Chapter: Operations Research: An Introduction : The Simplex Method and Sensitivity Analysis

Algebraic Sensitivity Analysis-objective Function

Algebraic Sensitivity Analysis-objective Function

In Previous Section we used graphical sensitivity analysis to determine the conditions that

will maintain the optimality of a two-variable LP solution. In this section, we

extend these ideas to the general LP problem.

Definition

of Reduced Cost. To facilitate the explanation of the objective

function sensitivity analysis, first we need to define reduced costs. In the TOYCO model (Example 3.6-2), the objective

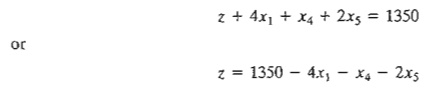

z-equation in the optimal tableau is

The

optimal solution does not recommend the production of toy trains (xl

= 0). This recommendation is confirmed by the informatIon in the z-equation

because each unit increase in Xl above its current zero level will decrease the

value of z by $4 - namely, z = 1350 - 4

X (1) - 1 x (0) - 2 X (0) = $1346.

We can think of the coefficient of xl in

the z-equation (= 4) as a unit cost

be-cause it causes a reduction in the revenue z. But where does this "cost" come from? We know that xl

has a unit revenue of $3 in the original model. We also know that each toy

train consumes resources (operations time), which in turn incur cost. Thus, the

"attractiveness" of x1 from the standpoint of

optimization depends on the relative values of the revenue per unit and the

cost of the resources consumed by one unit. This relation-ship is formalized in

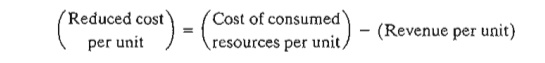

the LP literature by defining the reduced cost as

To

appreciate the significance of this definition, in the original TOYCO model the

revenue per unit for toy trucks (= $2) is less than that for toy trains (= $3). Yet the optimal solution

elects to manufacture toy trucks (x2

= 100 units) and no toy trains (x1 = 0). The

reason for this (seemingly nonintuitive) result is that the unit cost of the resources

used by toy trucks (i.e., operations time) is smaller than its unit price. The

op-posite applies in the case of toy trains.

With the

given definition of reduced cost we

can now see that an unprofitable variable (such as Xl) can be made profitable

in two ways:

1. By

increasing the unit revenue.

2. By

decreasing the unit cost of consumed resources.

In most real-life

situations, the price per unit may not be a viable option because its value is

dictated by market conditions. The real option then is to reduce the

consump-tion of resources, perhaps by making the production process more

efficient, as will be shown in Chapter 4.

Determination of the Optimality Ranges. We now

turn our attention to determining the conditions that will keep an optimal

solution unchanged. The presentation is based on the definition of reduced cost.

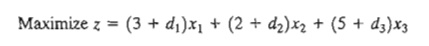

In the

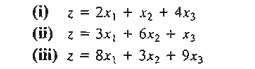

TOYCO model, let d1 d2, and d3 represent the change in unit revenues for toy trucks,

trains, and cars, respectively. The objective function then becomes

As we did

for the right-hand side sensitivity analysis in Section 3.6.2, we will first

deal with the general situation in which all the coefficients of the objective

function are changed simultaneously

and then specialize the results to the one-at-a-time case.

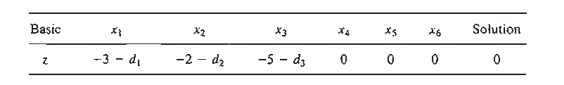

With the

simultaneous changes, the z-row in the starting tableau appears

as:

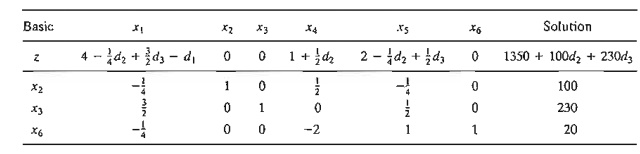

When we generate

the simplex tableaus using the same sequence of entering and leaving variables

in the original model (before the changes d

j are

introduced), the op-timal iteration will appear as follows (convince yourself

that this is indeed the case by carrying out the simplex row operations):

The new

optimal tableau is exactly the same as in the original optimal tableau except that the reduced costs (z-equation coefficients) have changed. This means

that changes in the objective-function

coefficients can affect the optimality of the problem only.

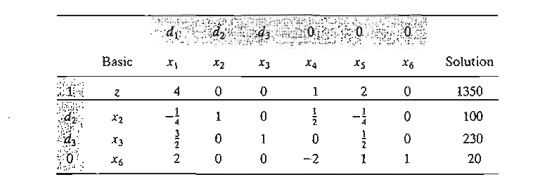

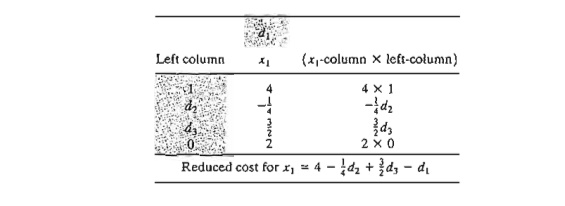

You really do not need to carry

out the row operation to compute the new reduced costs. An examination of the

new z-row shows that the coefficients of di are taken directly from the

constraint coefficients of the optimum tableau. A convenient way for computing

the new reduced cost is to add a new top row and a new leftmost column to the

optimum tableau, as shown by the shaded areas below. The entries in the top row

are the change d i

associated with each variable. For the leftmost column, the entries are 1 in

the z-row and the associated di

in the row of each basic variable. Keep in mind that d i = 0 for the slack variables.

Now, to compute the new reduced

cost for any variable (or the value of z), multiply the elements of its column

by the corresponding elements in the leftmost column, add them up, and subtract

the top-row element from the sum. For example, for xl, we have

Note that

the application of these computations to the basic variables will always pro-duce a zero reduced cost, a proven

theoretical result. Also, applying the same rule to the Solution column produces z

= 1350 + 100d2 + 230d3.

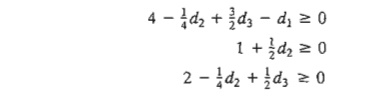

Because we are dealing with a

maximization problem, the current solution re-mains optimal so long as the new

reduced costs (z-equation coefficients) remain non-negative for all the

nonbasic variables. We thus have the following optimality conditions corresponding to nonbasic x1

x4, and x5

These conditions

must be satisfied simultaneously to

maintain the optimality of the current optimum.

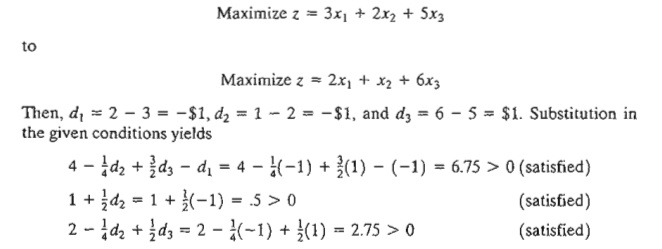

To illustrate the use of these

conditions, suppose that the objective function of TOYCO is changed from

The results show that the

proposed changes will keep the current solution (x1 = 0,

x2 = 100, x3 = 230) optimal. Hence no further

calculations are needed, except that the objective value will change to z = 1350 + 100d2 + 230d3 = 1350 + 100 X -1 + 230 X 1 = $1480. If any of the conditions is not

satisfied, a new solution must be de-termined (see Chapter 4).

The

discussion so far has dealt with the maximization case. The only difference in

the minimization case is that the reduced costs (z-equations coefficients) must

be ≤ 0 to maintain optimality.

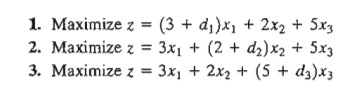

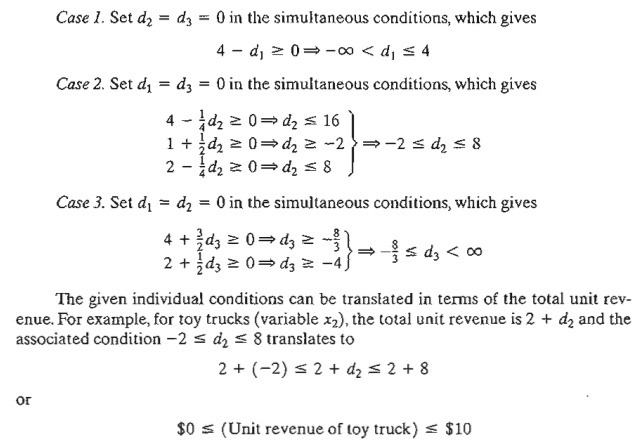

The

general optimality conditions can be used to determine the special case where

the changes d j occur one at

a time

instead of simultaneously. This analysis is equivalent to considering the

following three cases:

The individual conditions can be accounted for as special cases of the simultaneous case.

This

condition assumes that the unit revenues for toy trains and toy cars remain

fixed at $3 and $5, respectively.

The

allowable range ($0, $10) indicates that the unit revenue of toy trucks

(vari-able xz) can be as low as $0 or as high as $10 without changing the

current optimum, x1 = 0, x2 = 100, x3 = 230.

The total revenue will change to 1350 + 100d2, however.

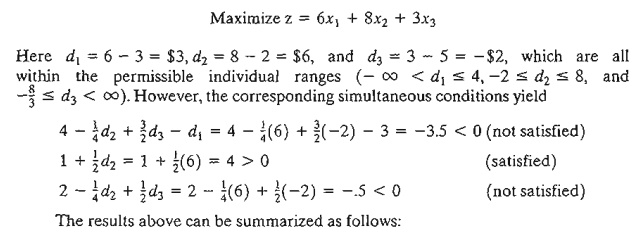

It is important to notice that the

changes d1,

d2,

and d3 may be within their allow-able

individual ranges without satisfying the simultaneous conditions, and vice

versa. For example, consider

1.The

optimal values of the variables remain unchanged so long as the changes dj , j =

1, 2, ...

,

n, in the objective function

coefficients satisfy all the optimality conditions when the changes are

simultaneous or fall within the optimality ranges when a change is made

individually_

2. For

other situations where the simultaneous optimality conditions are not satisfied

or the individual feasibility ranges are violated, the recourse is to either

re-solve the problem with the new values of dj or apply the post-optimal

analysis presented in Chapter 4.

PROBLEM

SET 3.60

1. In the

TOYCO model, determine if the

current solution will change in each of the following cases:

*2.

B&K grocery store sells three types of soft drinks: the brand names Al Cola

and A2 Cola and the cheaper store brand BK Cola. The price per can for Al, A2,

and BK are 80, 70, and 60 cents, respectively. On the average, the store sells

no more than 500 cans of all colas a day. Although Al is a recognized brand

name, customers tend to buy more A2 and BK because they are cheaper. It is

estimated that at least 100 cans of Al are sold daily and that A2 and BK

combined outsell Al by a margin of at least 4:2.

a.Show that the optimum solution does not call for selling the A3 brand.

b.By how much should the price per can of A3 be increased to be sold by

B&K?

c.To be competitive with other stores, B&K decided to lower the

price on all three types of cola by 5 cents per can. Recompute the reduced

costs to determine if this promotion will change the current optimum solution.

3. Baba

Furniture Company employs four carpenters for 10 days to assemble tables and

chairs. It takes 2 person-hours to assemble

a table and .5 person-hour to assemble a chair. Customers usually buy one table

and four to six chairs. The prices are $135 per table and $50 per chair. The

company operates one 8-hour shift a day.

a. Determine

the 10-day optimal production mix.

b. If the present unit prices per table

and chair are each reduced by 10%, use sensitivi-ty analysis to determine if

the optimum solution obtained in (a) will change.

c. If the present unit prices per table

and chair are changed to $120 and $,25, will the solution

in (a) change?

4. The

Bank of Elkins is allocating a maximum of $200,000 for personal and car loans

dur-ing the next month. The bank charges 14% for personal loans and 12% for car

loans. Both types of loans are repaid at the end of a I-year period. Experience

shows that about 3 % of personal loans and 2 % of car loans are not repaid. The

bank usually allocates at least twice as much to car loans as to personal

loans.

a.

Determine the optimal allocation of funds between

the two loans and the net rate of return on all the loans.

b.

If the

percentages of personal and car loans are changed to 4% and 3%, respectively, use sensitivity analysis to

determine jf the

optimum solution in (a) will change.

*5.

Electra produces four types of electric motors, each on a separate assembly

line. The re-spective capacities of the lines are 500, 500, 800, and 750 motors

per day. Type 1 motor uses 8 units of a certain electronic component, type 2

motor uses 5 units, type 3 motor uses 4 units, and type 4 motor uses 6 units.

The supplier of the component can provide 8000 pieces a day. The prices per

motor for the respective types are $60, $40, $25, $30.

a) Determine

the optimum daily production mix.

b) The

present production schedule meets Electra's needs. However, because of competition,

Electra may need to lower the price of type 2 motor. What is the most

re-duction that can be effected without changing the present production

schedule?

c) Electra

has decided to slash the price of all motor types by 25%. Use sensitivity

analysis to determine if the optimum solution remains unchanged.

d) Currently,

type 4 motor is not produced. By how much should its price be increased to be

induded in the production schedule?

6. Popeye

Canning is contracted to receive daily 60,000 lb of ripe tomatoes at 7 cents

per pound from which it produces canned tomato juice, tomato sauce, and tomato

paste. The canned products are packaged in 24-can cases. A can of juice uses

lib of fresh tomatoes, a can of sauce uses 3/4 lb, and

a can of paste uses ½ lb. The company's daily share of the market is

limited to 2000 cases of juice, 5000 cases of sauce, and 6000 cases of paste.

The wholesale prices per case of juice, sauce, and paste are $21, $9, and $12,

respectively.

a.

Develop an optimum daily production program for

Popeye.

b.

If the price

per case for juice and paste remains fixed as given in the problem, use sensitivity analysis to determine

the unit price range Popeye should charge for a case of sauce to keep the

optimum product mix unchanged.

7. Dean's

Furniture Company assembles regular and deluxe kitchen cabinets from precut lumber.

The regular cabinets are painted white, and the deluxe are varnished. Both

paint-ing and varnishing are carried out in one department. The daily capacity

of the assembly department is 200 regular cabinets and 150 deluxe. Varnishing a

deluxe unit takes twice as much time as painting a regular one. If the painting/varnishing

department is dedicat-ed to the deluxe units only, it can complete 180 units

daily. The company estimates that the revenues per unit for the regular and

deluxe cabinets are $100 and $140, respectively.

a.

Formulate the problem as a linear program and find

the optimal production sched-ule per day.

b.

Suppose that competition dictates that the price

per unit of each of regular and deluxe cabinets be reduced to $80. Use

sensitivity analysis to determine whether or not the optimum solution in (a)

remains unchanged.

Related Topics