Chapter: Operations Research: An Introduction : The Simplex Method and Sensitivity Analysis

Sensitivity Analysis with TORA, Solver, and AMPL

Sensitivity Analysis with TORA, Solver, and AMPL

We now

have all the tools needed to decipher the output provided by LP software,

particularly with regard to sensitivity analysis. We will use the TOYCO

example to demon-strate the TORA, Solver, and AMPL output.

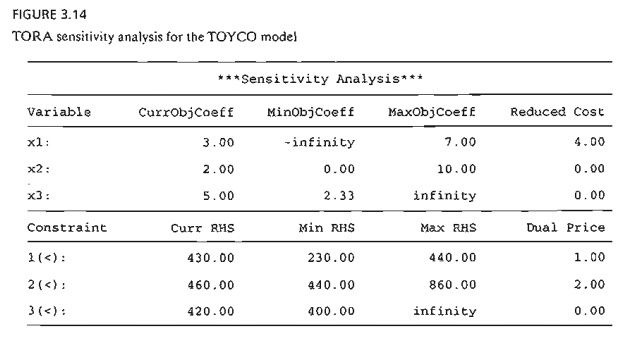

TORA's LP

output report provides the sensitivity analysis data automatically as shown in

Figure 3.14 (file toraTOYCO.txt). The output includes the reduced costs and the

dual prices as well as their allowable optimality and feasibility ranges.

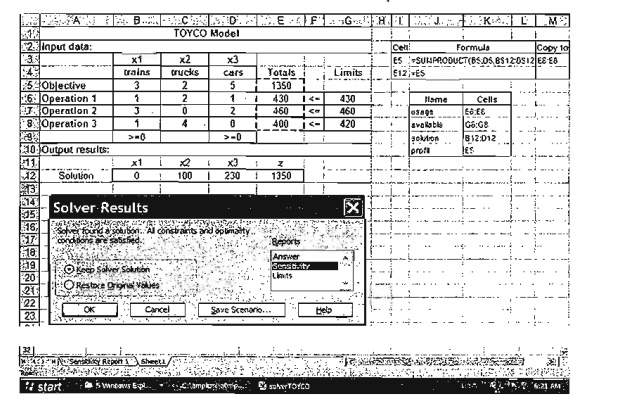

Figure

3.15 provides the Solver TOYCO model (file solverTOYCo.xls) and its sensitivity

analysis report. After you click Solve in the Solvcr Parameters dialogue box,

the new dialogue box Solver Rcsults will give you the opportunity to request

further details about the solution, including the important sensitivity

analysis report. The re-port will be stored in a separate Excel sheet, as shown

by the choices on the bottom of the screen. You can then click Sensitivity

Report 1 to view the results. The report

is similar to TORA's with three exceptions: (1) The reduced cost carries an

opposite sign. (2) The name shadow price

replaces the name du.al price. (3)

The optimality ranges are for the changes dj

and Dj rather than for the total

objective coefficients and constraints on the right-hand side. The differences

are minor and the interpretation of the results remains the same.

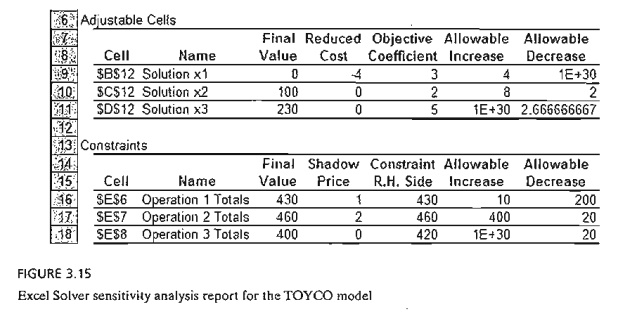

In AMPL,

the sensitivity analysis report is readily available. File amplTOYCo.txt

provides the code necessary to determine the sensitivity analysis output. It

requires the following additional statements:

The CPLEX

option statements are needed to be able to obtain the standard sen-sitivity

analysis report. In the TOYCO model, the indexed variables and constraints use

the root names x and oper, respectively. Using these names, the suggestive

suffixes . down, . current, and. up in the display statements automatically

generate the for-matted sensitivity analysis report in Figure 3.16. The

suffixes . dual and. rc provide the dual price and the reduced cost.

An

alternative to AMPL's standard sensitivity analysis report is to actually solve

the LP model for a range of values for the objective coefficients and the

right-hand side of the constraints. AMPL automates this process through the use

of commands (see Section A.7). Suppose in the TOYCO model, file amplTOYCo.txt,

that we want to in-vestigate the effect of making changes in b [1] , the total available time for

operation 1. We can

do so by moving solve and display from amplTOYCO.txt to a new file, which we

arbitrarily name analysis. txt:

The first

line will provide the model and its data and the second line will provide the

optimum solutions starting with b [II at 430 (the initial value given in

amplTOYCO.txt) and continuing in increments of 1 until b [1] reaches 500. An examination of

the out-put will then allow us to study the sensitivity of the optimum solution

to changes in b [1] Similar procedures can be

followed with other coefficients including the case of making simultaneous changes.

PROBLEM SET 3.6E

1. Consider

Problem 1, Set 2.3c (Chapter 2). Use the dual price to decide if it is

worthwhile to increase the funding for year 4.

2. Consider

Problem 2, Set 2.3c (Chapter 2).

a.

Use the dual prices to determine the overall return

on investment.

b.

If you wish

to spend $1000 on pleasure at the end of year 1, how would this affect the accumulated amount at the

start of year 5?

1. Consider

Problem 3, Set 2.3c (Chapter 2).

a. Give an

economic interpretation of the dual prices of the model.

b. Show how

the dual price associated with the upper bound on borrowed money at the

beginning of the third quarter can be derived from the dual prices associated

with the balance equations representing the in-out cash flow at the five

designated dates of the year.

2. Consider

Problem 4, Set 2.3c (Chapter 2). Use the dual prices to determine the rate of

re-turn associated with each year.

*5.

Consider Problem 5, Set 2.3c (Chapter 2). Use the dual price to determine if it

is worth-while for the executive to invest more money in the plans.

6. Consider

Problem 6, Set 2.3c (Chapter 2). Use the dual price to decide if it is

advisable for the gambler to bet additional money.

7. Consider

Problem 1, Set 2.3d (Chapter 2). Relate the dual prices to the unit production

costs of the model.

8. Consider

Problem 2, Set 2.3d (Chapter 2). Suppose that any additional capacity of

ma-chines 1 and 2 can be acquired only by using overtime. What is the maximum

cost per hour the company should be willing to incur for either machine?

*9. Consider Problem 3, Set 2.3d (Chapter 2).

a. Suppose

that the manufacturer can purchase additional units of raw material A at $12

per unit. Would it be advisable to do so?

b. Would you

recommend that the manufacturer purchase additional units of raw ma-terial B at $5 per unit?

10. Consider

Problem 10, Set 2.3e (Chapter 2).

a) Which of

the specification constraints impacts the optimum solution adversely?

b) What is

the most the company should pay per ton of each ore?

Related Topics