Monetary Economics - Functions of Money | 12th Economics : Chapter 5 : Monetary Economics

Chapter: 12th Economics : Chapter 5 : Monetary Economics

Functions of Money

Functions of Money

The main functions of money can be classified into four categories:

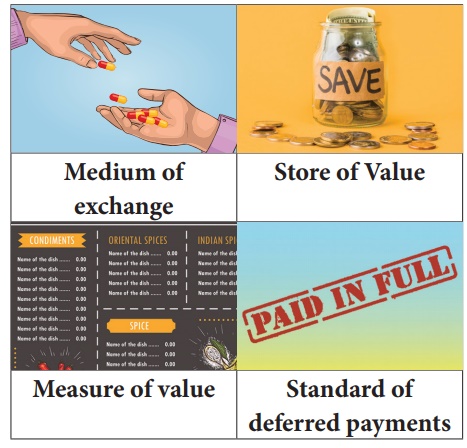

i) Money as a medium of exchange: This is

considered as the basic function of money. Money has the quality of general

acceptability, and all exchanges take place in terms of money. On account of

the use of money, the transaction has now come to be divided into two parts.

First, money is obtained through sale of goods or services. This is known as

sale. Later, money is obtained to buy goods and services. This is known as

purchase. Thus, in the modern exchange system money acts as the intermediary in

sales and purchases.

ii) Money as a measure of value: The second

important function of money is that it measures the value of goods and

services. In other words, the prices of all goods and services are expressed in

terms of money. Money is thus looked upon as a collective measure of value.

Since all the values are expressed in terms of money, it is easier to determine

the rate of exchange between various types of goods in the community.

2. Secondary Functions

i) Money as a Store of value: Savings done in terms

of commodities were not permanent. But, with the invention of money, this

difficulty has now disappeared and savings are now done in terms of money.

Money also serves as an excellent store of wealth, as it can be easily

converted into other marketable assets, such as, land, machinery, plant etc.

ii) Money as a Standard of Deferred Payments: Borrowing and lending

were difficult problems under the barter system. In the absence of

money, the borrowed amount could be returned only in terms of goods and

services. But the modern money-economy has greatly facilitated the borrowing

and lending processes. In other words, money now acts as the standard of

deferred payments.

iii) Money as a Means of Transferring Purchasing Power: The field of exchange

also went on extending with growing economic development. The exchange of goods

is now extended to distant lands. It is therefore, felt necessary to transfer

purchasing power from one place to another.

3. Contingent Functions

i) Basis of the Credit System: Money is the basis of the Credit System.

Business transactions are either in cash or on credit. For example, a depositor

can make use of cheques only when there are sufficient funds in his account.

The commercial bankscreate credit on the basis of adequate cash reserves. But,

money is at the back of all credit.

ii) Money facilitates distribution of National Income: The task of distribution of national income was

exceedingly complex under the barter system. But the invention of money has now

facilitated the distribution of income as rent, wage, interest and profit.

iii) Money helps to Equalize Marginal Utilities and Marginal

Productivities: Consumer can obtain maximum utility only if he incurs expenditure

on various commodities in such a manner as to equalize marginal utilities

accruing from them. Now in equalizing these marginal utilities, money plays an

important role, because the prices of all commodities are expressed in money.

Money also helps to equalize marginal productivities of various factors of

production.

iv) Money Increases Productivity of Capital: Money is the most liquid

form of capital. In other words, capital in the form of money can be put to

any use. It is on account of this liquidity of money that capital can be

transferred from the less productive to the more productive uses.

4. Other Functions

i) Money helps to maintain Repayment Capacity: Money possesses the

quality of general acceptability. To maintain its repayment capacity,

every firm has to keep assets in the form of liquid cash. The firm ensures its

repayment capacity with money. Likewise, banks, insurance companies and even

governments have to keep some liquid money (i.e., cash)to maintain their

repayment capacity.

ii) Money represents Generalized Purchasing Power: Purchasing power kept

in terms of money can be put to any use. It is not necessary that money should

be used only for the purpose for which it has been served.

iii) Money gives liquidity to Capital: Money is the most liquid

form of capital. It can be put to any use.

Related Topics