Monetary Economics - Trade Cycle | 12th Economics : Chapter 5 : Monetary Economics

Chapter: 12th Economics : Chapter 5 : Monetary Economics

Trade Cycle

Trade Cycle

The economic activity in a capitalist economy will have its

periodic ups and downs. The study of these ups and downs is called the study of

Business cycle or Trade cycle or Industrial Fluctuation.

1. Meaning of Trade Cycle

A Trade cycle refers to oscillations in aggregate economic

activity particularly in employment, output, income, etc. It is due to the

inherent contraction and expansion of the elements which energize the economic

activities of the nation. The fluctuations are periodical, differing in

intensity and changing in its coverage.

Definition

“A trade cycle is composed of periods of good trade characterised

by rising prices and low unemployment percentages altering with periods of bad

trade characterised by falling prices and high unemployment percentages”. -

J.M. Keynes

2. Phases of Trade Cycle

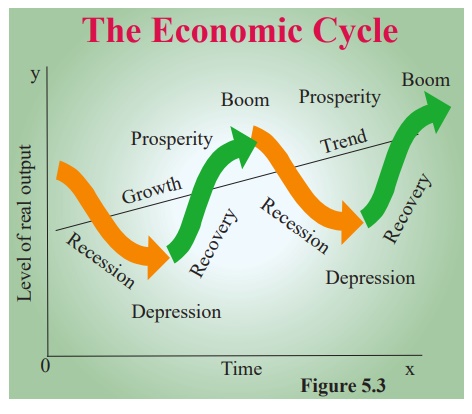

The four different phases of trade cycle is referred to as (i)

Boom (ii) Recession (iii) Depression and (iv) Recovery. These are illustrated

in the Figure 5.3.

Phases of Trade Cycle

i) Boom or Prosperity Phase: The full employment and the movement of

the economy beyond full employment is characterized as boom period. During this

period, there is hectic activity in economy. Money wages rise, profits increase

and interest rates go up. The demand for bank credit increases and there is

all-round optimism.

ii) Recession: The turning point from boom condition is

called recession. This happens at higher rate, than what was earlier.

Generally, the failure of a company or bank bursts the boom and brings a phase

of recession. Investments are drastically reduced, production comes down and

income and profits decline. There is panic in the stock market and business

activities show signs of dullness. Liquidity preference of the people rises and

money market becomes tight.

iii) Depression: During depression the level of economic

activity becomes extremely low. Firms incur losses and closure of business

becomes a common feature and the ultimate result is unemployment. Interest

prices, profits and wages are low. The agricultural class and wage earners

would be worst hit. Banking institutions will be reluctant to advance loans to

businessmen. Depression is the worst phase of the business cycle. Extreme point

of depression is called as “trough”, because it is a deep point in business cycle.

Any person fell down in deeps could not come out from that without other’s

help. Similarly, an economy fell down in trough could not come out from this

without external help. Keynes advocated that autonomous investment of the

government alone can help the economy to come out from the depression.

iv) Recovery: After a period of depression, recovery sets in. This is the

turning point from depression to revival towards upswing. It begins with the

revival of demand for capital goods. Autonomous investments boost the activity.

The demand slowly picks up and in due course the activity is directed towards

the upswing with more production, profit, income, wages and employment.

Recovery may be initiated by innovation or investment or by government

expenditure (autonomous investment).

Related Topics