Chapter: Operations Research: An Introduction : Modeling with Linear Programming

Selected LP Applications: Currency Arbitrage

SELECTED LP APPLICATIONS

This section presents realistic LP models in which the definition of the variables and the construction of the objective function and constraints are not as straight-forward as in the case of the two-variable model. The areas covered by these appli-cations include the following:

1. Urban planning.

2. Currency arbitrage.

3. Investment.

4. Production planning and inventory control.

5. Blending and oil refining.

6. Manpower planning.

Each model is fully developed and its optimum solution is analyzed and interpreted.

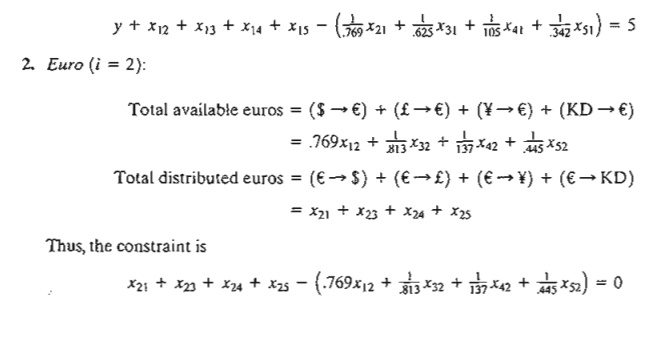

2. Currency Arbitrage

In

today's global economy, a multinational company must deal with currencies of

the countries in which it operates. Currency arbitrage, or simultaneous

purchase and sale of currencies in different markets, offers opportunities for

advantageous movement of money from one currency to another. For example,

converting £1000 to U.S. dollars in 2001 with an exchange rate of $1.60 to £1 will yield $1600. Another way of

making the conversion is to first change the British pound to Japanese yen and

then convert the yen to U.S. dollars using the 2001 exchange rates of £1 = ¥175 and

$1 = ¥105. The resulting dollar

amount is (£1,000x¥175) / ¥105 = $ 1,666,.67. This

example demonstrates the advantage of converting the British money first to

Japanese yen and then to dollars. This section shows how the arbitrage problem

involving many currencies can be formulated and solved as a linear program.

Example

2.3-2 (Currency

Arbitrage Model)

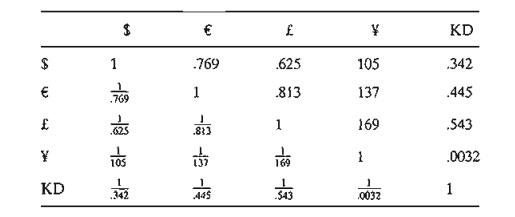

Suppose

that a company has a total of 5 million dollars that can be exchanged for euros

(€), British pounds (£), yen (¥), and Kuwaiti dinars (KD). Currency dealers set

the following limits on the amount of any single transaction: 5 million

dollars, 3 million euros, 3.5 million pounds, 100 million yen, and 2.8 million

KDs. The table below provides typical spot exchange rates. The bottom diagonal

rates are the reciprocal of the top diagonal rates. For example, rate(€→ $) = l/rate(

$ → €) = 1/.769 = 1.30.

Is it

possible to increase the dollar holdings (above the initial $5 million) by

circulating currencies through the currency market?

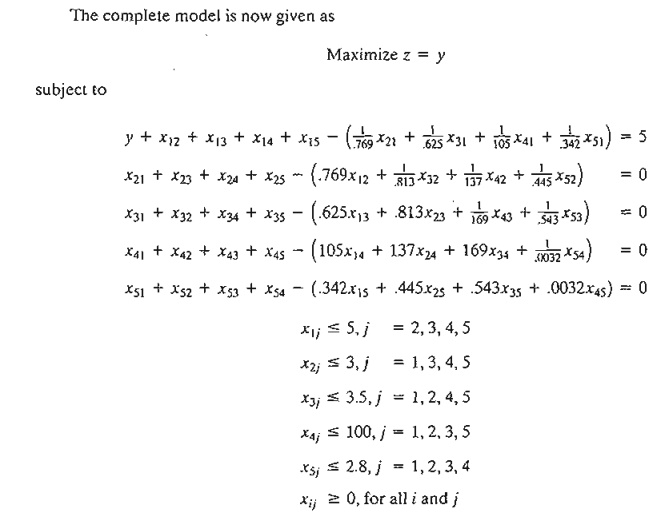

Mathematical Model: The

situation starts with $5 million. This amount goes through a number of conversions to other currencies before

ultimately being reconverted to dollars. The problem thus seeks determining the

amount of each conversion that will maximize the total dollar holdings.

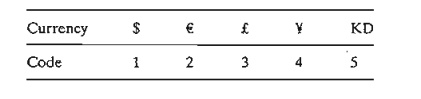

For the

purpose of developing the model and simplifying the notation, the following

nu-meric code is used to represent the currencies.

Define

xij = Amount

in currency i converted to currency j, i and j

= 1,2, ... ,5

For example,

x12 is the dollar amount converted

to euros and x51 is the KD amount converted to

dollars. We further define two additional variables representing the input and

the output of the arbitrage problem:

I = Initial dollar amount (= $5

million)

y = Final dollar holdings (to be determined from the solution)

Our goal

is to determine the maximum final dollar holdings, y, subject to the currency flow restrictions and the maximum limits

allowed for the different transactions.

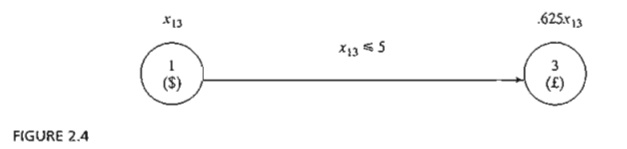

Definition

of the input/output variable, x13, between $ and £

We start

by developing the constraints of the model. Figure 2.4 demonstrates the idea of

converting dollars to pounds. The dollar amount xI3 at originating currency 1 is

converted to 625xl3 pounds at

end currency 3.At the same time, the transacted dollar amount cannot exceed the limit

set by the dealer, x13 ≤ 5.

To

conserve the flow of money from one currency to another, each currency must

satisfy the following input-output equation:

( Total

sum available of a currency (input) ) = ( Total sum converted to other

currencies (output) )

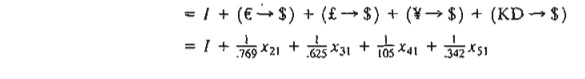

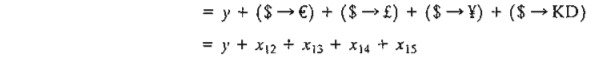

1. Dollar (i = 1):

Total

available dollars = Initial dollar amount +

dollar

amount from other currencies

Total

distributed dollars = Final dollar holdings +

dollar

amount to other currencies

Given I = 5, the

dollar constraint thus becomes

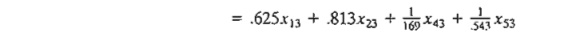

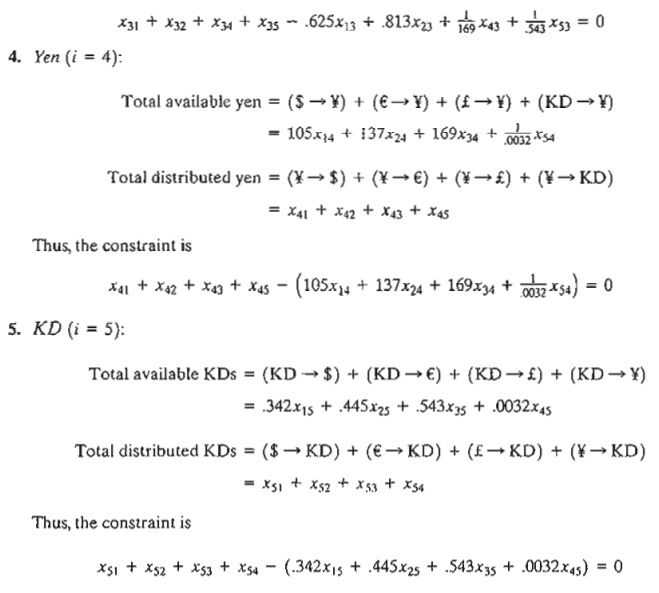

3. Pound (i = 3):

Total

available pounds = ($ -→ £) + (€→ £) + (¥→ £) + (KD → £)

Total

distributed pounds = (£→ $) + (£→ €) + (£→ ¥) + (£→ KD)

= x31

+ x32 +x34 + x35

Thus, the ,constraint is

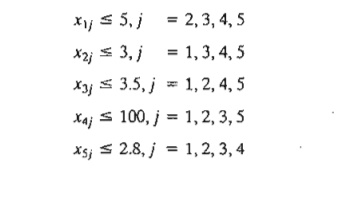

The only remaining constraints are the transaction limits, which are 5 million dollars, 3 million euros,3.5 million pounds, 100 million yen, and 2.8 million KDs. These can be translated as

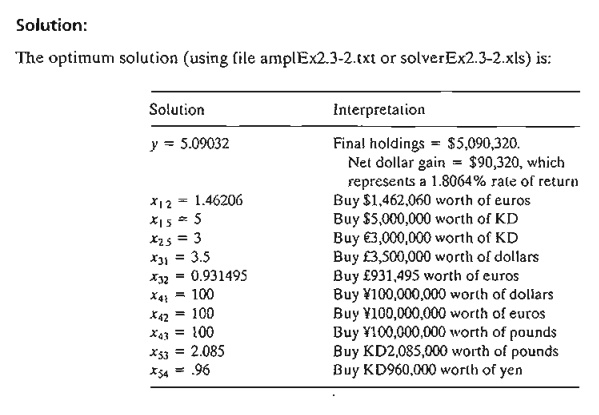

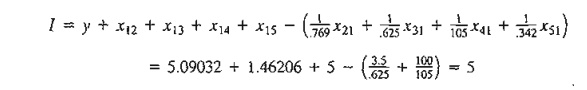

Remacks. At first it may appear that the

solution is nonsensical because it calls for using xl2 + x15

= 1.46206 + 5 = 6.46206,

or $6,462,060 to buy euros and KDs when the initial dollar amount is

only $5,000,000. Where do the extra dollars come from? What happens in practice

is that the given solution is submitted to the currency dealer as one order, meaning we do not wait until

we accumulate enough currency of a certain type before making a buy. In the

end, the net result of all these transactions is a net cost of $5,000,000 to

the investor. This can be seen by sum-ming up all the dollar transactions in

the solution:

Notice

that x21,

x31 , x41 and x51 are in euro, pound, yen, and KD,

respectively, and hence must be converted to dollars.

PROBLEM

SET 2.3B

1. Modify

the arbitrage model to account for a commission that amounts to.1 % of any currency

buy. Assume that the commission does not affect the circulating funds and that

it is collected after the entire order is executed. How does the solution

compare with that of the original model?

2. Suppose

that the company is willing to convert the initial $5 million to any other

currency that will provide the highest rate of return. Modify the original

model to determine which currency is the best.

3. Suppose

the initial amount I = $7 million and that the

company wants to convert it optimally to a combination of euros, pounds, and

yen. TIle final mix may not include more than €2 million, £3 million, and ¥200

million. Modify the original model to determine the optimal buying mix of the

three currencies.

4. Suppose

that the company wishes to buy $6 million. The transaction limits for different

currencies are the same as in the original problem. Devise a buying schedule

for this trans-action, given that mix may not include more than €3 million, £2

million, and KD2 million.

5. Suppose

that the company has $2 million, £5 million, £4 million. Devise a buy-sell

order that will improve the overall holdings converted to yen.

Related Topics