Chapter: 11th Auditing : Chapter 1 : Introduction to Audit

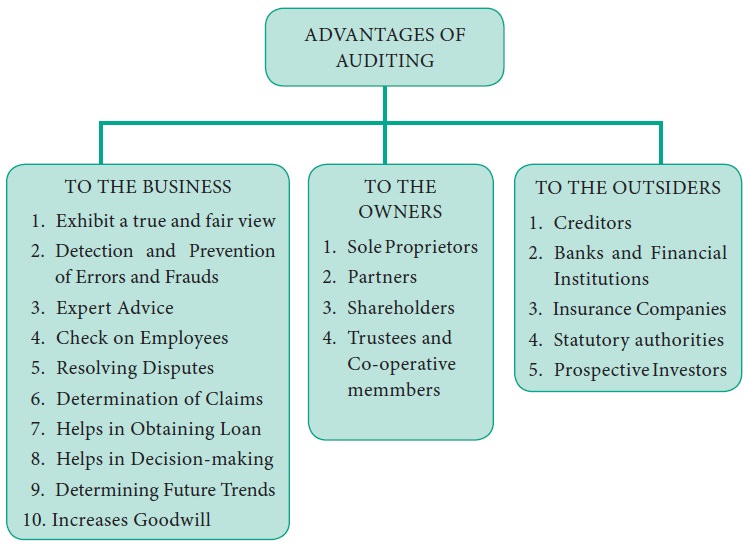

Advantages of Auditing

Advantages of Auditing:

Auditing provides benefits to the business, owners

and to the outsiders in the following ways:

I. Benefits to the Business

1.

Exhibits

a True and Fair View of the Financial Statements: Audited accounts enables to reveal that the

Profit and Loss Account and Balance Sheet of the business concern shows a true

and fair view of the state of affairs of the business concern.

2.

Detection

and Prevention of Errors and Frauds: When books of accounts are audited, errors and frauds can be

detected and necessary action can be taken to prevent it.

3.

Expert

Advice: Auditors who possess professional

outlook provide expert advice to the company on various aspects such as tax

matters, internal check, internal control and submission of various reports to

the statutory authorities, preparation of project reports etc.

4.

Check on

Employees: When accounts

are audited it creates a moral pressure on the employees to be very

cautious and regular in their work, as a result the chances of errors and

frauds will be minimized.

5.

Helps in

Resolving Disputes: Audited accounts

provides a basis for settling disputes and conflicts among the partners in the

case of partnership firm and to settle disputes with regard to bonus, wages

etc. in the case of companies.

6.

Helps in

Determination of Claims: An insurance company settles claims to the

companies for the loss due to damage of business property only on the basis of

audited accounts.

7.

Helps in

Obtaining Loan: Loans can

be easily borrowed from banks and other financial institutions on the basis of

audited accounts, as the audited accounts authenticate the truthfulness of the

books of accounts and financial statements.

8.

Helps in

Decision-Making: Audited accounts

are relied upon for the purpose of decision-making by the management.

9.

Helps to

Determine Future Trends: By comparing the audited accounts with past years,

the trend of financial activities can be determined. On the basis of review,

weaknesses are found out and policies for the future period can be determined.

10. Increase in Goodwill: Audit of business on a regular basis increases

confidence to the interested parties and general public, as a result goodwill

of the business can be enhanced.

II. Benefits to the Owners

1. Benefits to the Sole Proprietors: Audited

accounts provide assurance to the proprietor about the accuracy of accounts

maintained by his employees and also enables to know the financial performance

of the business. It further enables the proprietor to obtain loan and in

computation of income tax liability.

2. Benefit to the Partners: In case

of partnership business, audited

accounts help the partners in settlement of accounts among the partners at the

time of admission, retirement or in the case of death of a partner.

3.

Benefit

to the Shareholders: Share holders

are the owners of the company. With the help of audited accounts, they get a

real picture of the financial position of the company and that directors and

managing directors have not taken any undue advantage of their position.

4.

Benefit

to Trust, Co-operative Societies: Audit of accounts of co-operative

societies and Trusts provide evidence that the interest of the beneficiaries

and members are properly protected.

III. Benefits to the Third Parties

1.

Bank and

Financial Institutions: Banks and

other financial institutions grant loan to the business concern on the basis of

audited financial statements.

2. Creditors: Creditors who supply goods to the business may assess the solvency and liquidity position of the business on the basis of audited accounts.

3. Insurance Companies: For

settlement of insurance claims,

insurance companies can rely on audited accounts.

4. Statutory Authorities: Statutory authorities like income tax, sales

tax, wealth tax etc. accept audited statements for determining the liability

which arises due to income, sales and wealth.

5.

Prospective

Investors: Prospective investors

who wish to invest money in shares and debentures of a company rely on audited

accounts.

Related Topics