Accountancy - Methods of recording depreciation | 11th Accountancy : Chapter 10 : Depreciation Accounting

Chapter: 11th Accountancy : Chapter 10 : Depreciation Accounting

Methods of recording depreciation

Methods of recording depreciation

There are two methods followed to record depreciation.

1. Charging depreciation to asset account

2. Charging depreciation to provision for depreciation account.

1. Charging depreciation to asset account

Under this method at the end of every accounting period, the amount of depreciation charged is debited to depreciation account and the amount of depreciation is credited to asset account. Hence the asset appears in the balance sheet at its depreciated value. Depreciation being revenue charge is transferred to profit and loss account.

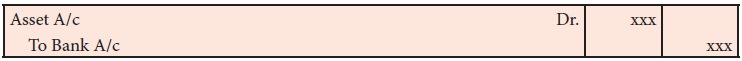

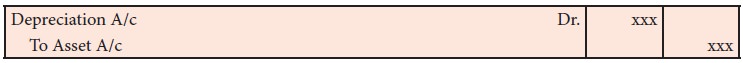

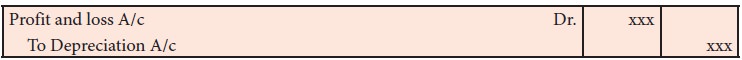

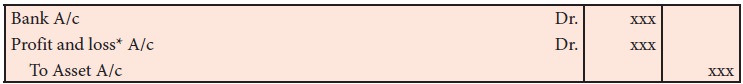

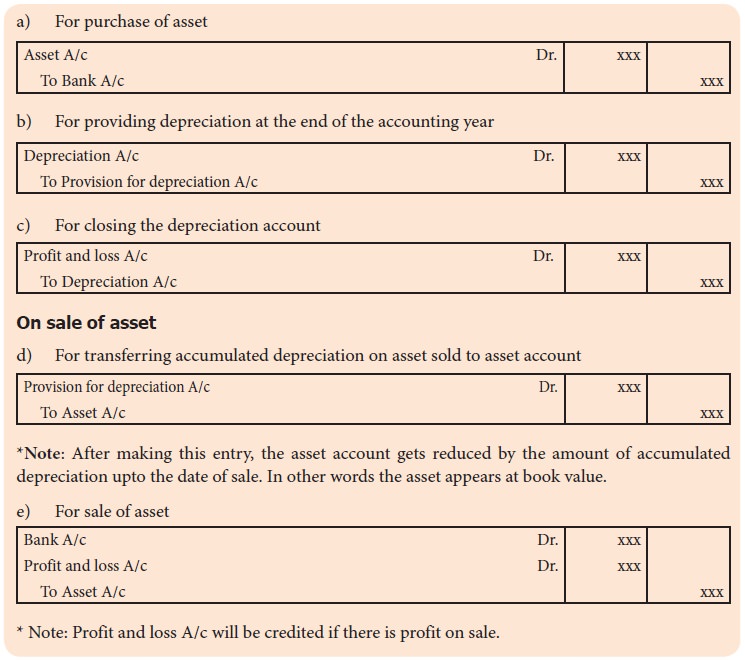

The following journal entries are to be passed in the books for depreciation and related transactions:

(a) For purchase of asset

(b) For providing depreciation at the end of the accounting year

(c) For closing the depreciation account

(d) For sale of asset

Tutorial note

Transactions relating to sale of asset may also be transferred to a temporary account called asset disposal account and completed. Each time an asset is sold, a separate asset disposal account is opened and the balance in the asset account is transferred to asset disposal account. All transactions relating to sale are entered in the asset disposal account. The asset disposal account is closed immediately after the sale.

Illustration 6

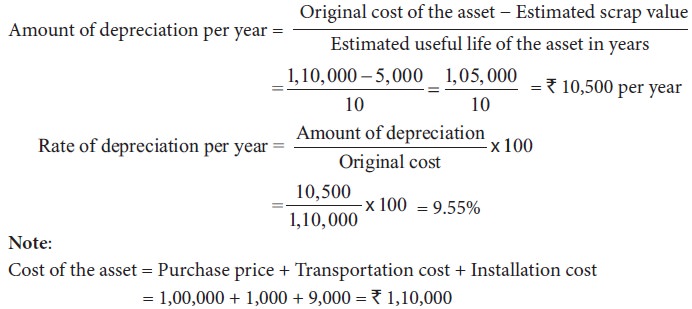

Calculate the amount of depreciation and depreciation rate from the following by using ‘straight line method’. Also give journal entries for the first two years. The books are closed on 31st December every year.

January 1, 2016 Payment to vendor for purchase of machinery Rs. 1,00,000

January 1, 2016 Transportation cost Rs. 1,000

January 1, 2016 Installation cost Rs. 9,000

Estimated scrap value at the end of the life Rs. 5,000

Estimated life 10 years

Solution

Note:

Cost of the asset = Purchase price + Transportation cost + Installation cost = 1,00,000 + 1,000 + 9,000 = Rs. 1,10,000

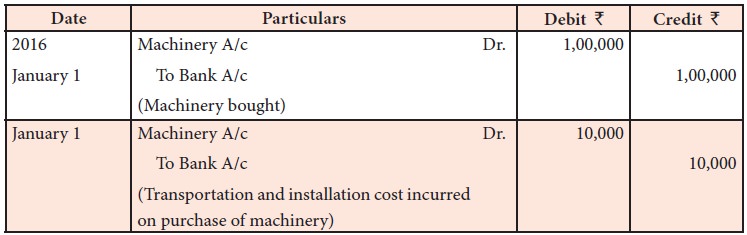

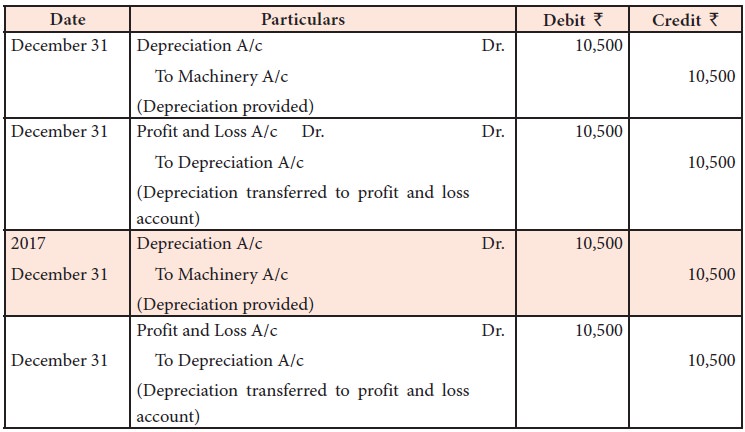

Journal entries

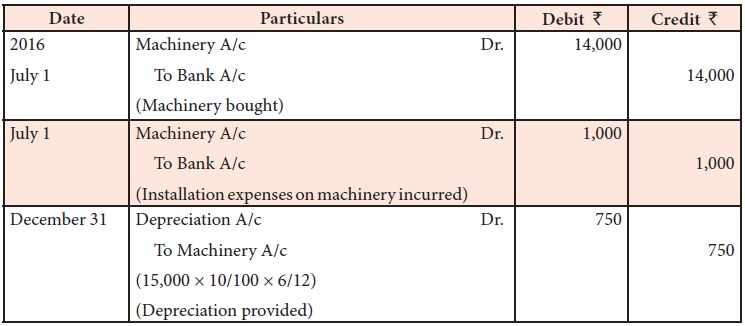

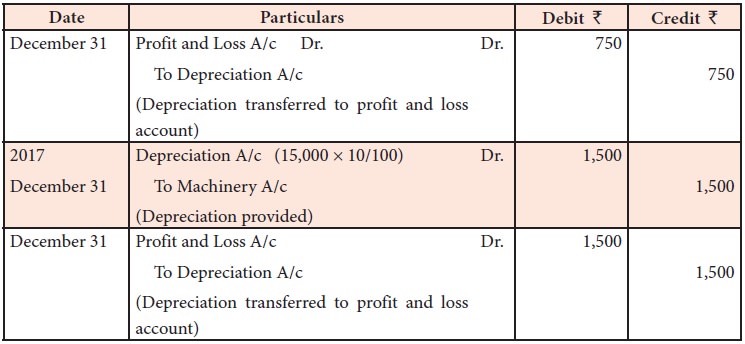

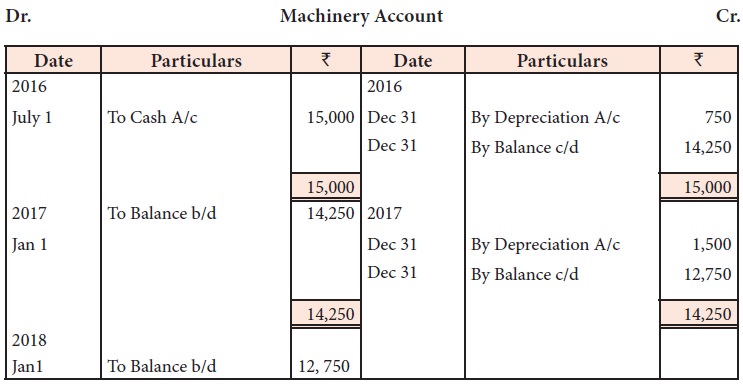

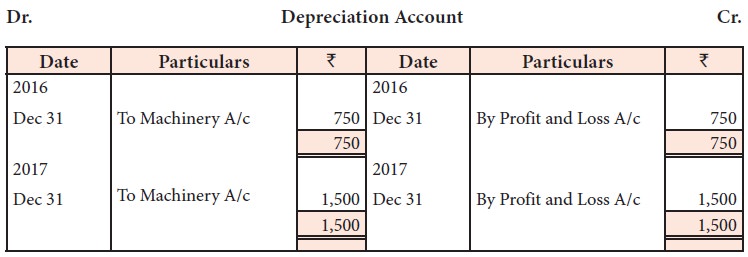

Illustration 7

Ramu Brothers purchased a machine on 1st July 2016 at a cost of Rs. 14,000 and spent Rs. 1,000 on its installation. The firm writes off depreciation at 10% of original cost every year. The books are closed on 31st December every year. Give journal entries and prepare machinery account and depreciation account for 2 years.

Solution

Note: Cost of the asset = Purchase price + Installation cost = 14,000 + 1,000 = Rs. 15,000

Journal entries

Ledgers

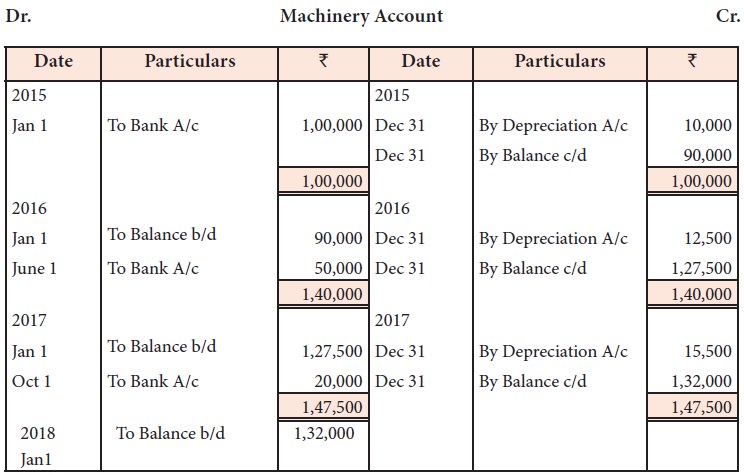

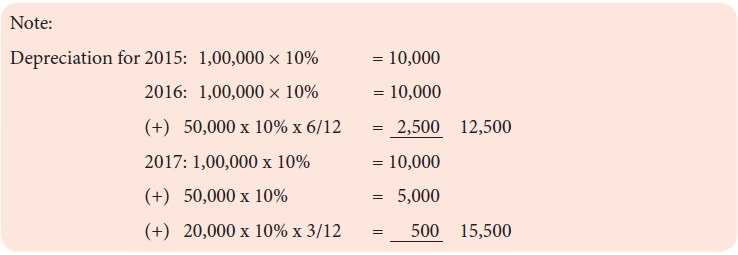

Illustration 8

Anand bought a machinery for Rs. 1,00,000 on 1-1-2015. On 1-6-2016, he bought another machine for Rs. 50,000. On 1-10-2017, he purchased another machine for Rs. 20,000. Provide depreciation at 10% p.a. on straight line method. Prepare machinery account for the years 2015 to 2017 by using accounts by assuming accounts are closed on 31st December every year.

Solution

Ledger accounts

Related Topics