Chapter: 12th Office Management and Secretaryship : Chapter 9 : Controlling

Techniques of Controlling

Techniques of Controlling

1. Budget and Budgetary Control

A budget is a

tool which helps the management in planning and controlling the business

activities. A budget is an estimate of expected results expressed in numerical

terms. There are various types of budgets like;

·

Sales budget,

·

Purchase budget,

·

Production budget,

·

Fixed budget,

·

Flexible budget,

·

Cash budget,

·

Zero base budget etc

Budgetary Control

is a system of control whereby budgets are prepared for future period and

compared with the actual results for finding out the variations. Corrective

actions are taken in case of deviations.

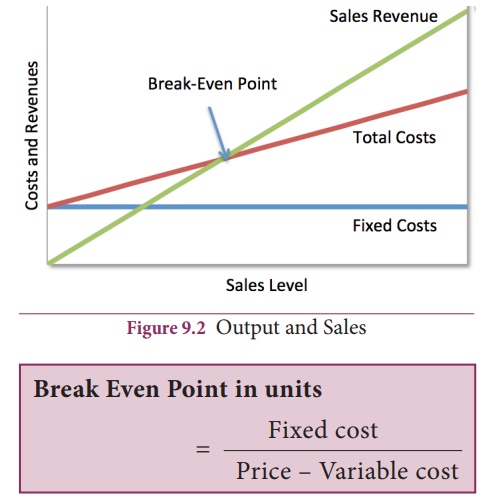

2. Break – Even point Analysis (BEP)

It is the tool used to analyse the Cost –

Volume – Profit relationships. BEP is the point at which there no profit no

loss. In this point the total costs are recovered. If the sales go up beyond

the break even point , organisation makes profit. If they come down , it may

secure loss.

Break even

point is used to take decision regarding price for the marketers.

3. Return on

Investment ( ROI ) – Return on Investment is one of the ratio used as a tool

for measuring the overall efficiency of the firm. It shows the relationship

between profits ( after interest and tax ) and the proprietors fund.

ROI = Net Profit (after interest

and tax) / Share holder fund

It is a

powerful managerial technique.

4. Statistical

Analysis – Statistical tools such as Percentages, averages, correlation, trend

analysis etc are useful for analysis. This Statistical tools are set as

standard and to find out the deviations and to find out the persons responsible

for such deviations. This helps in controlling.

5. Management

information System (MIS) – Management Information system can be defined as a

systematic procedure to provide relevant information in right time, in right

format to all levels of management for taking decision in business regarding

inventory level , wage payment etc . The information are useful for planning ,

decision making and control.

6. External and

Internal audit – External audit is done by qualified Chartered Accountant. The

object of external audit is to ensure that there is no manipulation in

accounts. After examining the accounting statements of the company the auditor

certifies it.

Internal audit

is done by the companies own staff. The audit ensures that there is no

manipulation in accounts.

7. Responsibility

Centre–Responsibility centre may be defined as any organisational unit under

the charge of a single person who is responsible for its operations. Budgetary

control system are arranged in proper order with the responsibility centre of

the organisation. There are four types of Responsibility Centres. They are,

a) Cost Centre – It is responsible

for controlling the cost. Generally the manager of cost centre is responsible

for salaries, supplies and other costs. Departments like accounting, research

and development, human resources and other staff function comes under cost

centres.

b) Revenue

Centre – The revenue centre may be defined as responsibility centre wherein the

managers are responsible for income in the organisation. Marketing and sales

department are organised as revenue centre.

c) Profit Centre–A

profit centre is usually a self contained organisational unit. It can control

its own cost and revenue. Many large corporations are divided into product

division with each division servicing as a profit centre for its product.

d) Investment

Centre – In this centre the manager is responsible for ascertaining the return

on investment of assets.

8. Personal Observation

– It is a

common technique used

in controlling. It cannot be used as a main control technique. In this

method the managers are expected to see whether the employees are doing what

they are expected to do. This technique is commonly used in small and medium

size concern.

9. PERT and

CPM – Programme Evaluation and Review Techniques (PERT) was developed in 1950s

by the US Navy’s project division. It describes the basic network techniques

which includes Planning, Monitoring and Controlling the project. It is applied

in aerospace and industrial projects. PERT is a statistical tool used to reduce

both time and cost required to complete the project

Critical Path Method (CPM) was

develop by E.I Dupont de Nemours company in 1956 to aid in the scheduling of

routine plant overhaul, maintenance and construction work. Critical path method

is determent by identifying the longest stretch of department activities and

measuring the time required to complete them from start to finish.

Related Topics