Accounts of Partnership Firms Fundamentals | Accountancy - Salary and commission to partners | 12th Accountancy : Chapter 3 : Accounts of Partnership Firms Fundamentals

Chapter: 12th Accountancy : Chapter 3 : Accounts of Partnership Firms Fundamentals

Salary and commission to partners

Salary

and commission to partners

In some firms, remuneration

may be allowed to the partners in the form of salary or commission for the

contribution of the partners to the firm in the form of sharing skill and

expertise, managerial work done, etc. In such cases, it must be specifically

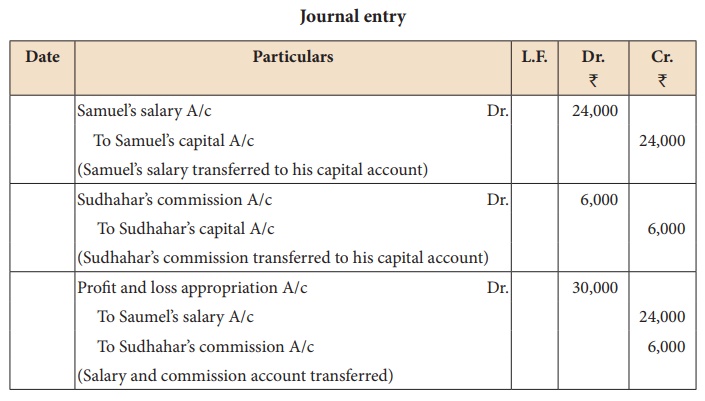

mentioned in the partnership deed. The following are the journal entries to be

passed in the books:

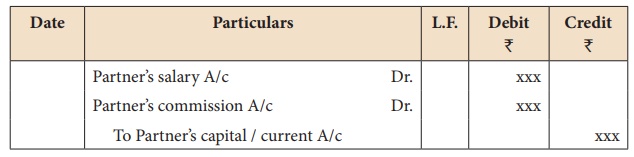

a. For partners’ salary and commission due

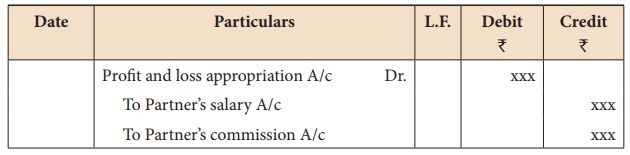

b. For closing partners’ salary and commission account at the end of the accounting year

Tutorial note: Partners are entitled to

remuneration only if there is a profit in the firm. Hence, Profit and loss

appropriation account is debited. As the remuneration is due to the partners,

capital/current account of partners is credited.

Commission to partners

may be allowed as a percentage of net profit before charging such commission or

as a percentage of net profit after charging such commission. In such cases,

commission is calculated as below:

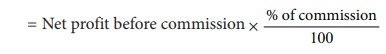

(i) Commission as a

percentage of net profit before charging such commission=

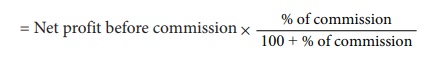

(ii) Commission as a

percentage of net profit after charging such commission=

Illustration 19

Syed, Samuel and

Sudhakar are partners in a firm sharing profits and losses equally. As per the

terms of the partnership deed, Samuel is allowed a monthly salary of ₹ 2,000 and Sudhakar is

allowed a commission of ₹

6,000 per annum for their contribution to the business of the firm. You are

required to pass the necessary journal entry. Assume that their capitals are

fluctuating.

Solution

Salary to Samuel = 2,000

x 12 = ₹ 24,000

Commission to Sudhahar =

₹ 6,000

Illustration 20

Murali and Sethu are

partners in a firm. Murali is to get a commission of 10% of net profit before

charging any commission. Sethu is to get a commission of 10% on net profit

after charging all commission. Net profit for the year ended 31st March 2019

before charging any commission was ₹

1,10,000. Find the amount of commission due to Murali and Sethu.

Solution

Calculation of commission:

Commission to Murali:

= Net profit before commission × % of

commission / 100

= 1,10,000 × 10/100 = ₹ 11,000

Commission to Sethu:

Net profit after

Murali’s commission = 1,10,000 –11,000 = ₹ 99,000

Sethu’s commission = Net

profit after Murali’s commission × [ % of commission / (100 + % of commission)

]

= 99,000 × 10/(100+10) = ₹ 9,000

Related Topics