Chapter: Software Project Management

Software Project Management: Project Evaluation

PROJECT EVALUATION

1 Strategic Assessment

2 Technical Assessment

3 Cost Benefit Analysis

4 Cash Flow Forecasting

5 Cost Benefit Evaluation Techniques

6 Risk Evaluation

Project

Evaluation:

A high

level assessment of the project

to see whether it is worthwhile to proceed with the

project

to see whether the project will fit in the

strategic planning of the whole organization

Project

Evaluation

Why

Want to decide whether a project can proceed before

it is too late

Want to decide which of the several alternative

projects has a better success rate, a higher turnover, a higher ...

Is it

desirable to carry out the development and operation of the software system

Who

Senior management

Project manager/coordinator

Team leader

When

• Usually at the beginning of the project e.g. Step

0 of Step Wise Framework

What

Strategic assessment

Technical assessment

Economic assessment

How

Cost-benefit analysis

Cash flow forecasting

Cost-benefit evaluation techniques

• Risk analysis

1 Strategic

Assessment

Used to assess whether a project fits in the long-term goal of the organization

Usually carried out by senior management

Needs a strategic plan that clearly defines the objectives of the

organization

Evaluates individual projects against the strategic plan or the overall

business objectives Programme management

suitable for projects developed for use in the organization Portfolio

management

suitable

for project developed for other companies by software houses

SA – Programme Management

Individual

projects as components of a programme within the organization

Programme as “a group of projects

that are managed in a coordinated way to gain benefits that would not be

possible were the projects to be managed independently

SA – Programme Management Issues

Objectives

How does the project contribute to the long-term goal of the organization?

Will the product increase the market share? By how

much?

IS plan

Does the product fit into the overall IS plan?

How does the product relate to other existing systems?

Organization structure

How does the product affect the existing

organizational structure? the existing workflow? the overall business model?

MIS

What information does the product provide?

To whom is the information provided?

How does the product relate to other existing MISs?

Personnel

What are the staff implications?

What are the impacts on the overall policy on staff

development?

Image

How does the product affect the image of the

organization?

SA –

Portfolio Management

suitable for product developed by a software company for an organization

may need to assess the product for the client organization

Programme

management issues apply

need to carry out strategic assessment for the providing software

company

Long-term goal of the

software company

The effects of the project on the portfolio of the company (synergies

and conflicts)

Any added-value to the overall portfolio of the company

2 Technical Assessment

Functionality against hardware and software

Thestrategic IS plan of the organization

any constraints imposed by the IS plan

1 Economic Assessment

Why?

Consider whether the project is the best among other options

Prioritise the projects so that the resources can be allocated

effectively if several projects are underway

How?

Cost-benefit analysis

Cash flow forecasting

Various cost-benefit evaluation techniques

NPV and

IRR

2 EA – Cost-benefit Analysis

A

standard way to assess the economic benefits

Two steps

Identify

and estimate all the costs and benefits of carrying out the project

Express

the costs and benefits in a common unit for easy comparison (e.g. $)

Costs

Development costs

Setup costs

Operational costs Benefits

Direct benefits

Assessable indirect benefits

Intangible benefits

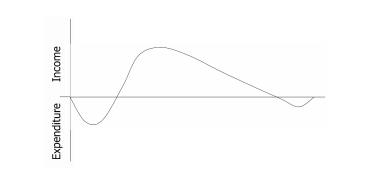

EA – Cash

Flow Forecasting

What?

Estimation of the cash flow over time

Why?

An excess of estimated benefits over the estimated

costs is not sufficient

Need detailed estimation of benefits and costs

versus time

What?

Estimation of the cash flow over time

Why?

An excess of estimated benefits over the estimated

costs is not sufficient

Need detailed estimation of benefits and costs

versus time

Need to

forecast the expenditure and the income

Accurate

forecast is not e asy

Need to

revise the forecast from time to time

4 Cost-benefit Evaluation Techniques

• Net profit

= Total

income – Total costs

• Payback period

= Time

taken to break even

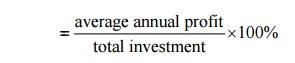

• Return on Investment ( ROI)

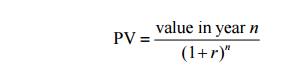

5 Cost-benefit Evaluation Techniques – NPV Net

present value (NPV)

It is the sum of the presennt values of all future amounts.

Present value is the

value which a future amount is worth at present

It takes into account the p rofitability of a project and the timing of

the cash flows

Let n be the number of yea r and r

be the discount rate, the present value (PV) is given

by

Issues in NPV

Choosingan

appro priate discount rate is difficult

Ensuring that the rankings of projects are not

sensitive to small changes in discount rate

Guidelines:

Use the standard rate prescribed by the

organization

Use interest rate + premium rate

Use a target rate of return

Rank the projects using various discount rates

Disadvantage

May not be directly comparable with earnings from

other investments or the costs of borrowing capital

Internal Rate of Return (IRR)

The percentage discount rate that would produce a

NPV of zero

A relative measure

Advantages

Convenient

Directly comparable with rate of return on other

projects and with interest rates

Useful

Dismiss a project due to its small IRR value

Indicate further precise evaluation of a project

Supported by MS Excel and Lotus 1-2-3

Estimation

Why? – to define the project budget and to ‘refine’ the product to

realize the budget

Who? – the manager

What? – size and cost

When? – always

How? – techniques and models

Issues related to Estimation

Difficult to make accurate estimation

Better to have previous data and analyze the actual values against their

estimates so that you know how accurate you are

Even better to have previous data of the whole organization so that you

know how accurate the estimation method, if any, used within the organization

Positive Attitude Towards Estimation

Use your estimation as a guide to manage your project

From time to time, you need to revise your estimation based on the

current status of the project

Estimation Approaches

Expert judgement

Ask the knowledgeable experts

Estimation by analogy

Use the data of a similar and completed project

Pricing to win

Use the price that is low enough to win the

contract

Top-down

An overall estimate is determined and then broken

down into each component task

Bottom-up

The estimates of each component task are aggregated

to form the overall estimate

Algorithmic model

Estimation

is based

on the characteristics of the product and the development

environment

Size Estimation

Problems related to size estimation

Size Estimation Model

Function

Point Analysis (FPA)

Problems related to size estimation

Nature of software

Novel application of software

Fast changing technology

Lack of homogeneity of project experience

Subjective nature of estimation

Political implications within the organization

3 Cost-Benefit Analysis

Cost/benefit

analysis, comparing

–

Expected costs

–

Expected benefits

Issues

–

Estimating costs

–

Estimating benefits

Use of

financial models to evaluate

Cost-Benefit

Analysis-Two Steps

Identifying

and estimating all of the costs and benefits of carrying out the project and

operating the delivered application

Expressing

the costs and benefits in common units

Cost-Benefit

Analysis-Cost Estimation

Estimate

costs to compare with benefits/other investment options

Overall

estimation based on

–

Estimation of required activities (structure)

–

Estimation for each activity

–

Estimation of installation/setup cost

–

Estimation of operational cost

Difficult,

as a lot of these are`estimates’;

estimation

errors cascade

Cost-Benefit Analysis-Cost Category

Development

costs

Setup

costs

Operational

costs

Cost-Benefit Analysis-Development Costs

Salaries (base, incentives, and bonuses)

Equipment for development

–

Hardware

–

Software

Cost-Benefit Analysis-Setup Cost

Hardware and software infrastructure

Recruitment/staff training

Installation and conversion costs

Cost-Benefit Analysis-Operational Costs

Costs of

operating the system once it has been installed

– Support

costs

– Hosting

costs

–

Licensing costs

–

Maintenance costs

– Backup

costs

Cost-Benefit Analysis-Benefit Estimation

Estimate

benefits of new system based on– Estimation of cost savings and money

generation when deployed– Value of information obtained for objective driven

project

– Value

of intangibles

Cost Benefits Analysis-Benefits Types

Direct benefits

Indirect benefits

Intangible benefits

Cost Benefits Analysis-Direct Benefits

Directly

accountable to new system

– Cost

savings (e.g., less staff, less paper, quicker turnaround)

– Money generation (e.g., new revenue stream, new markets) Measurable

after system is operational

Have to

be estimated for cost/benefit analysis

Cost Benefits Analysis -Intangible Benefits

Positive

side effects of new system

External

system (e.g., increase branding, entry to new markets)

Internal

system (increased interest in job for users, enabler for other systems) Often

very specific to a project; not measurable even after a system is operational

Part of strategic decision rather than cost/benefit analysis

4 Cash Flow Forecasting

Indicates

when expenditure and income will take place

1Cash Flow Analysis

Typically

there are outgoing payments initially and then incoming payments There might be

additional costs at the end of the project life

Cash flow

considerations

– Is

initial funding for the project available?

– Is

timing of incoming/outgoing cash flow in line with financial plans?

– If cash flow is critical, forecasting should be done quarterly or

monthly

Risky/expensive

projects might be funded using venture capital

5 Cost-Benefit Evaluation-Techniques

Costs and

benefits have to be expressed using the same scale to be comparable Usually

expressed in payments at certain times (cash flow table)

Payments

at different points in time are not comparable based only on the amount Time of

payment should be considered

Techniques

– Net

profit

– Payback

period

– Return

on investment

– Net

present value

–

Internal rate of return

Cost-Benefit Evaluation Techniques -Net Profit

Difference

between total cost and total income Pros: Easy to calculate

Cons

– Does

not show profit relative to size investment (e.g., consider Project 2)

– Does not consider timing of payments (e.g., compare Projects 1 and 3)

Not very useful other than for "back of envelope" evaluations

Cost-Benefit

Evaluation Techniques -Payback Period

Time

taken to break even

Pros

– Easy to

calculate

– Gives some idea of cash flow impact Cons: Ignores overall

profitability

Not very

useful by itself, but a good measure for cash flow impact

Costs-Benefit

Evaluation Techniques-Return On Investment

Also

known as the accounting rate of return (ARR)

Provides

a way of comparing the net profitability to the investment required The common

formula– ROI = (average annual profit/total investment) X 100

Cost-Benefit

Evaluation Techniques -Return On Investment

Pros:

Easy to calculate

Cons

– Does

not consider the timing of payments

– Misleading: does not consider bank interest rates Not very useful

other than for "back of envelope" evaluations

Cost-Benefit

Evaluation Techniques-Net Present Value

A project

evaluation technique that takes into account the profitability of a project and

the timing of the cash flows that are produced

Sum of

all incoming and outgoing payments, discounted using an interest rate, to a

fixed point in time (the present)

Cost-Benefit Evaluation Techniques-Net Present

Value

Present

value = (value in year t)/(1+r)^t

– r is

the discount rate

– t is

the number of years into the future that the cash flow occurs

– (1+r)^t

is known as discount factor

In the

case of 10% rate and one year

– Discount factor = 1/(1+0.10) = 0.9091 In the case of 10% rate and two

years

–

Discount factor = 1/(1.10 x 1.10) = 0.8294

Pros

– Takes

into account profitability

–

Considers timing of payments

– Considers economic situation through discount rate Cons: Discount rate

can be difficult to choose

Standard

measure to compare different options

Cost-Benefit

Evaluation Techniques -Internal Rate of Return

Internal

rate of return (IRR) is the discount rate that would produce an NPV of 0 for

the

project

Can be

used to compare different investment opportunities

There is

a Microsoft Excel function to calculate IRR

Pros:

Calculates figure which is easily comparable to interest rates

Cons:

Difficult to calculate (iterative)

Standard

way to compare projects

Definition

of Risk

A risk is

a potential problem – it might happen and it might not Conceptual definition of

risk

– Risk concerns future happenings

– Risk involves change in mind, opinion,

actions, places, etc.

– Risk involves choice and the uncertainty that

choice entails Two characteristics of risk

– Uncertainty – the risk may or may not happen,

that is, there are no 100% risks (those, instead, are called constraints)

– Loss – the risk becomes a reality and

unwanted consequences or losses occur

1 Risk Categorization – Approach

Project

risks

They

threaten the project plan

If they

become real, it is likely that the project schedule will slip and that

costs will increase

Technical

risks

They

threaten the quality and timeliness of the software to be

produced If they become real, implementation may become difficult or

impossible

Business

risks

They

threaten the viability of the software to be built

If they become real, they jeopardize the

project or the product Sub-categories of Business risks

Market

risk – building an excellent product or system that no one really wants

Strategic

risk – building a product that no longer fits into the overall business

strategy for the company

Sales

risk – building a product that the sales force doesn't understand how to sell

Management

risk – losing the support of senior management due to a change in focus or a

change in people

Budget

risk – losing budgetary or personnel commitment

Known

risks

Those

risks that can be uncovered after careful evaluation of the project

plan, the business and technical environment in which the project is being

developed, and other reliable information sources (e.g., unrealistic delivery

date)

Predictable

risks

Those

risks that are extrapolated from past project experience (e.g., past

turnover)

Unpredictable

risks

Those

risks that can and do occur, but are extremely difficult to identify in

advance

.2Reactive vs. Proactive Risk Strategies

Reactive risk

strategies

– "Don't worry, I'll think of

something"

– The majority of software teams and managers

rely on this approach

– Nothing is done about risks until something

goes wrong

The team then flies into action in an attempt to

correct the problem rapidly (fire fighting)

– Crisis management is the choice of management

techniques

Proactive risk

strategies

– Steps for risk management are followed (see

next slide)

– Primary objective is to avoid risk and to

have a contingency plan in place to handle unavoidable risks in a

controlled and effective manner

Steps for

Risk Management

Identify possible risks; recognize what

can go wrong

Analyze each risk to estimate the probability

that it will occur and the impact (i.e., damage) that it will do if it

does occur

3) Rank the risks by probability and impact

- Impact

may be negligible, marginal, critical, and catastrophic

Develop a contingency plan to manage

those risks having high probability and high impact

Risk

Identification

Risk identification is a systematic attempt to specify

threats to the project plan

By identifying known and predictable risks, the

project manager takes a first step toward avoiding them when possible

and controlling them when necessary

Generic risks

– Risks that are a potential threat to every

software project

Product-specific risks

– Risks that can be identified only by those a with

a clear understanding of the technology, the people, and

the environment that is specific to the software that is to be built

– This requires examination of the project

plan and the statement of scope

– "What special characteristics of this

product may threaten our project plan?"

Risk Item

Checklist

Used as one way to identify risks

Focuses on known and predictable risks in specific

subcategories (see next slide)

Can be organized in several ways

– A list of characteristics relevant to

each risk subcategory

– Questionnaire that leads to an

estimate on the impact of each risk

– A list containing a set of risk component

and drivers and their probability of occurrence

Known and

Predictable Risk Categories

Product size – risks associated with overall size

of the software to be built

Business impact – risks associated with constraints

imposed by management or the marketplace

Customer characteristics – risks associated with

sophistication of the customer and the developer's ability to communicate with

the customer in a timely manner

Process definition – risks associated with the

degree to which the software process has been defined and is followed

Development environment – risks associated with

availability and quality of the tools to be used to build the project

Technology to be built – risks associated with

complexity of the system to be built and the "newness" of the

technology in the system

Staff size and experience – risks associated with

overall technical and project experience of the software engineers who will do

the work

Questionnaire

on Project Risk

Have top

software and customer managers formally committed to support the project?

Are

end-users enthusiastically committed to the project and the system/product to

be built?

Are

requirements fully understood by the software engineering team and its

customers?

Have

customers been involved fully in the definition of requirements?

Do

end-users have realistic expectations?

Is the

project scope stable?

Does the software

engineering team have the right mix of skills?

Are

project requirements stable?

Does the

project team have experience with the technology to be implemented?

Is the

number of people on the project team adequate to do the job?

Do all

customer/user constituencies agree on the importance of the project and on the

requirements for the system/product to be built?

Risk

Components and Drivers

The project manager identifies the risk drivers

that affect the following risk components

– Performance risk - the degree of uncertainty that

the product will meet its requirements and be fit for its intended use

– Cost risk - the degree of uncertainty that

the project budget will be maintained

– Support risk - the degree of uncertainty that the

resultant software will be easy to correct, adapt, and enhance

– Schedule risk - the degree of uncertainty that

the project schedule will be maintained and that the product will be delivered

on time

The impact of each risk driver on the risk

component is divided into one of four impact levels

– Negligible, marginal, critical, and

catastrophic

Risk

drivers can be assessed as impossible, improbable, probable, and frequent

6 Risk Projection (Estimation)

Risk

projection (or estimation) attempts to rate each risk in two ways

– The probability that the risk is real

– The consequence of the problems

associated with the risk, should it occur

The

project planner, managers, and technical staff perform four risk projection

steps (see next slide)

The

intent of these steps is to consider risks in a manner that leads to

prioritization

Be

prioritizing risks, the software team can allocate limited resources where they

will have the most impact

1 Risk Projection/Estimation Steps

Establish

a scale that reflects the perceived likelihood of a risk (e.g., 1-low,

10-high)

Delineate

the consequences of the risk

Estimate

the impact of the risk on the project and product

Note the overall

accuracy of the risk projection so that there will be no misunderstandings

2 Contents of a Risk Table

A risk

table provides a project manager with a simple technique for risk projection

It

consists of five columns

– Risk Summary – short description of the risk

– Risk Category – one of seven risk categories

(slide 12)

– Probability – estimation of risk occurrence

based on group input

– Impact – (1) catastrophic (2) critical (3)

marginal (4) negligible

– RMMM – Pointer to a paragraph in the Risk

Mitigation, Monitoring, and Management Plan

3 Developing a Risk Table

List all risks in the first column (by way of the

help of the risk item checklists)

Mark the

category of each risk

Estimate

the probability of each risk occurring

Assess

the impact of each risk based on an averaging of the four risk components to

determine an overall impact value (See next slide)

Sort the

rows by probability and impact in descending order

Draw a

horizontal cutoff line in the table that indicates the risks that will be given

further attention

.4 Assessing Risk Impact

Three

factors affect the consequences that are likely if a risk does occur

– Its nature – This indicates the problems that

are likely if the risk occurs

– Its scope – This combines the severity of the

risk (how serious was it) with its overall distribution (how much was affected)

– Its timing – This considers when and for how

long the impact will be felt

The

overall risk exposure formula is RE = P x C

– P = the probability of occurrence for a risk

– C = the cost to the project should the risk

actually occur

Example

– P = 80% probability that 18 of 60 software

components will have to be developed

– C = Total cost of developing 18 components is

$25,000

– RE = .80 x $25,000 = $20,000

Risk Mitigation, Monitoring, and Management

• An effective strategy for dealing with risk must

consider three issues (Note: these are not mutually exclusive)

– Risk mitigation (i.e., avoidance)

– Risk monitoring

– Risk management and contingency planning

Risk

mitigation (avoidance) is the primary strategy and is achieved through a

plan Example: Risk of high staff turnover

Seven

Principles of Risk ManagementMaintain a global perspective

– View software risks within the context of a

system and the business problem that is is intended to solve

Take a

forward-looking view

– Think about risks that may arise in the

future; establish contingency plans

Encourage

open communication

– Encourage all stakeholders and users to point

out risks at any time

Integrate

risk management

– Integrate the consideration of risk into the

software process

Emphasize

a continuous process of risk management

– Modify identified risks as more becomes known and

add new risks as better insight is achieved

Develop a

shared product vision

– A shared vision by all stakeholders facilitates

better risk identification and assessment

Encourage

teamwork when managing risk

– Pool the skills and experience of all

stakeholders when conducting risk management activities

Related Topics