Chapter: 11th Auditing : Chapter 1 : Introduction to Audit

Auditing in a Computer Based Environment

Auditing in a Computer

Based Environment

Introduction

Information Technology (IT) is integral to modern

accounting and management information systems. It is, therefore, essential that

auditors should be aware of the impact of IT on the audit of a client’s

financial statements. Information Technology auditing (IT auditing) began as

Electronic Data Process (EDP) auditing and developed largely as a result of the

rise in technology in accounting systems. The last few years have been an

exciting time in the world of IT, auditing as a result of the accounting

scandals and increased regulations. Regardless of the computer systems used,

the audit objectives and approach will remain largely unchanged from that if

the audit was being carried out in a non-computer environment.

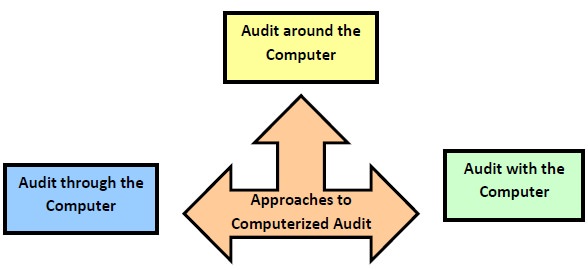

Audit Approach in Computeriszed Environment

1. Auditing

Around the Computer: It is the

type of auditing done in a traditional method. The auditor summarises the input

data and ignores the computer’s processing but ensures the correctness of the

output data generated by the computer, this approach is generally referred to

as “auditing around the computer”. This methodology was primarily focused on

ensuring that source documentation was correctly processed and this was

verified by checking the output documentation to the source documentation

2. Auditing

Through the Computer: Due to

the “real time” computer environments, there may only be a limited amount of

source documentation or paperwork hence the auditor may employ an approach

known as “auditing through the computer”. In this approach, the reliability and

accuracy of the results are analysed through the computer. This involves the

auditor to perform tests on the information technology controls to evaluate

their effectiveness like Compliance test, Test Packs, Reprocessing.

3. Auditing

with the Computer: The utilization

of computer by the auditor for some audit work and he uses some general

software for the purpose of calculating depreciation, printing letters, and

duplicate checking and files comparison.

The computer is not used for all the audit work and

it is done manually.

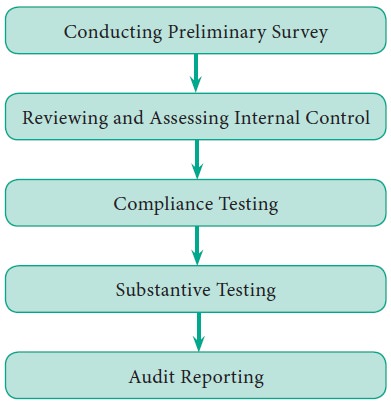

Audit Process for Computerized Accounting System

The audit process for a computerized accounting

system involves the following five major steps:

1. Conducting

Preliminary Survey: This is a preliminary work to plan how the audit

should be conducted. The auditors gather information about the computerized

accounting system that is relevant to the audit plan. This includes an

understanding of how the computerized accounting functions are organized,

identification of the computer software used, understanding accounting

application processed by computer and identification applicable controls.

2. Reviewing and Assessing Internal Controls: There are two types of controls namely general controls and application controls.

·

General

Controls: General controls are those

that cover the organization, management and processing within the computer

environment. They should be tested prior to application controls, because if

they are found to be ineffective, the auditor will not be able to rely on

application controls. General controls include proper segregation of duties,

file backup, use of labels, access control, etc.

·

Application

Controls: Application controls relate

to specific tasks performed by the system. They include input controls,

processing controls, and output controls. They should provide reasonable

assurance that the initiating, recording, processing and reporting of data are

properly performed.

3. Compliance Testing: Compliance testing is performed to determine whether the controls actually exist and function as intended. This can be performed by comparing the results to predetermined results or by processing dummy transactions.

4. Substantive

Testing: This is performed to

determine whether the data is real. Substantive tests are tests of transactions

and balances and analytical procedures designed to substantiate the assertions.

Auditors must obtain and evaluate evidence concerning management’s assertions

about the financial statements. The auditor must obtain sufficient competent

evidential matter to provide a basis for an opinion regarding the financial

statements under audit. If sufficient competent evidence cannot be obtained

then an opinion cannot be issued.

5. Audit

Reporting: The audit report will contain detailed information on various aspects of their findings

in the process of audit in a computerized environment.

Related Topics