Accounts of Partnership Firms Fundamentals | Accountancy - Profit and loss appropriation account | 12th Accountancy : Chapter 3 : Accounts of Partnership Firms Fundamentals

Chapter: 12th Accountancy : Chapter 3 : Accounts of Partnership Firms Fundamentals

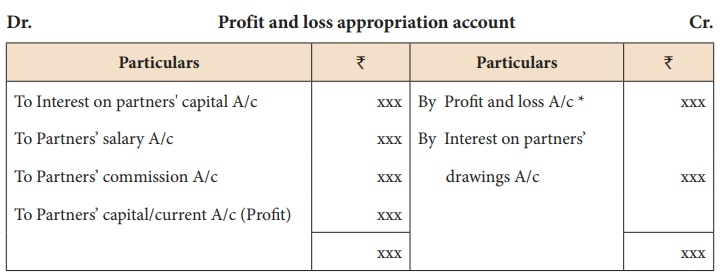

Profit and loss appropriation account

Profit

and loss appropriation account

The profit and loss

appropriation account is an extension of profit and loss account prepared for

the purpose of adjusting the transactions relating to amounts due to and

amounts due from partners. It is nominal account in nature. It is credited with

net profit, interest on drawings and it is debited with interest on capital,

salary and other remuneration to the partners. The balance being the profit or

loss is transferred to the partners’ capital or current account in the profit

sharing ratio.

Format of Profit and loss appropriation account

The following is the

format of profit and loss appropriation account:

*Amount of profit

transferred from profit and loss account.

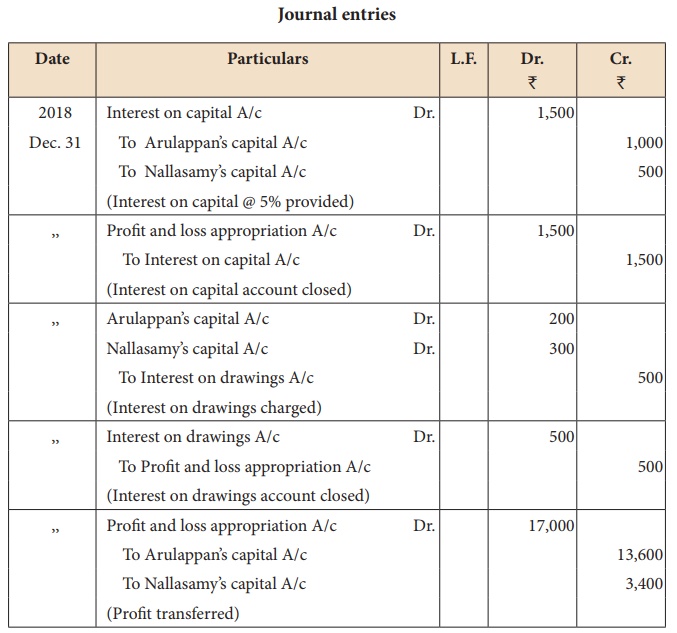

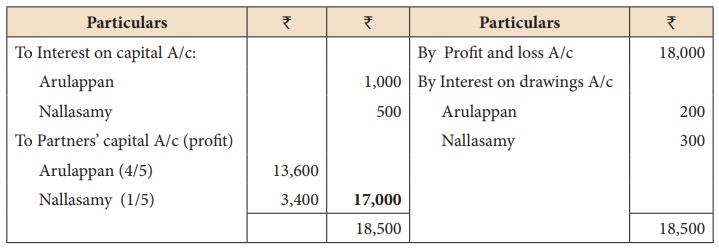

Illustration 21

Arulappan and Nallasamy

are partners in a firm sharing profits and losses in the ratio of 4:1. On 1st

January 2018, their capitals were ₹

20,000 and ₹ 10,000 respectively.

The partnership deed specifies the following:

a) Interest on capital is

to be allowed at 5% per annum.

b) Interest on drawings

charged to Arulappan and Nallasamy are ₹

200 and ₹ 300 respectively.

c) The net profit of the

firm before considering interest on capital and interest on drawings amounted

to ₹ 18,000.

Give necessary journal

entries and prepare Profit and loss appropriation account for the year ending

31st December 2018. Assume that the capitals are fluctuating.

Solution

Dr. Profit and loss appropriation account for the year ended 31st December 2018 Cr.

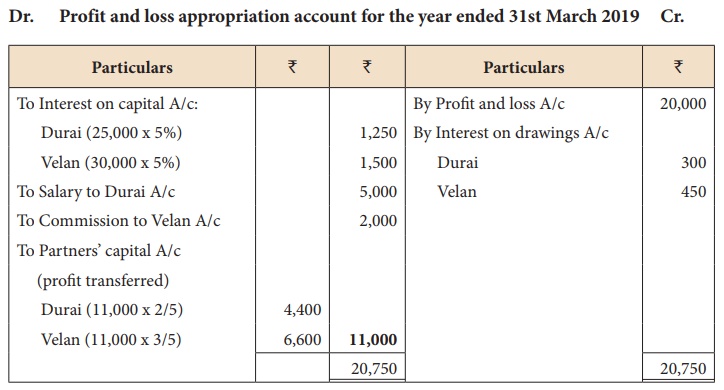

Illustration 22

Durai and Velan entered

into a partnership agreement on 1st April 2018, Durai contributing ₹ 25,000 and Velan ₹

30,000 as capital. The agreement provided that:

a) Profits and losses to be

shared in the ratio 2:3 as between Durai and Velan.

b) Partners to be entitled

to interest on capital @ 5% p.a.

c) Interest on drawings to

be charged Durai: ₹

300 Velan: ₹ 450

d) Durai to receive a

salary of ₹ 5,000 for the year, and

e) Velan to receive a

commission of ₹ 2,000

During the year, the

firm made a profit of ₹

20,000 before adjustment of interest, salary and commission. Prepare the Profit

and loss appropriation account.

Solution

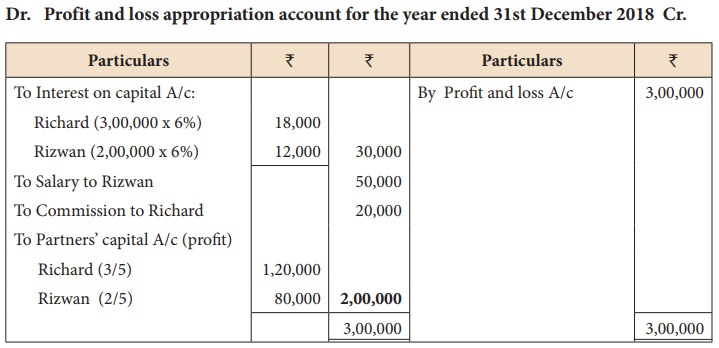

Illustration 23

Richard and Rizwan

started a business on 1st January 2018 with capitals of ₹ 3,00,000 and ₹ 2,00,000 respectively.

According to the

Partnership Deed

a) Interest on capital is

to be provided @ 6% p.a.

b) Rizwan is to get salary

of ₹ 50,000 per annum.

c) Richard is to get 10%

commission on profit (after interest on capital and salary to Rizwan) after

charging such commission.

d) Profit-sharing ratio

between the two partners is 3:2.

During the year, the

firm earned a profit of ₹

3,00,000.

Prepare profit and loss

appropriation account. The firm closes its accounts on 31st December every year.

Solution

Dr. Profit and loss appropriation account for the year ended 31st

December 2018 Cr.

Note:

Calculation of commission:

Profit before commission

= 3,00,000 – (50,000+30,000) = ₹ 2,20,000

Commission = Net profit

before commission × Rate of commission / (100 + Rate of commission)

Commission = 2,20,000 × 10/110 = ₹ 20,000

Related Topics