Meaning, Definitions, Characteristics - Fiscal Economics - Tax Revenue | 12th Economics : Chapter 9 : Fiscal Economics

Chapter: 12th Economics : Chapter 9 : Fiscal Economics

Tax Revenue

Tax Revenue

1. Meaning

Tax is a compulsory payment by the citizens to the government to

meet the public expenditure. It is legally imposed by the government on the tax

payer and in no case tax payer can refuse to pay taxes to the government.

2 Definitions

“A Tax is a compulsory

payment made by a person or a firm to a government without reference to any

benefit the payer may derive from the government.” -Anatol Murad

“A Tax is a compulsory contribution imposed by public authority,

irrespective of the exact amount of service rendered to the tax payer in return

and not imposed as a penalty for any legal offence.” - Dalton

3. Characteristics of Tax

1. A tax is a compulsory payment made to the government. People on

whom a tax is imposed must pay the tax. Refusal to pay the tax is a punishable

offence.

2. There is no quid pro quo between a taxpayer and public

authorities. This means that the tax payer cannot claim any specific benefit

against the payment of a tax.

3. Every tax involves some sacrifice on part of the tax payer.

4. A tax is not levied as a fine or penalty for breaking law.

Some of the tax revenue sources are

❖ Income tax

❖ Corporate tax

❖ Sales tax

❖ Surcharge and

❖ Cess

4. Non-Tax Revenue

The revenue obtained by the government from sources other than tax

is called Non-Tax Revenue. The sources of non-tax revenue are

1. Fees

Fees are another important source of revenue for the government. A

fee is charged by public authorities for rendering a service to the citizens.

Unlike tax, there is no compulsion involved in case of fees. The government

provides certain services and charges certain fees for them. For example, fees

are charged for issuing of passports, driving licenses, etc.

2. Fine

A fine is a penalty imposed on an individual for violation of law.

For example, violation of traffic rules, payment of income tax after the

stipulated time etc.

3. Earnings from Public Enterprises

The Government also gets revenue by way of surplus from public

enterprises. Some of the public sector enterprises do make a good amount of

profits. The profits or dividends which the government gets can be utilized for

public expenditure.

4. Special assessment of betterment levy

It is a kind of special charge levied on certain members of the

community who are beneficiaries of certain government activities or public

projects. For example, due to a public park or due to the construction of a

road, people in that locality may experience an appreciation in the value of

their property or land.

5. Gifts, Grants and Aids

A grant from one government to another is an important source of

revenue in the modern days. The government at the Centre provides grants to

State governments and the State governments provide grants to the local

government to carry out their functions.

Grants from foreign countries are known as Foreign Aid. Developing

countries receive military aid, food aid, technological aid, etc. from other

countries.

6. Escheats

It refers to the claim of the state to the property of persons who

die without legal heirs or documented will.

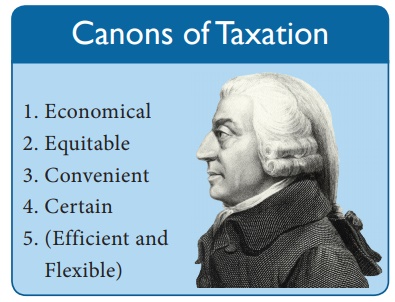

5. Canons of Taxation:

The characteristics or qualities which a good tax should possess

are described as canons of taxation. It must be noted that canons refer to the

qualities of an isolated tax and not to the tax system as a whole. A good tax

system should have a proper combination of all kinds of taxes having different

canons.

According to Adam Smith, there are four canons or maxims of

taxation. They are as follows:

Canons of Taxation

1. Economical

2. Equitable

3. Convenient

4. Certain

5. (Efficient and Flexible)

1. Canon of Ability

The Government should impose tax in such a way that the people

have to pay taxes according to their ability. In such case a rich person should

pay more tax compared to a middle class person or a poor person.

2. Canon of Certainty

The Government must ensure that there is no uncertainty regarding

the rate of tax or the time of payment. If the Government collects taxes

arbitrarily, then these will adversely affect the efficiency of the people and

their working ability too.

3. Canon of Convenience

The method of tax collection and the timing of the tax payment

should suit the convenience of the people. The Government should make

convenient arrangement for all the tax payers to pay the taxes without

difficulty.

4. Canon of Economy

The Government has to spend money for collecting taxes, for

example, salaries are given to the persons who are responsible for collecting

taxes. The taxes, where collection costs are more are considered as bad taxes.

Hence, according to Smith, the Government should impose only those taxes whose

collection costs are very less and cheap .

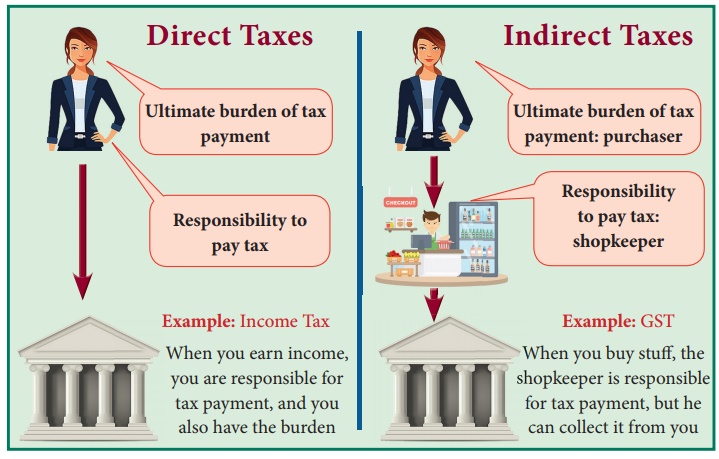

6. Direct Tax and Indirect Tax

Direct Tax

A direct tax is referred to as a tax levied on person’s income and

wealth and is paid directly to the government; the burden of such tax cannot be

shifted. The tax is progressive in nature. It is levied according to the paying

capacity of the person, i.e. the tax is collected more from the rich and less

from the poor people.

The plans and policies of the Direct Taxes are being recommended

by the Central Board of Direct Taxes (CBDT) which is under the Ministry of

Finance, Government of India.

7. Merits of Direct Taxes

1.Equity

Direct taxes are progressive i.e. rate of tax varies according to

tax base. For example, income tax satisfies the canon of equity.

2.Certainity

Canon of certainty can be ensured by direct taxes. For example, an

income tax payer knows when and at what rate he has to pay income tax.

3. Elasticity:

Direct taxes also satisfy the canon of elasticity. Income tax is

income elastic in nature. As income level increases, the tax revenue to the

Government also increases automatically.

4. Economy

The cost of collection of direct taxes is relatively low. The tax

payers pay the tax directly to the state.

8. Demerits of Direct Taxes

1. Unpopular

Direct taxes are generally unpopular.

It is inconvenient and less flexible.

2. Productivity affected

According to many economists direct tax may adversely affect

productivity. Citizens are not willing to earn more income because in that case

they have to pay more taxes.

3. Inconvenient

The tax payers find it inconvenient to maintain accounts, submit

returns and pay tax in lump sum.

4. Tax Evasion

The burden of direct tax is so heavy that tax-payers always try to

evade taxes. This ultimately leads to the generation of black money, which is

harmful to the economy.

9. Indirect Tax

Indirect Tax is referred to as a tax charged on a person who

purchases the goods and services and it is paid indirectly to the government.

The burden of tax can be easily shifted to the another person. It is levied on

all persons equally whether rich or poor.

There are several types of Indirect Taxes, such as:

Excise Duty: Payable by the manufacturer who shifts the tax burden to

retailers and wholesalers.

Sales Tax: Paid by a shopkeeper or retailer, who then shifts the tax

burden to customers by charging sales tax on goods and services.

Custom Duty: Import duties levied on goods from outside the country,

ultimately paid for by consumers and retailers.

Entertainment Tax: Liability is on the cinema theatre

owners, who transfer the burden to cinema goers.

Service Tax: Charged on services like telephone bill, insurance premium

such as food bill in a restaurant etc.

10. Merits of Indirect Taxes

(1) Wider Coverage

All the consumers, whether they are rich or poor, have to pay

indirect taxes. For this reason, it is said that indirect taxes can cover more

people than direct taxes. For example, in India everybody pays indirect tax as

against just 2 percent paying income tax.

(2) Equitable

The indirect tax satisfies the canon of equity when higher tax is

imposed on luxuries used by rich people.

(3) Economical

Cost of collection is less as producers and retailers collect tax

and pay to the Government. The traders act as honorary tax collectors.

(4) Checks harmful consumption

The Government imposes indirect taxes on those commodities which

are harmful to health e.g. tobacco, liquor etc. They are known as sin taxes.

(5) Convenient

Indirect taxes are levied on commodities and services. Whenever

consumers make purchase, they pay tax along with the price. They do not feel

the pinch of paying tax.

11. Demerits of Indirect Taxes

(1) Higher Cost of Collection

The cost of collection of indirect taxes is higher than the direct

taxes. The Government has to spend huge money to collect indirect taxes.

(2) Inelastic

Indirect taxes are less elastic compared to direct taxes. As

indirect taxes are generally proportional.

(3) Regressive

Indirect taxes are sometimes unjust and regressive in nature since

both rich and poor persons have to pay same amount as taxes irrespective of

their income level.

(4) Uncertainity

The rise in indirect taxes increase the price and reduces the

demand for goods. Therefore, the Government is uncertain about the expected

revenue collection. So Dalton says under indirect taxes 2+2 is not 4 but 3 or

even less than 3.

(5) No civic Consciousness

As the tax is hidden in price, the consumers are not aware of

paying tax.

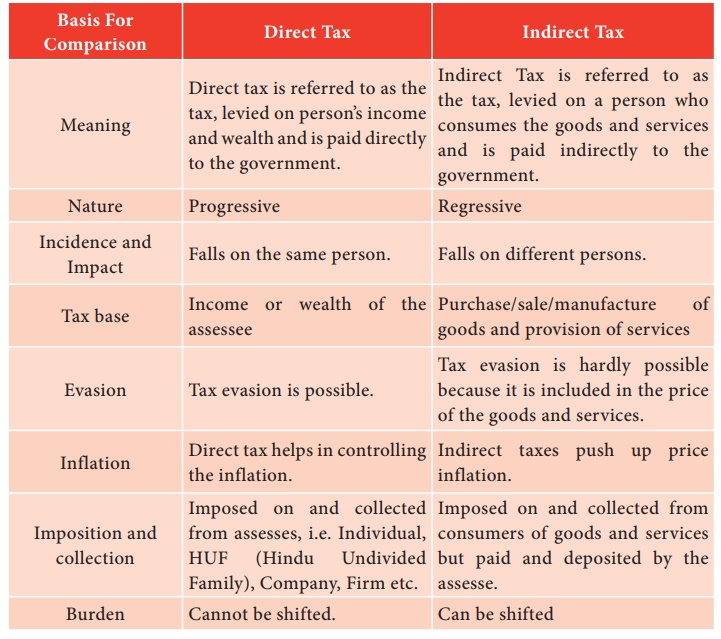

12. Comparison Chart

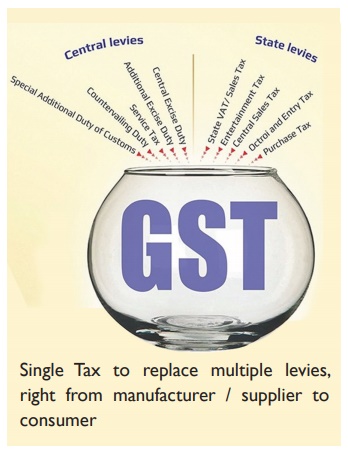

13. GST (Goods and Service Tax)

GST is an Indirect Tax which has replaced many Indirect Taxes in

India. The Goods and Service Tax Act was passed in the Parliament on 29th March

2017. The Act came into effect on 1st July 2017; Goods & Services Tax in

India is a comprehensive, multi-stage, destination-based tax that

is levied on every value addition.

In simple words, Goods and Service Tax (GST) is an indirect tax

levied on the supply of goods and services. This law has replaced many indirect

tax laws that previously existed in India.

GST is one indirect tax for the entire country.

Under the GST regime, the tax will be levied at the final point of

sale. In case of intra-state sales, Central GST and State GST will be charged.

Inter-state sales will be chargeable to Integrated GST.

Destination Based

Consider goods manufactured in Tamil Nadu and are sold to the

final consumer in Karnataka. Since Goods Service Tax is levied at the point of

consumption, in this case, Karnataka, the entire tax revenue will go to

Karnataka and not Tamil Nadu.

Components of GST

The component of GST are of 3 types.

They are: CGST, SGST & IGST.

CGST: Collected by the Central Government on an intra-state sale

(Eg: Within state/ union territory)

SGST: Collected by the State Government on an intra-state sale

(Eg: Within state/ union territory)

IGST: Collected by the Central Government for inter-state sale

(Eg: Maharashtra to Tamil Nadu)

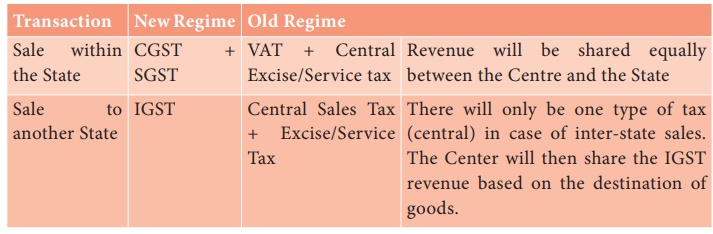

In most cases, the tax structure under the new regime will be as

follows:

Nature of Sales tax, VAT and GST

1. Sales tax was multipoint tax with cascading effect.

2. VAT was multipoint tax without cascading effect.

3. GST is one point tax without cascading effect.

Advantages of GST

1. GST will mainly remove the cascading effect on the sale of

goods and services. Removal of cascading effect will directly impact the cost

of goods. Since tax on tax is eliminated in this regime, the cost of goods

decreases.

2. GST is also mainly technologically driven. All activities like

registration, return filing, application for refund and response to notice need

to be done online on the GST Portal. This will speed up the processes.

Related Topics