Accounts of Partnership Firms Fundamentals | Accountancy - Calculation of interest on drawings | 12th Accountancy : Chapter 3 : Accounts of Partnership Firms Fundamentals

Chapter: 12th Accountancy : Chapter 3 : Accounts of Partnership Firms Fundamentals

Calculation of interest on drawings

Calculation

of interest on drawings

Interest on drawings can

be computed by following either direct method or product method. Also if the

partners withdraw fixed amount at fixed time interval, interest on drawings may

be calculated on the basis of the average period method. Based on the dates of

drawings and the amount of drawings, different methods can be followed for

calculating interest on drawings.

(i) Direct method

Interest is calculated

on drawings for the period from the date of drawings to the date of closing

date of the accounting year. The following formula is used to compute the

interest on drawings:

Interest on drawings =

Amount of drawings x Rate of interest x Period of interest

Period of interest

refers to the period from the date of drawings to the closing date of the

accounting year. This method is suitable when different amounts are withdrawn

at different time intervals.

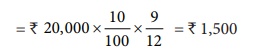

Illustration 11

Velan is a partner who

withdrew ₹ 20,000 on 1st April

2018. Interest on drawings is charged at 10% per annum. Calculate interest on

drawings on 31st December 2018 and pass journal entries by assuming fluctuating

capital method.

Solution

Interest on drawings = Amount of drawings x Rate of interest x Period of interest

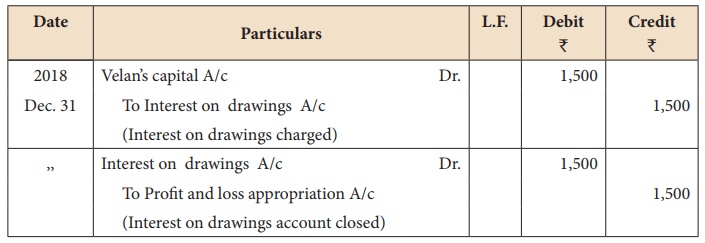

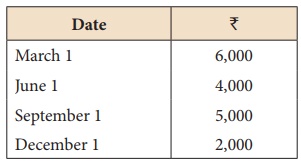

Illustration 12

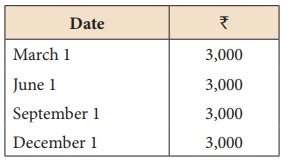

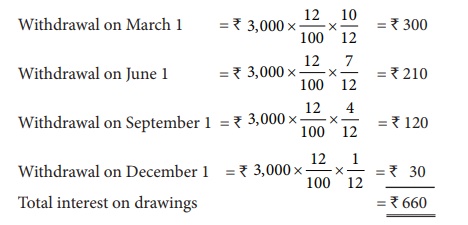

Arun is a partner in a partnership firm. As per the partnership deed, interest on drawings is charged at 12% p.a. During the year ended 31st December 2018 he drew as follows:

Calculate the amount of interest on drawings.

Solution

Interest on drawings = Amount of drawings x Rate of interest x Period of interest

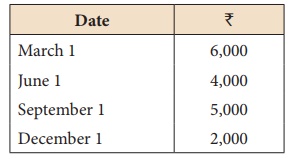

Illustration 13

Arul is a partner in a

partnership firm. As per the partnership deed, interest on drawings is charged

at 12% p.a. During the year ended 31st December 2018 he drew as follows:

Calculate the amount of interest on

drawings.

Solution

Interest on drawings = Amount of drawings × Rate of interest × Period of interest

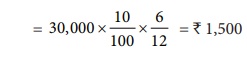

Illustration 14

Rajan is a partner who

withdrew ₹ 30,000 during the year

2018. Interest on drawings is charged at 10% per annum. Calculate interest on

drawings on 31st December, 2018.

Solution

Note: Since, date of drawings

is not given, interest is calculated for an average period of six months.

(ii) Product method

Under product method,

interest is calculated on the total of the products, that is, the product of

amount of drawings and the period for which the amount remained withdrawn. If

the product is calculated in terms of months, then interest is calculated on

the total of products at the rate per month. If the product is calculated in

terms of days, then interest is calculated on the total of products at the rate

per day. This method can be used in all situations as an alternative to direct

method.

The procedure for

calculating interest on drawings under product method is as follows:

a) Multiply each amount

withdrawn by the relevant period (in months) to find out the individual

product.

b) Find out the sum of all

the individual products.

c) Calculate interest at

the prescribed rate for one month by using the following formula.

Interest on drawings =

Sum of products x Rate of interest p.a. × 1/12

Tutorial note

If the period of

interest is taken in days, each amount withdrawn is to be multiplied by the

relevant period (in days) to find out the individual product and the following

formula is to be used to find out the interest on drawings.

Interest on drawings =

Sum of products x Rate of interest p.a. ×1/365

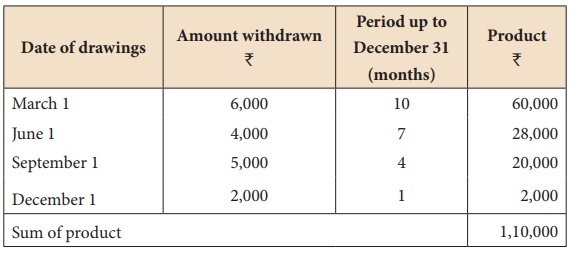

Illustration 15

Anbu is a partner in a

partnership firm. As per the partnership deed, interest on drawings is charged

at 12% p.a. During the year ended 31st December 2018 he drew as follows:

Calculate the amount of interest on drawings by using product method.

Solution

Calculation of interest

on drawings under product method

Interest on drawings = Sum of product x Rate of interest × 1/12

= 1,10,000 × 12/100 × 1/12

= ₹ 1,100

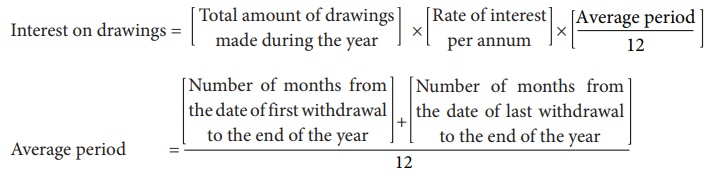

(iii) Average period method

If the partners withdraw

fixed amount at fixed time interval, interest on drawings may be calculated on

the basis of the average period. Fixed time interval refers to withdrawal made

monthly, quarterly, half-yearly, once in 2 months and once in 4 months. The

following formula may be used to calculate interest on drawings:

Average period is

computed as follows:

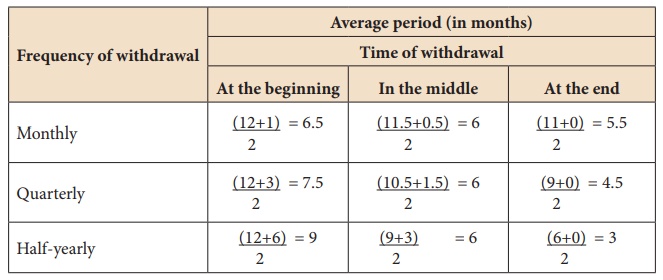

The following table

shows the average period in months for withdrawal made at the beginning, in the

middle and at the end of every month, quarter and half-year of the year.

Illustration 16

John is a partner in a

firm. He withdraws ₹

1,000 p.m. regularly. Interest on drawings is charged @ 5% p.a.

Calculate the interest on drawings using average period, if he draws

i.

at the beginning of every month

ii.

in the middle of every month

iii.

at the end of every month

Solution

Total amount withdrawn = 1,000 × 12

= ₹ 12,000

(i)

If drawings are made at the beginning of every month:

Average period = 6.5

Interest on drawings = Total amount

of drawings × Rate of interest × Average period / 12

= ₹ 12,000 x 5/100 x 6.5/12

= ₹ 325

(ii)

If drawings are made in the middle of every month:

Average period = 6

Interest on drawings = Total amount

of drawings × Rate of interest × Average period/12

= ₹ 12,000 x 5/100 x 6/12

= ₹ 300

(iii)

If drawings are made at the end of every month:

Average period = 5.5

Interest on drawings = Total amount

of drawings × Rate of interest × Average period/12

= ₹ 12,000 x 5.5/100 x 6/12

= ₹ 275

Illustration 17

Priya and Kavitha are

partners. Priya draws ₹

4,000 at the end of each quarter. Interest on drawings

is chargeable at 6% p.a. Calculate interest on drawings for the year ending

31st December 2018 using average period.

Solution

Calculation of interest

on drawings of Priya (using average period)

Total amount of drawings

= 4,000 x 4 = ₹ 16,000

If drawings are made at

the end of every quarter, average period = 4.5

Interest on drawings =

Total amount of drawings × Rate of interest × Average period / 12

= ₹ 16,000 6/100 x 4.5/12 = ₹ 360

Illustration 18

Vennila and Eswari are

partners. Vennila draws ₹

5,000 at the beginning of each half year. Interest on drawings is chargeable at

4% p.a. Calculate interest on drawings for the year ending 31st December 2018

using average period.

Solution

Calculation of interest

on drawings of Vennila (using average period)

Total amount of drawings

= 5,000 × 2 = ₹ 10,000

If drawings are made at

the end of every half year, average period = 9

Interest on drawings =

Total amount of drawings × Rate of interest × Average period/12

= ₹ 10,000 x 4/100 x9/12 = ₹ 300

Related Topics