Chapter: 11th Auditing : Chapter 1 : Introduction to Audit

Auditor: Meaning, Functions, Qualities

Auditor

Meaning – Auditor

The person who checks the accuracy of the books of

accounts and expresses an opinion on the financial statements of the business

concern is called as an Auditor. The person who is a Chartered Accountant

holding Certificate of Practice from the Institute of Chartered Accountants of

India is referred to as an Auditor. Auditors enjoy a distinctive professional

status in the society because of specialized functions of auditing.

Functions of an Auditor

The following are the functions or basic aspects to

be covered by the auditor in the course of audit. They are:

1.

Examination:

Auditor

should examine the accounting system

to ensure about their appropriateness.

2.

Books: Check the

books of accounts to ensure the

arithmetical accuracy.

3. Evidence: The auditor should examine documentary evidence to support the

entries in the books of accounts.

4. Full Inclusion: Check whether all entries in the books of accounting

have been taking while preparing financial statements.

5. Properness: Examine whether information contained in financial

statements is proper and it does not contain any fraudulent entry.

6. Verification of Assets and Liabilities: Check the

existence, valuation and disclosure of all assets and liabilities in financial

statements.

7. Statutory Compliance: Verify

the compliance of financial

statements with the relevant statutory authorities.

8. Disclosure: Examine whether the information in financial statements is

disclosed properly as per accounting principles.

9.

Truth and

Fairness: Check whether financial

statements represent a true and fair view of profit or loss and of assets and

liabilities of the business concern.

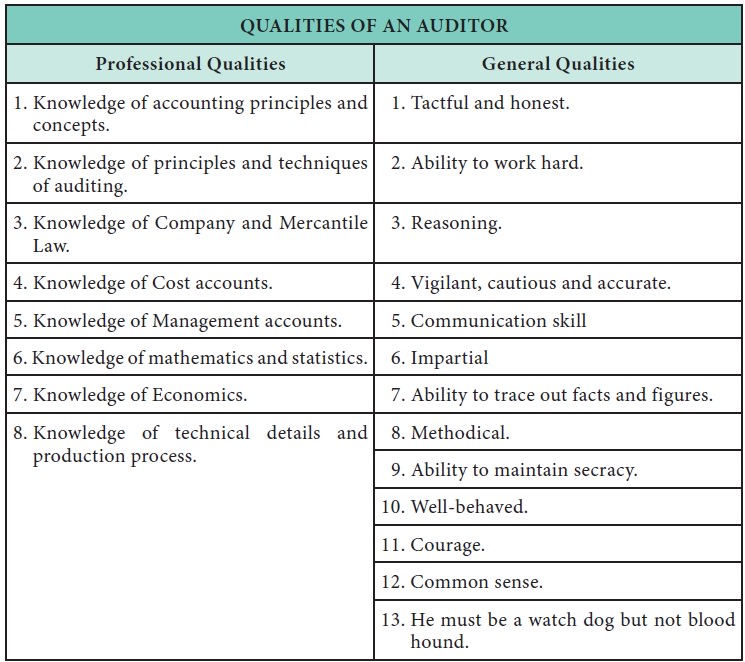

Qualities of an Auditor

Related Topics