Meaning, Definitions, Objectives and Fiscal Instruments - Fiscal Economics - Fiscal policy | 12th Economics : Chapter 9 : Fiscal Economics

Chapter: 12th Economics : Chapter 9 : Fiscal Economics

Fiscal policy

Fiscal policy

As an instrument of macro-economic policy, fiscal policy has been

very popular among modern governments. The growing importance of fiscal policy

was due to the Great Depression and the development of ‘New Economics’ by

Keynes.

1. Meaning of Fiscal Policy

In common parlance fiscal policy means the budgetary manipulations

affecting the macro economic variables – output, employment, saving, investment

etc.

2. Definitions

“The term fiscal policy refers to a policy under which the

Government uses its expenditure and revenue programmes to produce desirable

effects and avoid undesirable effects on the national income, production and

employment” – Arthur Smithies

“By fiscal policy is meant the use of public finance or

expenditure, taxes, borrowing and financial administration to further our

national economic objectives” – Buehler

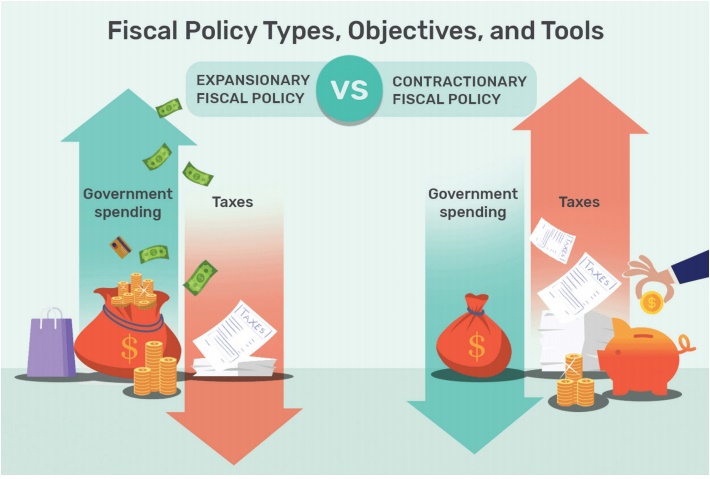

3. Fiscal Instruments

Fiscal Policy is implemented through fiscal instruments also

called ‘fiscal tools’ or fiscal levers: Government expenditure, taxation and

borrowing are the fiscal tools.

i) Taxation: Taxes transfer income from the people to the Government.

Taxes are either direct or indirect. An increase in tax reduces disposable

income. So taxation should be raised to control inflation. During depression,

taxes are to be reduced.

ii) Public Expenditure: Public expenditure raises wages and

salaries of the employees and thereby the aggregate demand for goods and

services. Hence public expenditure is raised to fight recession and reduced to

control inflation.

iii) Public debt: When Government borrows by floating a

loan, there is transfer of funds from the public to the Government. At the time

of interest payment and repayment of public debt, funds are transferred from

Government to public.

4. Objectives of Fiscal Policy:

The Fiscal Policy is useful to achieve the following objectives:

1. Full Employment

Full Employment is the common objective of fiscal policy in both

developed and developing countries. Public expenditure on social overheads help

to create employment opportunities. In India, public expenditure on rural

employment programmes like MGNREGS is aimed at employment generation.

2. Price Stability

Price instability is caused by mismatch between aggregate demand

and aggregate supply. Inflation is due to excess demand for goods. If excess

demand is caused by Government expenditure in excess of real output, the most

effective measure is to cut down public expenditure. Taxation of income is the

best measure if excess demand is due to private spending.

Taxation reduces disposable income and so aggregate demand.

To fight depression, the Government needs to increase its spending

and reduce taxation.

3. Economic Growth

Fiscal Policy is used to increase the productive capacity of the

economy. Tax is to be used as an instrument for encouraging investment. Tax

holidays and tax rebates for new industries stimulate investment. Public sector

investments are to be increased to fill the gap left by private investment.

When resource mobilization through tax measures is inadequate, the Government

resorts to borrowing both from internal and external sources to finance growth

projects.

4. Equitable distribution

Progressive rates in taxation help to reduce the gap between rich

and poor. Similarly progressive rates in public expenditure through welfare

schemes such as free education, noon meal for school children and subsidies

promote the living standard of poor people.

5. Exchange Stability

Fluctuations in international trade cause movements in exchange

rate. Tax concessions and subsidy to export oriented units help to boost

exports. Customs duties on import of non-essential items help to cut import

bill. The reduction in import duty on import of raw material and machinery

enables reduction in cost and make the exports competitive.

6. Capital formation

Capital formation is essential for rapid economic development. Tax

relief helps to increase disposable income, savings and thereby capital

formation. Government expenditure on infrastructure development like power and

transport encourages private investment.

7. Regional balance

Fiscal incentives for industries in the backward regions help to

narrow down regional imbalances. Public expenditure may be used to start

industrial estates so that industrial activity is stimulated in backward

regions.

Related Topics