Monetary Economics - Quantity Theories of Money | 12th Economics : Chapter 5 : Monetary Economics

Chapter: 12th Economics : Chapter 5 : Monetary Economics

Quantity Theories of Money

Quantity Theories of Money

Quantity theories of money explain the relationship between

quantity of money and value of money. Here, we are given two approaches of

Quantity Theory of Money, viz. Fisher’s Transaction Approach and Cambridge Cash

Balance Approach.

(a) Fisher’s Quantity Theory of Money:

The quantity theory of money is a very old theory. It was first

propounded in 1588 by an Italian economist, Davanzatti. But, the credit for

popularizing this theory in recent years rightly belongs to the well-known

American economist, Irving Fisher who published his book, ‘The Purchasing Power

of Money” in 1911.He gave it a quantitative form in terms of his famous

“Equation of Exchange”.

The general form of equation given by Fisher is

MV = PT

Where M = Money Supply/quantity of Money

V = Velocity of Money

P = Price level

T = Volume of Transaction.

Fisher points out that in a country during any given period of

time, the total quantity of money (MV) will be equal to the total value of all

goods and services bought and sold (PT).

MV = PT

Supply of Money = Demand for Money

This equation is referred to as “Cash Transaction Equation”.

It is expressed as P = MV / T which implies that the quantity of

money determines the price level and the price level in its turn varies

directly with the quantity of money, provided ‘V’ and ‘T’ remain constant.

The above equation considers only currency money. But, in a modern

economy, bank’s demand deposits or credit money and its velocity play a vital

part in business. Therefore, Fisher extended his original equation of exchange

to include bank deposits M1 and its velocity V1. The revised equation was:

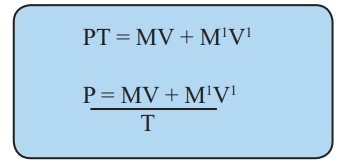

PT = MV + M1V1

P = [ MV + M1V1] / T

From the revised equation, it is evident, that the price level is

determined by

(a) the quantity of money in circulation ‘M’

(b) the velocity of circulation of money ‘V’

(c) the volume of bank credit money M1

(d) the velocity of circulation of credit money V1 and the volume of trade

(T)

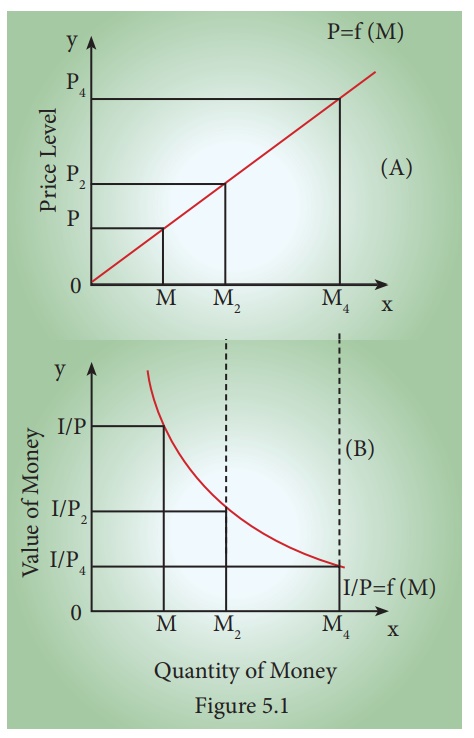

Diagrammatic Illustration

Figure (A) shows the effect of changes in the quantity of money on

the price level. When the quantity of money is OM, the price level is OP. When

the quantity of money is doubled to OM2 , the price level is also doubled to OP 2 . Further, when the

quantity of money is increased four-fold to OM4 , the price level also

increases by four times to OP4 . This relationship is expressed by the curve

OP = f (M) from the origin at 450.

Figure (B), shows the inverse relation between the quantity of

money and the value of money, where the value of money is taken on the vertical

axis. When the quantity of money is OM, the value of money is OI / P. But with

the doubling of the quantity of money to OM2 , the value of money becomes one-half of what

it was before, (OI / P2). But, with the quantity of money increasing by four-fold to OM4, the value of money is

reduced by OI / P4. This inverse relationship between the quantity of money and the

value of money is shown by downward sloping curve IO / P = f(M).

b) Cambridge Approach (Cash Balances Approach)

i) Marshall’s Equation

The Marshall equation is expressed as:

M = KPY

Where

M is the quantity of money

Y is the aggregate real income of the community

P is Purchasing Power of money

K represents the fraction of the real income which the public

desires to hold in the form of money.

Thus, the price level P = M/KY or the value of money (The

reciprocal of price level) is 1/P = KY/M

The value of money in terms of this equation can be found out by

dividing the total quantity of goods which the public desires to holdout of the

total income by the total supply of money.

According to Marshall’s equation, the value of money is influenced

not only by changes in M, but also by changes in K.

ii) Keynes’ Equation

Keynes equation is expressed as:

n = pk (or) p = n / k

Where

n is the total supply of money

p is the general price level of consumption goods

k is the total quantity of consumption units the people

decide to keep in the form of cash,

Keynes indicates that K is a real balance, because it is

measured in terms of consumer goods.

According to Keynes, peoples’ desire to hold money is unaltered by

monetary authority. So, price level and value of money can be stabilized

through regulating quantity of money (n) by the monetary authority.

Later, Keynes extended his equation in the following form:

n = p (k + rk') or p = n/(k + rk')

Where,

n = total money supply

p = price level of consumer goods

k = peoples' desire to hold money in hand (in terms of

consumer goods) in the total income of them

r = cash reserve ratio

k' = community’s total money deposit in banks, in terms of

consumers goods.

In this extended equation also, Keynes assumes that, k, k'

and r are constant. In this situation, price level (P) is changed

directly and proportionately changing in money volume (n).

Related Topics