Chapter: Operations Research: An Introduction : The Simplex Method and Sensitivity Analysis

Algebraic Sensitivity Analysis-Changes in the Right-Hand Side

Algebraic Sensitivity Analysis-Changes

in the Right-Hand Side

In Previous Section , we used the graphical solution to determine the dual prices (the unit worths of

resources) and their feasibility ranges. This section extends the analysis to

the general LP model. A numeric example (the TOYCO model) will be used to

facilitate the presentation.

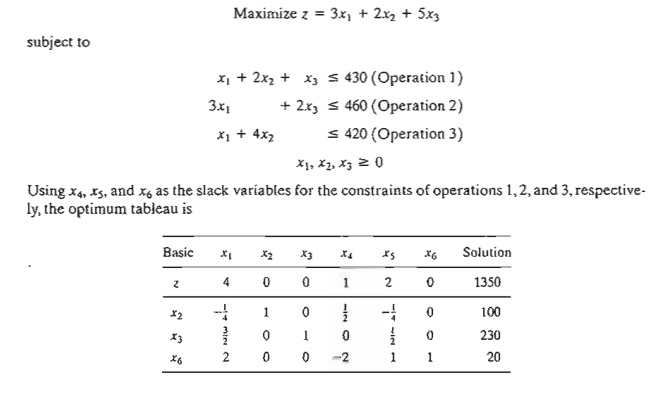

Example 3.6-2

(TOYCO Model)

TOYCO

assembles three types of toys-trains, trucks, and cars-using three operations.

The daily limits on the available times for the three operations are 430,460,

and 420 minutes, respectively, and the revenues per unit of toy train, truck,

and car are $3, $2, and $5, respectively. The as-sembly times per train at the

three operations are 1, 3, and 1 minutes, respectively. The corresponding times

per train and per car are (2,0,4) and (1,2,0) minutes (a zero time indicates

that the operation is not used).

Letting x1,

x2, and x3 represent the daily number of

units assembled of trains, trucks, and cars, respectively, the associated LP

model is given as:

The

solution recommends manufacturing 100 trucks and 230 cars but no trains. The

associated revenue is $1350.

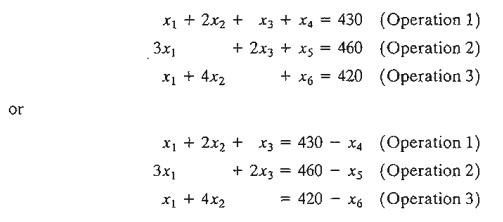

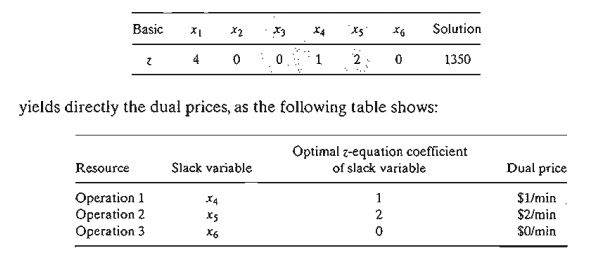

Determination of Dual Prices. The

constraints of the model after adding the slack variables x4,

x5, and x6 can be written as follows:

With this

representation, the slack variables have the same units (minutes) as the operation

times. Thus, we can say that a one-minute decrease

in the slack variable is equivalent to a one-minute increase in the operation time.

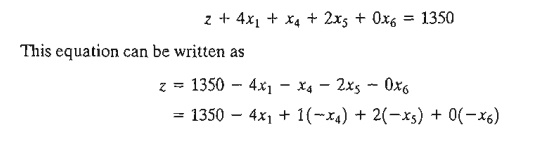

We can

use the information above to determine the dual

prices from the z-equa-tion in the optimal tableau:

Given

that a decrease in the value of a

slack variable is equivalent to an increase

in its operation time, we get

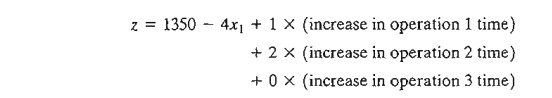

This

equation reveals that (1) a one-minute increase in operation 1 time increases z by $1, (2) a one-minute increase in

operation 2 time increases z by $2,

and (3) a one-minute increase in operation 3 time does not change z.

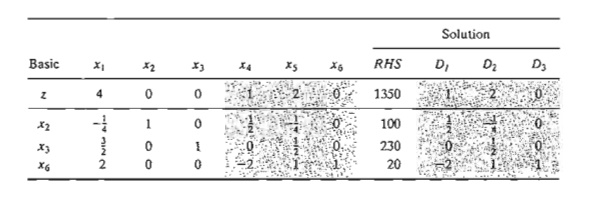

To

summarize, the z-row in the optimal

tableau:

The zero

dual price for operation 3 means that there is no economic advantage in

allocating more production time to this operation. The result makes sense

because the resource is already abundant, as is evident by the fact that the

slack variable associated with Operation 3 is positive (= 20) in the optimum

solution. As for each of Operations 1 and 2, a one minute increase will improve

revenue by $1 and $2, respectively. The dual prices also indicate that, when

allocating additional resources, Operation 2 may be given higher priority

because its dual price is twice as much as that of Operation 1.

The

computations above show how the dual prices are determined from the optimal

tableau for ≤

constraints. For ≥

constraints, the same idea remains applicable except that the dual price will

assume the opposite sign of that associated with the ≤ constraint. As for the case

where the constraint is an equation, the determination of the dual price from

the optimal simplex tableau requires somewhat "involved"

calcula-tions as will be shown in Chapter 4.

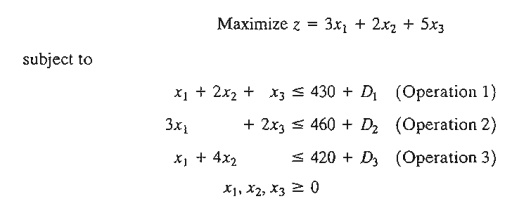

Determination of the Feasibility Ranges. Having

determined the dual prices, we show next how the feasibility ranges in which they remain valid are determined. Let DI , Dz, and D3

be the changes (positive or negative) in the daily manufacturing time allocated

to operations 1,2, and 3, respectively. The model can be written as follows:

We will

consider the general case of making the changes simultaneously. The special

cases of making change one at a time are derived from these results.

The

procedure is based on recomputing the optimum simplex tableau with the modified

right-hand side and then deriving the conditions that will keep the solution

feasible-that is, the right-hand side of the optimum tableau remains nonnegative.

To show how the right-hand side is recomputed, we start by modifying the Solution column of the starting tableau

using the new right-hand sides: 430 + D1

460 + D2, and 420 + D3 . The starting tableau will thus appear

as

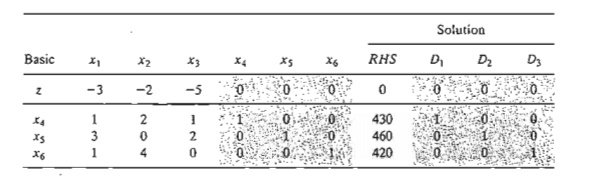

The

columns under D1 D2 and D3 are

identical to those under the starting basic columns x4,x5, and x6. This means that when we carry

out the same simplex iterations as in

the original model, the columns in

the two groups must come out identical as well. Effectively, the new optimal

tableau will become

The new

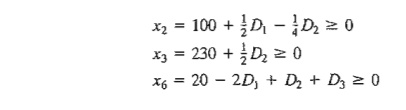

optimum tableau provides the following optimal solution:

Interestingly,

as shown earlier, the new z-value confirms that the dual prices for operations

1,2, and 3 are 1,2, and 0, respectively.

The

current solution remains feasible so long as all the variables are nonnegative,

which leads to the following feasibility

conditions:

Any

simultaneous changes D1, D2, and D3 that satisfy

these inequalities will keep the solution feasible. If all the conditions are

satisfied, then the new optimum solution can be found through direct

substitution of D1,D2 and D3

in the equations given above.

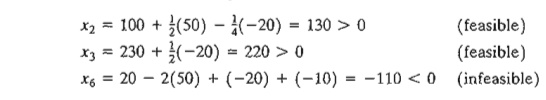

To

illustrate the use of these conditions, suppose that the manufacturing time

available for operations 1,2, and 3 are 480,440, and 410 minutes respectively.

Then, Dl = 480 - 430 = 50, D2 = 440 - 460 = -20, and D3 = 410 -

420 = -10. Substituting in the

feasibility conditions, we get

The calculations

show that x6 < 0, hence

the current solution does not remain feasible. Additional calculations will be

needed to find the new solution. These calculations are discussed in Chapter 4

as part of the post-optimal analysis.

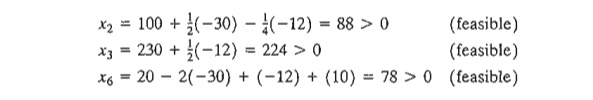

Alternatively,

if the changes in the resources are such that D1 = -30, D2 = -12, and D3 = 10, then

The new

feasible solution is x1 = 88, x3 = 224, and

x6 = 68

with z = 3(0) + 2(88) +

5(224) = $1296. Notice that the optimum

objective value can also be computed as z = 1350 + 1( -30) + 2( -12) = $1296.

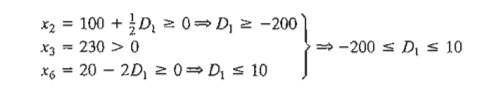

The given

conditions can be specialized to produce the individual feasibility ranges that result from changing the resources one at a time (as defined in Section

3.6.1).

Case 1. Change in operation 1 time

from 460 to 460 + D1 minutes. This

change is equiv-alen to setting D2 = D3 = 0 in the simultaneous

conditions, which yields

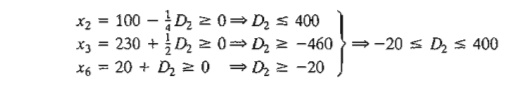

Case 2. Change in operation 2 time

from 430 to 430 + D2 minutes. This change is equivalent to setting D1 = D3 = 0 in

the simultaneous conditions, which yields

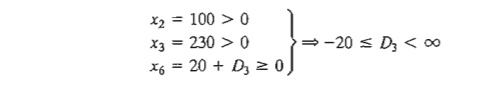

Case 3. Change in operation 3 time

from 420 to 420 +

D3 minutes. This

change is equivalent to setting D1 = D2

= 0 in the simultaneous conditions, which yields

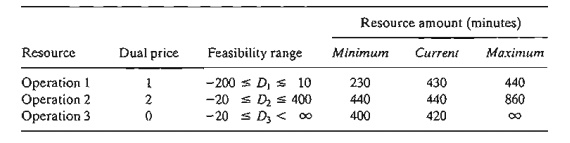

We can

now summarize the dual prices and their feasibility ranges for the TOYCO model

as follows:

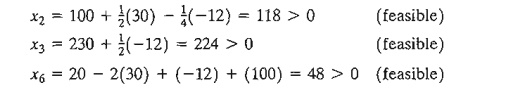

It is

important to notice that the dual prices will remain applicable for any simultaneous changes that keep the

solution feasible, even if the

changes violate the indi-vidual ranges. For example, the changes D1 = 30, D2 = -12, and D3

= 100, will keep the solution feasible even though D1 = 30

violates the feasibility range -200 ≤ Dl ≤ 10, as

the following computations show:

This

means that the dual prices will remain applicable, and we can compute the new

optimum objective value from the dual prices as z = 1350 + 1(30) + 2( -12) + 0(100) = $1356

The

results above can be summarized as follows:

1. The

dual prices remain valid so long as the changes Di , i = 1,2, ... , m, in the

right-hand sides of the constraints satisfy all the feasibility conditions when

the changes are simultaneous or fall within the feasibility ranges when the

changes are made individually.

2. For

other situations where the dual prices are not valid because the simultaneous

feasibility conditions are not satisfied or because the individual feasibility

ranges are violated, the recourse is to either re-solve the problem with the

new values of Di or apply the post-optimal analysis

presented in Chapter 4.

PROBLEM SET 3.6et

1. In the

TOYCO model, suppose that the changes DI , Dz, and D3

are made simultaneously in the three

operations.

(a) If the availabilities of operations

1,2, and 3 are changed to 438,500, and 410 minutes, respectively, use the

simultaneous conditions to show that the current basic solution remains

feasible, and determine the change in the optimal revenue by using the optimal

dual prices.

(b) If

the availabilities of the three operations are changed to 460,440, and 380

minutes, respectively, use the simultaneous conditions to show that the current

basic solution becomes infeasible.

*2. Consider the TOYCO model.

(a) Suppose that any additional time for

operation 1 beyond its current capacity of 430 minutes per day must be done on

an overtime basis at $50 an hour. The hourly cost includes both labor and the

operation of the machine. Is it economically advantageous to use overtime with

operation I?

(b) Suppose that the operator of operation 2

has agreed to work 2 hours of overtime daily at $45 an hour. Additionally, the

cost of the operation itself is $10 an hour. What is the net effect of this

activity on the daily revenue?

(c) Is overtime needed for operation 3?

(d) Suppose

that the daily availability of operation 1 is increased to 440 minutes. Any

overtime used beyond the current maximum capacity will cost $40 an hour.

Deter-mine the new optimum solution, including the associated net revenue.

(e) Suppose

that the availability of operation 2 is decreased by 15 minutes a day and that

the hourly cost of the operation during regular time is $30. Is it advantageous

to decrease the availability of operation 2?

3. A

company produces three products, A, B, and C. The sales volume for A is at

least 50% of the total sales of all three products. However, the company cannot

sell more than 75 units of A per day. The three products use one raw material,

of which the maxi-mum daily availability is 240 lb. The usage rates of the raw

material are 2 lb per unit of A,4 lb per unit of B, and 3lb per unit of C. The

unit prices for A, B, and Care $20, $50, and $35, respectively.

(a) Determine

the optimal product mix for the company.

(b) Determine

the dual price of the raw material resource and its allowable range. If

available raw material is increased by 120 lb, determine the optimal solution

and the change in total revenue using the dual price.

(c) Use

the dual price to determine the effect of changing the maximum demand for

product A by ± 10 units.

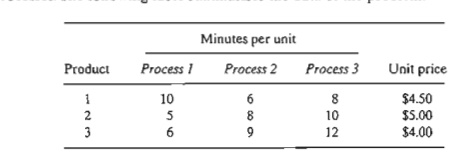

4. A

company that operates 10 hours a day manufactures three products on three

sequential processes. The following table summarizes the data of the problem:

(a) Determine the optimal product mix.

(b) Use the dual prices to prioritize the three

processes for possible expansion.

(c) If additional production hours can be

allocated, what would be a fair cost per additional hour for each process?

5. The

Continuing Education Division at the Ozark Community College offers a total of

30 courses each semester. The courses offered are usually of two types:

practical, such as wood-working, word processing, and car maintenance; and

humanistic, such as history, music, and fine arts. To satisfy the demands of

the community, at least 10 courses of each type must be offered each semester.

The division estimates that the revenues of offering practical and hu-manistic

courses are approximately $1500 and $1000 per course, respectively.

a. Devise

an optimal course offering for the college.

b. Show

that the dual price of an additional course is $1500, which is the same as the

revenue per practical course. What does this result mean in temlS of offering

addi-tional courses?

c. How

many more courses can be offered while guaranteeing that each will contribute

$1500 to the total revenue?

d. Determine

the change in revenue resulting from increasing the minimum requirement of

humanistics by one course.

*6. Show

& Sell can advertise its products on local radio and television (TV), or in

newspa-pers. The advertising budget is limited to $10,000 a month. Each minute

of advertising on radio costs $15 and each minute on TV costs $300. A newspaper

ad costs $50. Show & Sell likes to advertise on radio at least twice as

much as on TV. In the

meantime, the use of at least 5 newspaper ads and no more than 400 minutes of

radio advertising a month is recommended. Past experience shows that

advertising on TV is 50 times more effective than on radio and 10 times more

effective than in newspapers.

a. Determine

the optimum allocation of the budget to the three media.

b. Are

the limits set on radio and newspaper advertising justifiable economically?

c. If the monthly budget is increased

by 50%, would this result in a

proportionate in-crease in the overall effectiveness of advertising?

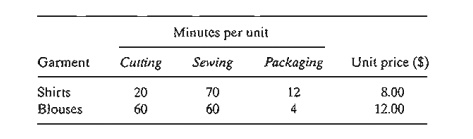

7. The

Burroughs Garment Company manufactures men's shirts and women's blouses for

Walmark Discount Stores. Walmark will accept all the production supplied by

Burroughs. The production process includes cutting, sewing, and packaging.

Burroughs employs 25 workers in the cutting department, 35 in the sewing

department, and 5 in the

packaging department. The factory works one 8-hour shift, 5 days a week. The

following table gives the time requirements and prices per unit for the two

garments:

a. Determine

the optimal weekly production schedule for Burroughs.

b. Determine

the worth of one hour of cutting, sewing, and packaging in terms of the total

revenue.

c. If overtime can be used in cutting

and sewing, what is the maximum hourly rate Bur-roughs should pay for overtime?

8. ChemLabs

uses raw materials I and II to produce two domestic cleaning

solutions, A and B. The daily availabilities of raw materials I and II are 150 and 145

units, respectively. One unit of

solution A consumes .5 unit of raw materiall and .6 unit of raw materialll, and

one unit of solution Buses .5 unit of

raw materiall and .4 unit of

raw materialll. The prices per unit of solutions A and Bare $8 and $10,

respectively. The daily demand for so-lution A lies between 30 and 150 units,

and that for solution B between 40 and 200 units.

a. Find

the optimal amounts of A and B that ChemLab should produce.

b. Use

the dual prices to determine which demand limits on products A and B should

be relaxed to improve profitability.

c. If additional units of raw material

can be acquired at $20 per unit, is this advisable? Explain.

d. A

suggestion is made to increase raw material II by 25% to remove a bottleneck in

production. Is this advisable? Explain.

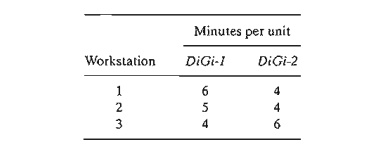

9. An

assembly line consisting of three consecutive workstations produces two radio

models: DiGi-l and DiGi-2. The following table provides the assembly times for

the three workstations.

The daily

maintenance for workstations 1,2, and 3 consumes 10%,14%, and 12%,

re-spectively, of the maximum 480 minutes available for each workstation each

day.

a. The

company wishes to determine the optimal product mix that will minimize the idle

(or unused) times in the three workstations. Determine the optimum utilization of

the workstations. [Hint; Express the

sum of the idle times (slacks) for the three operations in terms of the

original variables.]

b. Determine

the worth of decreasing the daily maintenance time for each workstation by 1

percentage point.

c. It is proposed that the operation

time for all three workstations be increased to 600 minutes per day at the additional

cost of $1.50 per minute. Can this proposal be im-proved?

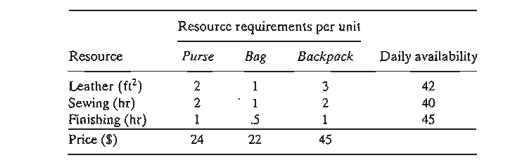

10. The

Gutchi Company manufactures purses, shaving bags, and backpacks. The

construc-tion of the three products requires leather and synthetics, with

leather being the limiting raw material. The production process uses two types

of skilled labor: sewing and finishing. The following table gives the

availability of the resources, their usage by the three products, and the

prices per unit.

Formulate

the problem as a linear program and find the optimum solution. Next, indicate

whether the following changes in the resources will keep the current solution

feasible.

For the

cases where feasibility is maintained, determine the new optimum solution

(values of the variables and the objective function).

a. Available

leather is increased to 45 ft2•

b. Available

leather is decreased by 1 ft2•

c. Available sewing hours are

changed to 38 hours.

d. Available

sewing hours are changed to 46 hours.

e. Available

finishing hours are decreased to 15 hours.

f. Available

finishing hours are increased to 50 hours.

g. Would

you recommend hiring an additional sewing worker at $15 an hour?

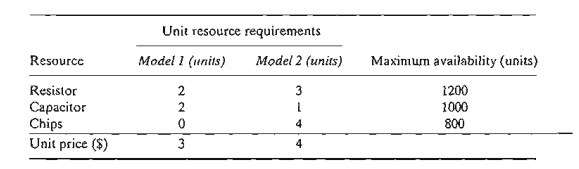

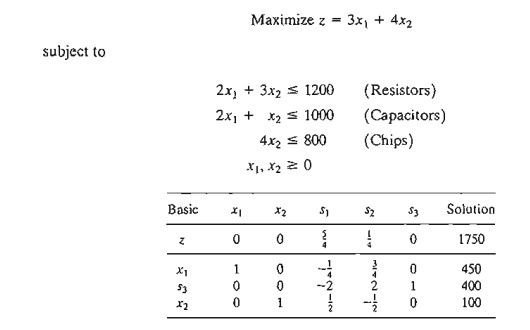

11. HiDec

produces two models of electronic gadgets that use resistors, capacitors, and

chips. The following table summarizes the data of the situation:

Let x1 and x2 be the amounts produced of

Models 1 and 2, respectively. Following are the LP model and its associated

optimal simplex tableau.

*(a) Determine

the status of each resource.

*(b) In

terms of the optimal revenue, determine the dual prices for the resistors,

capaci-tors, and chips.

(c) Determine

the feasibility ranges for the dual prices obtained in (b).

(d) If

the available number of resistors is increased to 1300 units, find the new

optimum solution.

*(e) If the available number of chips is

reduced to 350 units, will you be able to deter-mine the new optimum solution

directly from the given information? Explain.

(f) If the availability of capacitors is

limited by the feasibility range computed in (c), determine

the corresponding range of the optimal revenue and the corresponding ranges for

the numbers of units to be produced of Models 1 and 2.

(g) A new

contractor is offering to sell HiDec additional resistors at 40 cents each, but

only if HiDec would purchase at least 500 units. Should HiDec accept the offer?

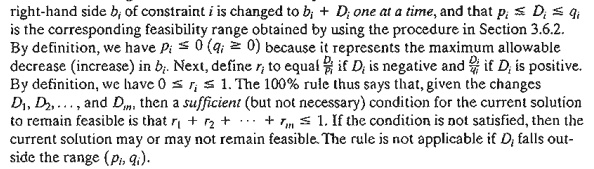

12. The 100% feasibility rule. A

simplified rule based on the individual changes D1,D2…... , and Dm in the right-hand side of the

constraints can be used to test whether or not simultaneous changes will maintain the feasibility of the current

solution. Assume that the right-hand

side bj of constraint i is changed to bi + D; one at a time, and that Pi≤ Di ≤ qj is the corresponding feasibility

range obtained by using the procedure in Section 3.6.2. By definition, we have Pi ≤; 0 (qj≥ 0) because it represents the

maximum allowable decrease (increase) in bi.

Next, define r1 to equal D1/P1 if Dj is negative and Di/qi if Di is positive. By definition, we

have 0 ≤ r1 ≤ 1. The

100% rule thus says that, given the changes

In

reality, the 100% rule is too weak to be consistently useful. Even in the cases

where feasibility can be confirmed, we still need to obtain the new solution

using the regular simplex feasibility conditions. Besides, the direct

calculations associated with simultane-ous changes given in Section 3.6.2 are

straightforward and manageable.

To

demonstrate the weakness of the rule, apply it to parts (a) and (b) of Problem

1 in this set. The rule fails to confirm the feasibility of the solution in (a)

and does not apply in (b) because the changes in Dj arc outside the admissible

ranges. Problem 13 further demonstrates this point.

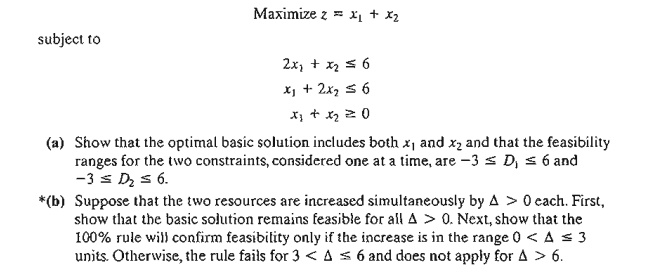

13. Consider the problem

Related Topics