Example, Merits, Limitations, Example Illustration, Solution | Methods of providing depreciation | Accountancy - Written down value / Diminishing balance method | 11th Accountancy : Chapter 10 : Depreciation Accounting

Chapter: 11th Accountancy : Chapter 10 : Depreciation Accounting

Written down value / Diminishing balance method

Written down value / Diminishing

balance method

Under this method, depreciation

is charged at a fixed percentage on the written down value of the asset every

year. Hence, it is called written down value method. Written down value is the

book value of the asset, i.e., original cost of the asset minus depreciation

upto the previous accounting period. As the amount of depreciation goes on

decreasing year after year, it is called diminishing balance method or reducing

installment method.

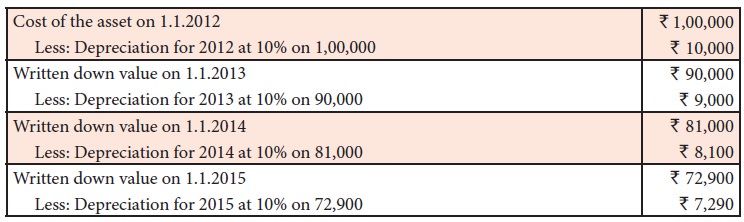

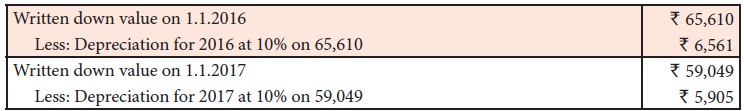

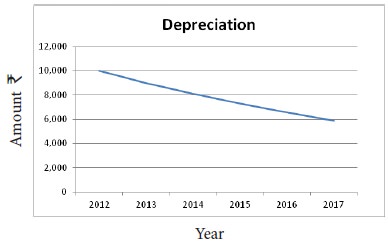

Example

On 1.1.2012, a firm purchased a

machine at a cost of Rs. 1,00,000. Depreciation charged at 10% p.a. on

written down value method for the five years is as follows:

Merits

Following are the merits of

written down value method.

(a) Equal charge against income

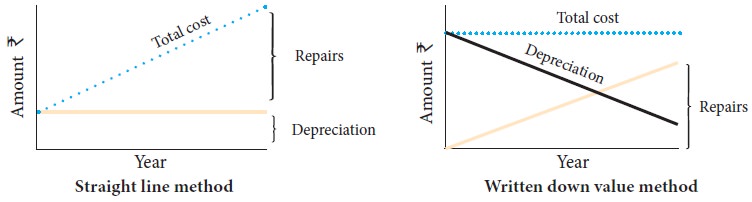

In the initial years depreciation is high and repair charges are low. When the asset becomes older, the amount of depreciation charged is less but repair charges are high. Hence, the total burden on profit in respect of depreciation and repairs put together remains almost similar year after year.

(b) Logical method

In the earlier years, when the asset is more productive, high

depreciation is charged. In the later years when the asset becomes less

productive, the depreciation charge is less.

Limitations

Following are the limitations of written down value method.

(a) Assets cannot be completely written off

Under this method, the value of an asset even if it becomes obsolete and

useless, cannot be reduced to zero and some balance would continue in the asset

account.

(b) Ignores the interest factor

This method does not take into account the loss of interest on the

amount invested in the asset. The amount would have earned interest, had it

been invested outside the business is not considered.

(c) Difficulty in determining the rate of depreciation

Under this method, the rate of providing depreciation cannot be easily

determined. The rate is generally kept higher because it takes very long time

to write off an asset down to its scrap value.

(d) Ignores the actual use of the asset

Under this method, a fixed rate of depreciation is provided on the

written down value of the asset by applying the predetermined rate of

depreciation on its original cost. But, the actual use of the asset is not

considered in the computation of depreciation.

Suitability

This method is suitable in case of assets having a comparatively long

life and which require considerable repairs in the later years when they become

older. Examples are building and plant and machinery.

Illustration

A firm purchased a plant on

1.1.2018 for Rs. 9,000 and

spent Rs. 1,000 as

erection charges. Calculate the amount of depreciation for the year 2018 @ 15%

per annum under the written down value method. Accounts are closed on 31st

March every year.

Solution

Original cost = 9,000 +

1,000 = 10,000

Rate of depreciation = 15%

Date of purchase = 1.1.2018

Number of months used = 1.1.2018 to 31.03.2018 = 3 months

Amount of depreciation = 15% on 10,000 for 3 months

= 10,000 ×15% × 3/12 = Rs. 375

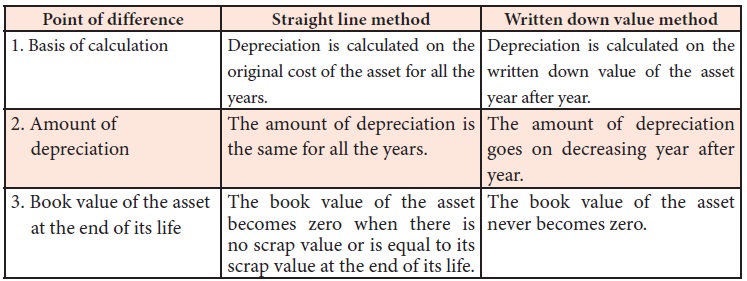

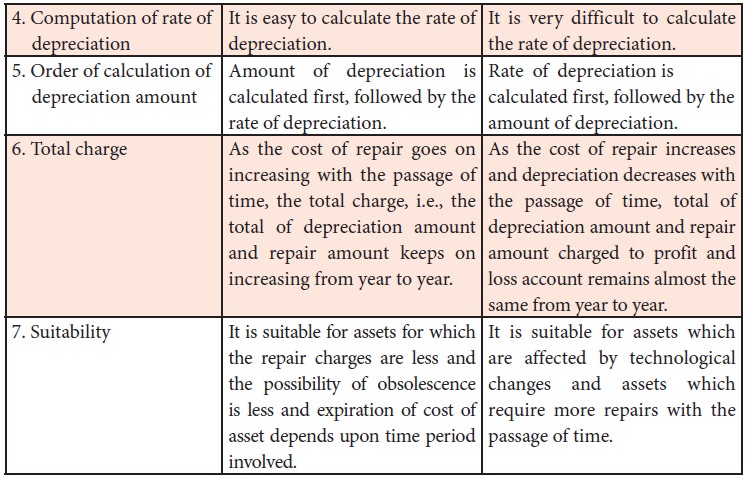

Differences between straight line method and written down value method

Following are the differences

between straight line method and written down value method

Related Topics