Chapter: 11th Auditing : Chapter 1 : Introduction to Audit

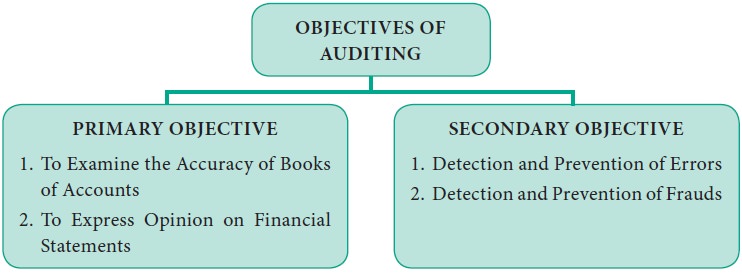

Objectives of Auditing

Objectives of Auditing

The objective of an audit is to express an opinion

on financial statements. The auditor has to verify the financial statements and

books of accounts to certify the truth and fairness of the financial position

and operating results of the business. Therefore, the objectives of audit are

categorized as primary or main objectives and secondary objectives.

Primary Objectives

The primary or main objective of audit is as follows:

1. To Examine the Accuracy of the Books of Accounts

An auditor has to examine the accuracy of the books

of accounts, vouchers and other records to certify that Profit and Loss Account

discloses a true and fair view of profit or loss for the financial period and

the Balance Sheet on a given date is properly drawn up to exhibit a true and

fair view of the state of affairs of the business. Therefore the auditor should

undertake the following steps:

·

Verify the arithmetical accuracy of the books of

accounts.

·

Verify the existence and value of assets and

liabilities of the companies.

·

Verify whether all the statutory requirements on

maintaining the book of accounts has been complied with.

Meaning of Books of Accounts

·

Books of Accounts mean the financial records maintained

by a business concern for a period of one year. The period of one year can be

either calendar year i.e., from 1st January to 31st December or financial year

i.e., from 1st April to 31st March. Usually, business concerns adopt financial

year for accounting all business transactions.

·

Books of accounts include the following: ledgers,

subsidary books, cash and other account books either in the written form or

through print outs or through electronic storage devices.

2. To Express Opinion on Financial Statements

After verifying the accuracy of the books of

accounts, the auditor should express his expert opinion on the truthness and

fairness of the financial statements. Finally, the auditor should certify that

the Profit and Loss Account and Balance Sheet represent a true and fair view of

the state of affairs of the company for a particular period.

Meaning of Financial Statement

Financial Statement means the statements prepared

at the end of the year taking into account the business activities that took

place for a year, for example, transactions that takes place in a business

concern from 1st April to 31st March.

Components of Financial Statement

Financial Statement includes the following:

·

Trading and Profit and Loss Account, and

·

Balance Sheet.

Elements of Financial Statements include the following:

·

Assets: Assets

include cash and bank balance, value of closing stock, debtors, bills receivable, investments, fixed

assets, prepaid expenses and accrued income.

·

Liabilities:

Liabilities

include capital, profit and loss balance, creditors, bills payable, outstanding expenses and income received in advance.

·

Revenue: Revenue

includes sales, collection from debtors, rent received, dividend, interest received and other incomes received.

·

Expenditure:

Expenditure

includes purchases, payment to creditors,

manufacturing and trade expenses, office expenses, selling and distribution

expenses, interest and dividend paid.

Secondary Objectives

The secondary objectives of audit are: (1) Detection

and Prevention of Errors, and (2) Detection and Prevention of Frauds.

Detection And Prevention of Errors

The Institute of Chartered Accountants of India

defines an error as, “an unintentional mistake in the books of accounts.”

Errors are the carelessness on the part of the person preparing the books of

accounts or committing mistakes in the process of keeping accounting records.

Errors which take place in the books of accounts and the duty of an auditor to

locate such errors are discussed below:

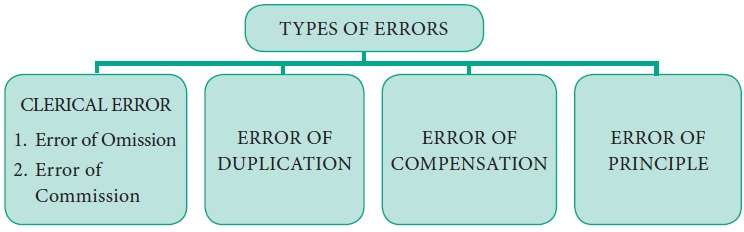

1. CLERICAL ERROR

Errors that are committed in posting, totalling and

balancing of accounts are called as Clerical Errors. These errors may or may

not affect the agreement of the Trial Balance.

Types of Clerical Errors:

(A) Errors of Omission:

When a transaction is not recorded or partially

recorded in the books of account is known as Errors of Omission. Usually, it

arises due to the mistake of clerks. Error of omission can occur due to

complete omission or partial omission.

(1) Error of Complete Omission: When a transaction is totally or completely

omitted to be recorded in the books it is called as “Error of Complete

Omission”. It will not affect the agreement of the Trial Balance and hence it

is difficult to detect such errors.

Example – 1: Goods purchased on credit from Mr. X on 10.5.2016 for Rs. 20,500, not recorded in Purchases Book.

Example – 2: Goods sold for cash to Ram for Rs. 10,000 on 1.7.2016, not

recorded in Cash Book.

(2) Errors of Partial Omission: When a transaction is partly recorded, it is

called as “Error of Partial Omission”. Such kind of errors can be detected

easily as it will affect the agreement of the Trial Balance.

Example – 1: Credit purchase from Mr.C for Rs. 45,000 on 10.12.2016, is entered in the Purchases Book but not posted

in Mr.C’s account.

Example – 2: Cash book total of Rs. 1,10,100 in Page 5 is not carried forward to next page.

(B) Errors of Commission:

Errors which are not supposed to be committed or

done by carelessness is called as Error of Commission. Such errors arise in the

following ways:

(1) Error of

Recording,

(2) Error of

Posting,

(3) Error of

casting, or Error of Carry-forward.

(1) Error of Recording: The

error arises when any transaction is

incorrectly recorded in the books of original entry. This error does not affect

the Trial Balance.

Example – 1: Goods purchased from Shyam for Rs. 1000 wrongly recorded in Purchases Day Book as Rs. 100.

Example – 2: Goods purchased from Ram for Rs. 1,000, instead of entering in Purchase Day Book wrongly entered

in Sales Day Book.

(2) Error of Posting : The

error arises when a transaction is

correctly journalised but wrongly posted in ledger account.

Example – 1: Rent paid to landlord for Rs. 10,000 on 1.5.2016 is wrongly posted

to debit side of Repairs account instead of debit side of Rent account.

Example – 2: Rent paid to landlord for Rs. 10,000 on 1.5.2016 is wrongly posted

to credit side of Rent account instead of debit side of Rent account.

(3) Error of casting, or Error of Carry-forward: The

error arises when a mistake is

committed in carrying forward a total of one page on the next page. This error

affects the Trial Balace.

Example – 1: Purchases Book is totalled as Rs. 10,000 instead of 1,000.

Example – 2: Total of Purchases Book is carried forward as Rs. 1,000 instead of Rs. 100.

2. ERROR OF DUPLICATION

Errors of duplication arise when an entry in a book

of original entry has been made twice and has also been posted twice. These

errors do not affect the agreement of trial balance, hence it can’t located

easily.

Example: Amount paid to Anbu, a creditor on 1.10.2016 for Rs. 75,000 wrongly accounted twice to Anbu’s account.

3. ERROR OF COMPENSATION (or) COMPENSATING ERRORS

When one error on debit side is compensated by

another entry on credit side to the same extent is called as Compensating

Error. They are also called as Off-setting Errors. These errors do not affect

the agreement of trial balance and hence it cannot be located.

Example: A’s account which was to be debited for Rs. 5,000 was credited as Rs. 5,000 and similarly B’s account which

was to be credited for Rs.

5,000 was debited for Rs. 5,000.

4. ERROR OF PRINCIPLE

An error of principle occurs when the generally

accepted principles of accounting are not followed while recording the

transactions in the books of account. These errors may be due to lack of

knowledge on accounting principles and concepts. Errors of principle do not

affect the trial balance and hence it is very difficult for an auditor to

locate such type of errors.

Example – 1: Repairs to Office Building for Rs. 32,000, instead of debiting to repairs account is wrongly

debited to building account.

Example – 2: Freight charges of Rs. 3,000 paid for a new machinery, instead of debiting to Machinery account wrongly debited to

Freight account.

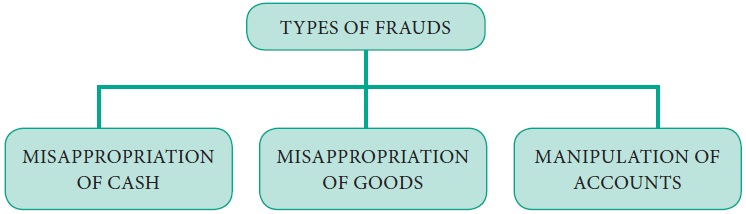

Detection and Prevention of Frauds

Fraud is the intentional or wilful

misrepresentation of transactions in the books of accounts by the dishonest

employees to deceive somebody. Thus detection and prevention of fraud is of

great importance and constituents an important duty of an auditor. Fraud can be

classified as:

1. MISAPPROPRIATION OF CASH

This is a very common method of misappropriation of

cash by the dishonest employees by giving false representation in the books of

accounts intentionally. In order to detect and prevent misappropriation, the

auditor should verify the system of internal check in operation and by making a

detailed examination of records and documents. Cash may be misappropriated in

the following ways:

(1) By omitting to enter cash which has been

received.

Example: Cash received on account of cash sales for Rs. 35,000 is not accounted in the debit side of the cash book.

(2) By accounting less amount on the receipt side

of cash book than the actual amount received.

Example: Cash received on account of cash sales for Rs. 35,000 is accounted in the debit side of the cash book as Rs. 25,000. The difference of Rs. 10,000 may be defrauded by the cashier.

(3) By recording fictitious entries on the payment

side of cash book.

Example: Cash book is credited for Rs. 44,000 as amount paid to Mr.X for goods purchased on credit but actually no amount is paid.

Hence, cashier misappropriates Rs. 44,000 of cash as paid to Mr.X.

(4) By accounting more amount on payments side of

cash book than the actual amount paid.

Example: Amount paid to Gopal for Rs. 5,000 is accounted on the credit side of cash book as Rs. 15,000. The difference of Rs. 10,000 may be defrauded by the cashier.

(5) Teeming and Lading of Fraud which means cash

received from one customer is misappropriated and remittance received from

another debtor is posted to the first debtors account.

2. MISAPPROPRIATION OF GOODS

Fraud which takes places in respect of goods is

Misappropriation of Goods. Such a type of fraud is difficult to detect and

usually takes place where the goods are less bulky and are of high value.

·

By showing less amount of purchase than actual

purchase in the books of accounts.

·

By showing issue of material more than actual issue

made.

·

By showing good materials as obsolete or poor line

of goods.

·

By showing fictitious entries in the books of accounts.

Example – 1: Goods purchased amounting to Rs. 58,000 is wrongly accounted in Purchases Book as Rs. 50,000. Hence, showing less amount of purchases than the actual

and misappropriating goods worth Rs. 8,000.

Example – 2: Goods issued from stores for 1000 units is wrongly

accounted in the Ledger accounts as 3000 units issued. The difference of 2000

units may be misappropriated by the storeskeeper.

Example – 3: Entries in the Purchases Book may

be suppressed or inflated to show more or less profit.

Detection of Misappropriation of goods is a

difficult task for an Auditor. Only through efficient system of inventory

control, periodical stock verification, internal check system and adequate

security arrangement the scope for such frauds can be eliminated or minimized.

Auditor has to thoroughly scrutinize the inward and

outward registers, invoices, sales memos, audit notes, etc., to detect the

goods-related frauds.

3. MANIPULATION OF ACCOUNTS

There is a very common practice almost in every

organization, some dishonest employees have intention to commit this type of

fraud. Manipulation of accounts is the procedure to alter books of accounts in

such a way that there will be an increase or decrease in the amount of profit

to achieve some personal objectives of the high officials. It is very difficult

for the auditors to identify such frauds which may be due to manipulation of

accounts.

Causes of Manipulation of Accounts

·

There are different reasons for manipulation of

accounts. The reasons are:

· To get

more commission calculated on profit

· For

evasion of income tax and sales tax

· To get

huge loan from financial institutions by showing more profit in the books of

accounts.

· To

declare more dividend to the shareholders.

· By

showing more profit than actual to get confidence of the shareholders.

·

To make secret reserves by showing less income or

by showing more expenses in the books of accounts.

Ways of Manipulation of Accounts

Manipulation of accounts may be made in the

following ways:

·

By showing more or less amount on fixed assets,

·

By showing over valuation or under valuation of

stock,

·

Over or under valuation of liabilities,

·

Creation of over or under provision for

depreciation,

·

Charging capital expenditure as revenue expenditure

or vice versa,

·

By making more or less provision for bad debts and

for outstanding liabilities,

·

By showing advance income or expenditure in the

current year accounts.

Objectives of Manipulation of Accounts

The objectives of Manipulation may be window dressing or creation of secret reserves.

Window

Dressing: In window dressing, accounts

are manipulated in such a manner to reveal a much better and sound financial

position of the business than what actually it is, in order to mislead the

outsiders by inflating the profit.

Secret

Reserves: Accounts are prepared in

such a manner that they disclose a worse financial position than the real. The

real picture of the business is concealed and a distorted one is revealed.

Related Topics