Example, Merits, Limitations, Example Illustration, Solution | Methods of providing depreciation | Accountancy - Straight line method/ Fixed instalment method / Original cost method | 11th Accountancy : Chapter 10 : Depreciation Accounting

Chapter: 11th Accountancy : Chapter 10 : Depreciation Accounting

Straight line method/ Fixed instalment method / Original cost method

Straight

line method/ Fixed instalment method / Original cost method

Under this method, a fixed percentage on the original cost of the asset

is charged every year by way of depreciation. Hence it is called original cost

method. As the amount of depreciation remains equal in all years over the

useful life of an asset it is also called as fixed instalment method. When the

amount of depreciation charged over its life is plotted on a graph and the

points are joined together, the graph will show a horizontal straight line.

Hence, it is called straight line method.

This method is suitable for those assets the useful life of which can be

estimated accurately and which do not require much expense on repairs and

renewals.

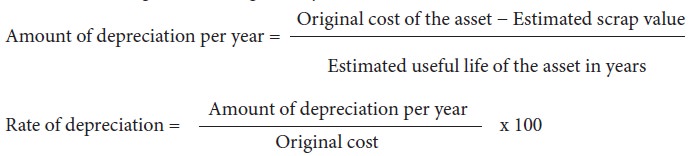

Under this method, the following

formulae are used for calculating the amount of depreciation and the rate of

depreciation respectively:

Tutorial note

·

In the year of purchase, if the period of use is

less than a year, the amount of depreciation will be charged proportionately

for the period for which the asset has been used in the business.

·

If depreciation is deducted from the cost of the

asset at the end of useful life of the asset the amount left in the asset

account will be equal to the scrap value if there is any scrap value or it will

be zero if there is no scrap value.

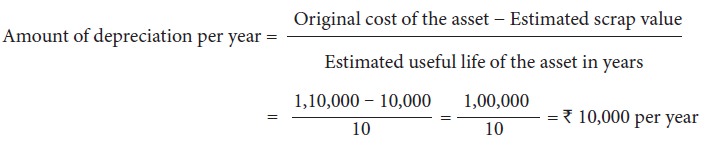

Example

On 1.1.2012, a firm purchased a

machine at a cost of Rs. 1,10,000. Its life was estimated to be 10

years with a scrap value of Rs. 10,000. The amount of depreciation to be

charged at the end of each year is:

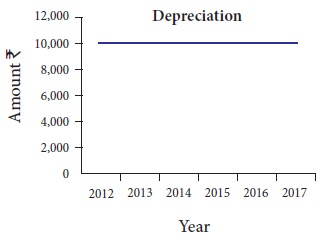

When it is plotted on a graph for

5 years, it appears as follows:

Merits

Following are the merits of

straight line method of depreciation:

(a) Simple and easy to understand

Computation of depreciation under

this method is very simple and is easy to understand.

(b) Equality of depreciation burden

Under this method, equal amount of depreciation is debited to the profit and loss account each year. Hence, the burden of depreciation on the profit of each year is equal..

(c) Assets can be completely written off

Under this method, the book value of an asset can be reduced to zero if

there is no scrap value or to the scrap value at the end of its useful life.

Thus the asset account can be completely written off.

(d) Suitable for the assets having fixed working life

This method is appropriate for the fixed assets having certain fixed

period of working life. In such cases, the estimation of useful life is easy and

in turn it helps in easy determination of rate of depreciation.

Limitations

Following are the limitations of

straight line method of depreciation:

(a) Ignores the actual use of the asset

Under this method, a fixed amount of depreciation is provided on each

asset by applying the predetermined rate of depreciation on its original cost.

But, the actual use of the asset is not considered in computation of

depreciation.

(b) Ignores the interest factor

This method does not take into account the loss of interest on the

amount invested in the asset. That is, the amount would have earned interest,

had it been invested outside the business is not considered.

(c) Total charge on the assets will be more when the asset becomes older

With the passage of time, the cost of maintenance of an asset goes up.

Hence, the amount of depreciation and cost of maintenance put together is less

in the initial period and goes up year after year. But, this method does not

consider this.

(d) Difficulty in the determination of scrap value

It may be quite difficult to assess the true scrap value of the asset

after a long period say 10 or 15 years after the date of its installation.

Suitability

Straight line method of depreciation is suitable in case of fixed assets

in respect of which useful life can be determined and maintenance and repair

cost is the same throughout the life of the asset.

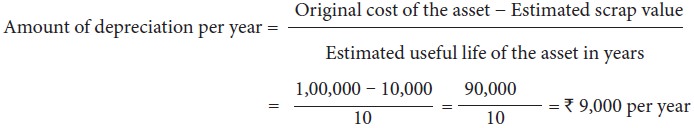

Illustration 1

On 1.1.2017 a firm purchased a machine at a cost of Rs. 1,00,000. Its life was estimated to be 10

years with a scrap value of Rs. 10,000.

Compute the amount of depreciation to be charged at the end of each year.

Solution

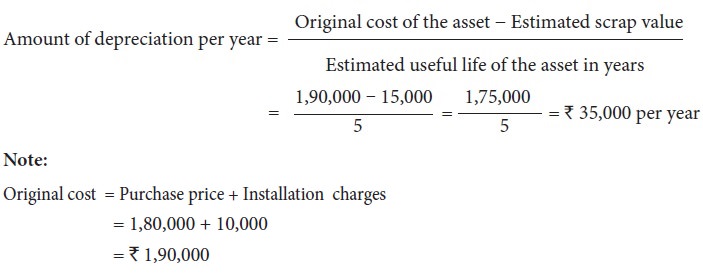

Illustration 2

A company has purchased a

machinery for Rs. 1,80,000 and

spent Rs. 10,000 for

its installation. The estimated life of the machinery is 5 years with a

residual value of Rs. 15,000. Find

out the amount of depreciation to be provided every year.

Solution

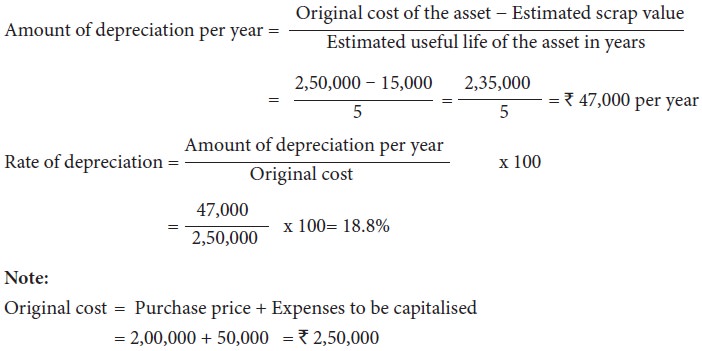

Illustration 3

From the following information, calculate the amount of depreciation and

rate of depreciation under straight line method.

Purchase price of machine Rs.

2,00,000

Expenses to be capitalised Rs.

50,000

Estimated residual value Rs.

15,000

Expected useful life 5

years

Solution

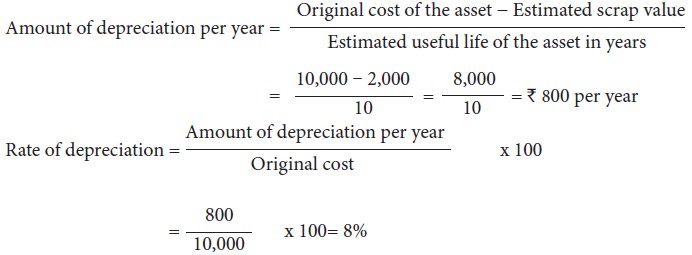

Illustration 4

Find out the rate of depreciation under straight line method from the

following details:

Original cost of the asset = Rs. 10,000

Estimated life of the asset = 10 years

Estimated scrap value at the end = Rs. 2,000

Solution

Related Topics