 bbVday short of

satisfying the maximum demand. The demand for the remaining two grades is

satisfied.

PROBLEM SET 2.3E

Hi-V

produces three types of canned juice drinks, A, B, and C, using fresh strawberries,

grapes, and apples. The daily supply is limited to 200 tons of strawberries,

100 tons of grapes, and 150 tons of apples. The cost per ton of strawberries,

grapes, and apples is $200, $100, and $90, respectively. Each ton makes 1500 Ib

of strawberry juice, 1200 Ib of grape juice, and 1000 Ib of apple juice. Drink A is a 1:1

mix of strawberry and apple juice. Drink B is 1:1:2 mix of strawberry,

grape, and apple juice. Drink C is a 2:3 mix of grape and apple juice. All

drinks are canned in 16-oz (1 lb) cans. The price per can is $1.15, $1.25, and

$1.20 for drinks A, B, and C. Determine the optimal

production mix of the three drinks.

*2. A

hardware store packages handyman bags of screws, bolts, nuts, and washers.

Screws come in 100-lb boxes and cost $110 each, bolts come in 100-lb boxes and

cost $150 each, nuts come in 80-lb boxes and cost $70 each, and washers come in

30-lb boxes and cost $20 each. The handyman package weighs at least lib and

must include, by weight, at least 10% screws and 25% bolts, and at most 15%

nuts and 10% washers. To balance the package, the number of bolts cannot exceed

the number of nuts or the number of washers. A bolt weighs 10 times as much as

a nut and 50 times as much as a washer. Determine the optimal mix of the

package.

3. All-Natural

Coop makes three breakfast cereals, A, B, and C, from four ingredients:

rolled oats, raisins, shredded coconuts, and slivered almonds. The daily

availabilities of the ingredients are 5 tons, 2 tons, 1 ton, and 1 ton,

respectively. The corresponding costs per ton are $100, $120, $110, and $200.

Cereal A is a 50:5:2 mix of oats,

raisins, and almond. Cereal B is a 60:2:3 mix of oats,

coconut, and almond. Cereal C is a 60:3:4:2 mix of oats, raisins, coconut, and

almond. The cereals are produced in jumbo 5-lb sizes. All-Natural sells A, B, and Cat

$2, $2.50, and $3.00 per box, respectively. The minimum daily demand for

cereals A, B, and Cis 500,600, and 500 boxes. Determine the

optimal production mix of the cereals and the associated amounts of

ingredients.

4. A

refinery manufactures two grades of jet fuel, F1 and F2, by blending four types of gaso-line, A, B, C, and D. Fuel F1 uses gasolines A, B, C, and D in the ratio 1:1:2:4, and fuel F2 uses the ratio 2:2:1:3. The supply

limits for A, B, C, and Dare 1000, 1200,900, and 1500 bbl/day,

respectively. The costs per bbl for gasolines A, B, C, and Dare $120,

$90, $100, and $150, respectively. Fuels F1 and F2 sell for $200 and $250 per bbi. The

minimum demand for F1 and F2 is 200 and 400 bbUday. Determine the

optimal production mix for F1 and F2.

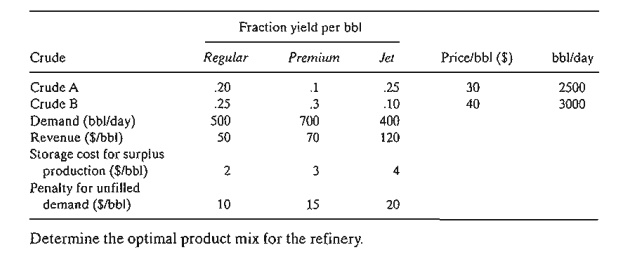

5. An oil

company distills two types of crude oil, A and B, to produce regular and premium

gasoline and jet fuel. There are limits on the daily availability of crude oil

and the minimum demand for the final products. If the production is not sufficient to cover demand, the short-age must be

made up from outside sources at a penalty.

Surplus production will not be sold immediately and will incur storage cost.

The following table provides the data of the situation:

Determine

the optimal product mix for the refinery.

6. In the

refinery situation of Problem 5, suppose that the distillation unit actually

produces the intermediate products naphtha and light oil. One bbl of crude A produces .35 bbl of naphtha and .6 bbl

of light oil, and one bbl of crude B produces .45 bbl of naphtha and .5 bbl of light oil. Naphtha and light

oil are blended to produce the three final gasoline products: One bbl of regular

gasoline has a blend ratio of 2:1 (naphtha to light oil), one bbl of premium

gasoline has a blend ratio of ratio of 1:1, and one bbl of jet fuel has a blend

ratio of 1:2. Determine the optimal production mix.

7. Hawaii

Sugar Company produces brown sugar, processed (white) sugar, powdered sugar,

and molasses from sugar cane syrup. The company purchases 4000 tons of syrup

weekly and is contracted to deliver at least 25 tons weekly of each type of

sugar. The production process starts by manufacturing brown sugar and molasses

from the syrup. A ton of syrup produces .3 ton of brown sugar and .1 ton of

molasses. White sugar is produced by processing brown sugar. It takes 1 ton of brown sugar to

produce .8 ton of white sugar. Powdered sugar is produced from white sugar

through a special grinding process that has a 95% conversion efficiency (1 ton

of white sugar produces .95 ton of powdered sugar). The profits per ton for

brown sugar, white sugar, powdered sugar, and molasses are $150, $200, $230,

and $35, respectively. Formulate the problem as a linear program, and

deter-mine the weekly production schedule.

8. Shale

Oil refinery blends two petroleum stocks,A and B, to produce two high-octane gasoline

products, I and II. Stocks A and B are produced at the maximum

rates of 450 and 700 bbl/hour, respectively. The corresponding octane numbers

are 98 and 89, and the vapor pres-sures are 10 and 8 Ib/in2.

Gasoline I and gasoline II must have octane numbers of at least 91 and 93,

respectively. The vapor pressure associated with both products should not

exceed 12 Ib/in2. The profits per bbl of I and II are $7 and $10,

respectively. Determine the optimum production rate for I and II and their

blend ratios from stocks A and B. (Hint: Vapor pressure, like the

octane number, is the weighted average of the vapor pressures of the blended

stocks.)

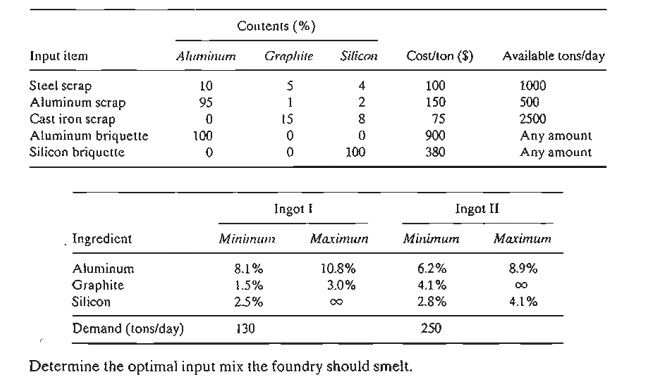

9. A

foundry smelts steel, aluminum, and cast iron scraps to produce two types of

metal ingots, I and II, with specific limits on the aluminum, graphite and

silicon contents. Aluminum and silicon briquettes may be used in the smelting

process to meet the desired specifications.

The following tables set the specifications of the problem:

10. Two

alloys, A and B, are made from four metals, I, II, III, and IV, according to

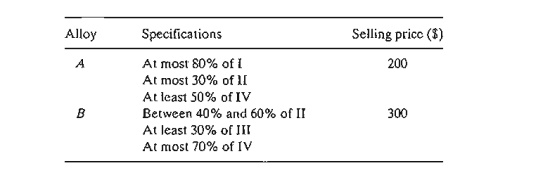

the following specifications:

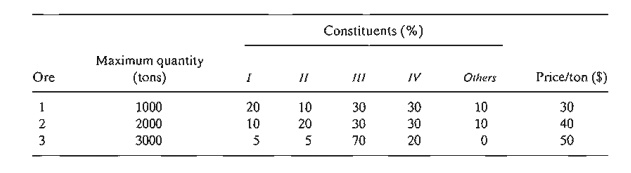

The four metals, in turn, are extracted from three ores according to the following data:

How much

of each type of alloy should be produced? (Hint:

Let xkj be tons of are i

allocated to alloy k, and define wk as tons

of alloy k produced.)

Related Topics