Accounts of Partnership Firms Fundamentals | Accountancy - Methods of maintaining capital accounts of partners | 12th Accountancy : Chapter 3 : Accounts of Partnership Firms Fundamentals

Chapter: 12th Accountancy : Chapter 3 : Accounts of Partnership Firms Fundamentals

Methods of maintaining capital accounts of partners

Methods

of maintaining capital accounts of partners

Amount invested by

partners in the partnership business is called partners’ capital. Capital may

be contributed by a partner in cash or in the form of assets, etc. For each

partner, a separate capital account is maintained. Capital accounts of partners

of a firm may be maintained by following two methods: (i) Fixed capital method

and (ii) Fluctuating capital method.

1. Fixed capital method

Under fixed capital

method, the capital of the partners is not altered and it remains generally

fixed. Two accounts are maintained for each partner namely (a) Capital account

and (b) Current

account. The transactions relating to initial capital introduced, additional

capital introduced and capital permanently withdrawn are entered in the capital

account and all other transactions are recorded in the current account.

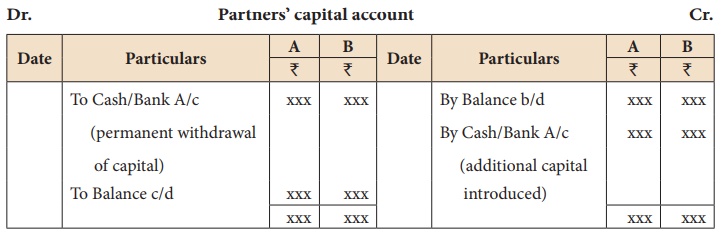

(a) Partners’ capital account

Capital account is

credited with the original amount of capital introduced by a partner into the

business and any additional capital introduced by him/her in the subsequent

years. The account is debited with the amount of capital permanently withdrawn

by a partner from the business. No other items are debited or credited to this

account. Capital account will always show credit balance under this method. The

balance of capital account remains the same unless any additional capital is

introduced or capital is permanently withdrawn.

(b) Partners’ current account

Partners’ current

account is prepared for recording all transactions between the partner and the

firm other than initial capital introduced, additional capital introduced and

capital permanently withdrawn. This account is credited with interest on

capital, partner’s salary or commission and share of profit to the partner.

This account is debited with drawings, interest on drawings and share of loss

of the partner. As a result, the balance in this account changes periodically.

Current account may show either credit balance or debit balance.

Credit balance is the

amount due to the partner from the firm. It is shown on the liabilities side of

the balance sheet. Debit balance is the amount due from the partner to the

firm. It is shown on the assets side of the balance sheet.

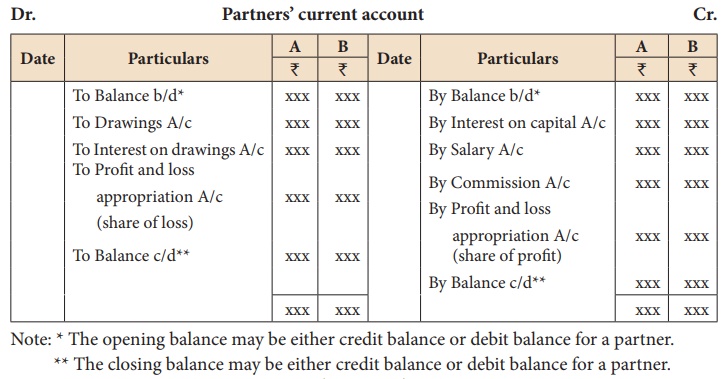

Illustration 2

From the following information,

prepare capital accounts of partners Shanthi and Sumathi, when their capitals

are fixed.

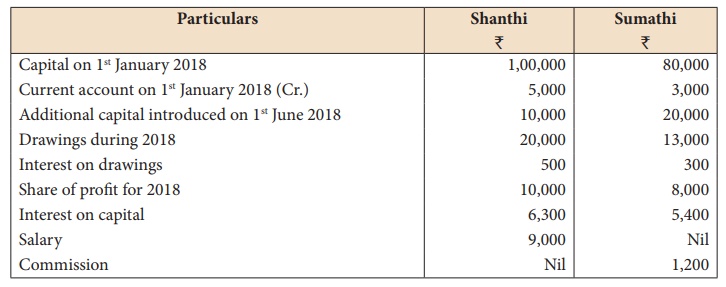

Solution

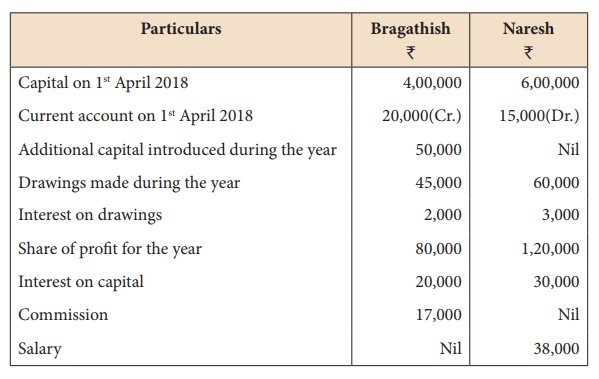

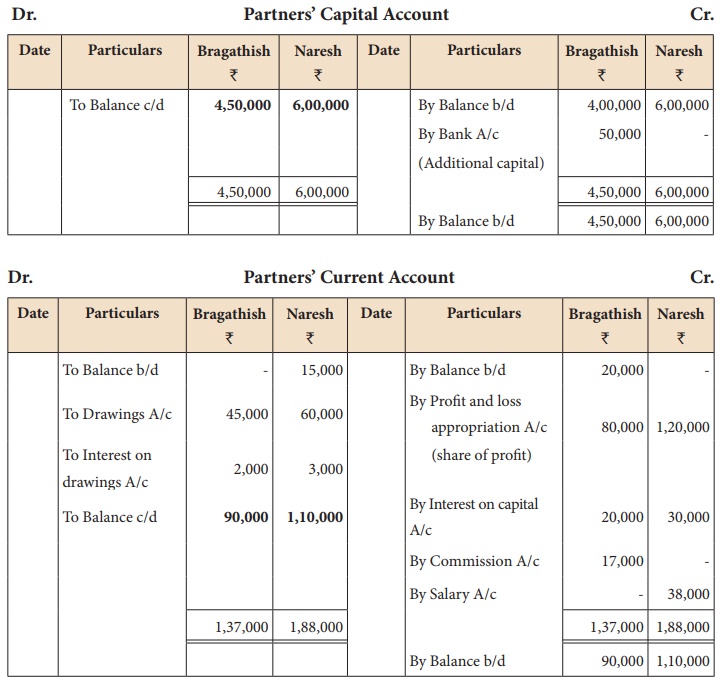

Illustration 3

Bragathish and Naresh

are partners who maintain their capital accounts under fixed capital method.

From the following particulars, prepare capital accounts of partners.

Solution

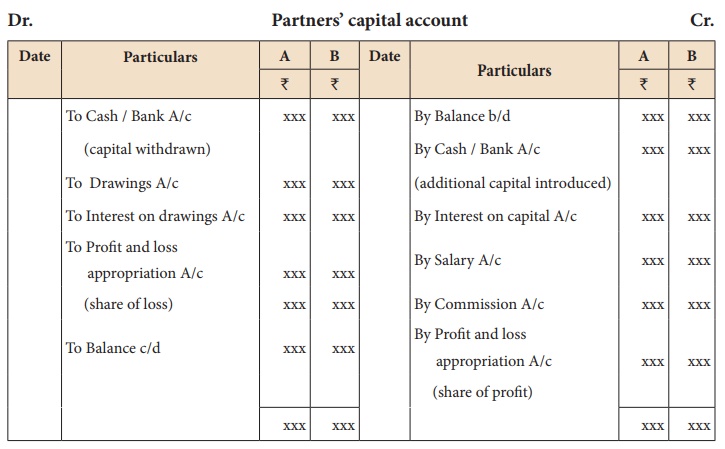

2. Fluctuating capital method

Under this method, only

capital account is maintained for each partner. All the transactions between

the partner and the firm are recorded in the capital account. This account is

credited with initial and additional capital introduced by the partner,

interest on capital, partner’s salary or commission and share of profit of the

partner. The account is debited with capital withdrawn, drawings, interest on

drawings and share of loss of the partner. As a result, the balance in this

account goes on fluctuating periodically. Under this method, the partner’s

capital account may show either credit balance or debit balance.

Format of capital account under fluctuating capital method

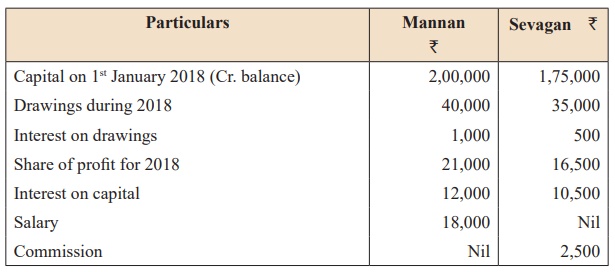

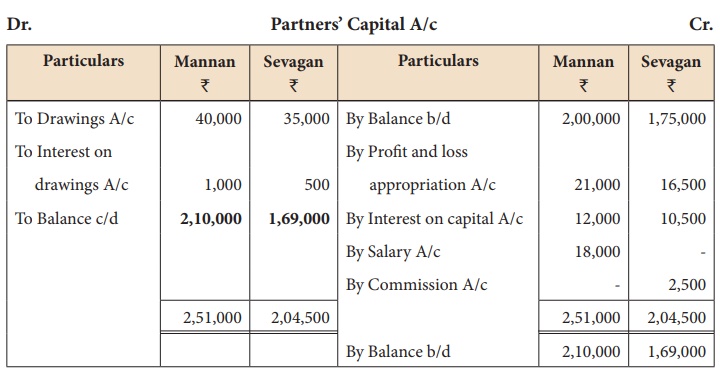

Illustration 4

From the following

information, prepare capital accounts of partners Mannan and Sevagan, when

their capitals are fluctuating.

Solution

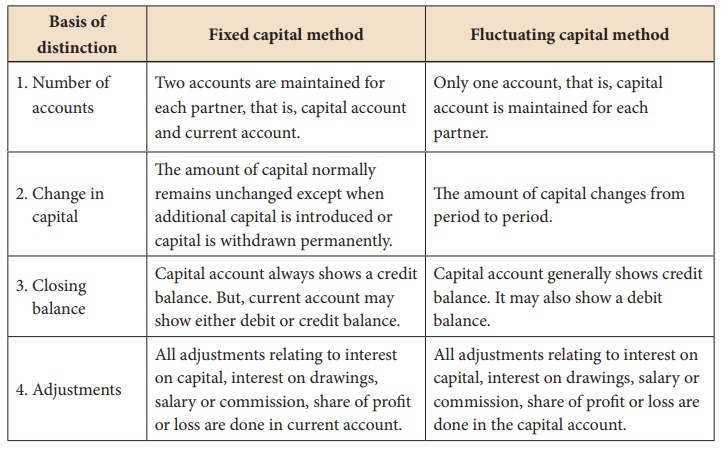

3. Differences between fixed capital method and fluctuating capital method

Following are the

differences between fixed capital method and fluctuating capital method of

maintaining capital accounts of partners:

Related Topics