Chapter: 11th Auditing : Chapter 1 : Introduction to Audit

Limitations of Auditing

Limitations of Auditing

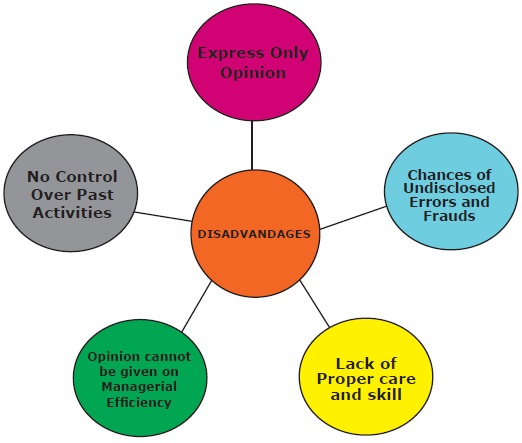

The limitations or disadvantages of auditing are as

follows:

1.

Gives

Opinion: After the completion of

audit, an auditor gives only the opinion regarding true and fair view of the

books of accounts and financial position of the business. Therefore, an auditor

is not an insurer; he does not give guarantee regarding financial reflections

of the business.

2.

Chances

of Undisclosed Errors and Frauds: An Auditor has to depend on many financial data and statements

supplied by the management which may be wrong or misleading. Therefore, there

may be some undisclosed errors and frauds in the books of accounts.

3.

Lack of

Proper Care and Skill: Often it

is seen that an Auditor does not apply proper care and skill to verify the

books of accounts and take it as a routine matter. As a result, the books of

accounts do not reflect true and fair view of the financial position of the

business.

4.

No

Evaluation of Managerial Efficiency: An Auditor is not an advisor, therefore, he cannot give his

opinion regarding managerial efficiency because every concern has its own

policy, procedures and practices.

5.

Not

Preventive: Audit is a post-mortem examination. The work of

audit starts after the completion of transactions recorded in the books of

accounts. Therefore, audited accounts can prevent the future activities but not

the past.

Related Topics