Accounts of Partnership Firms Fundamentals | Accountancy - Calculation of interest on capital | 12th Accountancy : Chapter 3 : Accounts of Partnership Firms Fundamentals

Chapter: 12th Accountancy : Chapter 3 : Accounts of Partnership Firms Fundamentals

Calculation of interest on capital

Calculation of interest on capital

Interest on capital is

to be calculated on the capitals at the beginning for the relevant period. If

there is any additional capital introduced or capital withdrawn during the

year, it will cause change in the capitals and interest is to be calculated

proportionately on the changed capitals for the relevant period.

Interest on capital = Amount

of capital x Rate of interest per annum x Period of interest

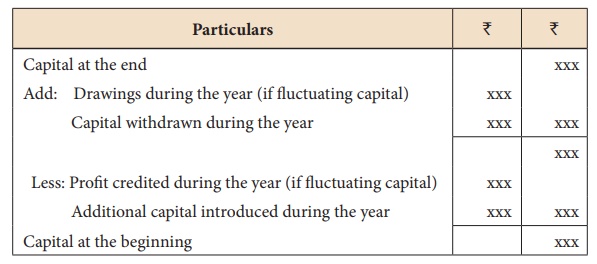

Tutorial note: If capital at the

beginning is not given, then it can be calculated as below:

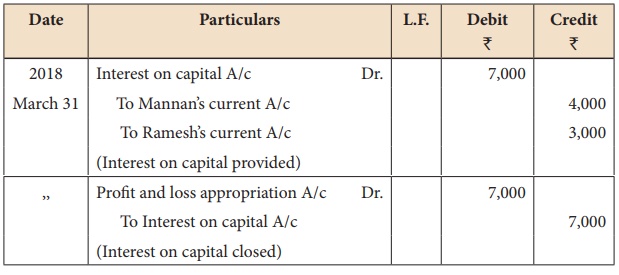

Illustration 5

Mannan and Ramesh share

profits and losses in the ratio of 3:1. The capital on 1st April 2017 was ₹ 80,000 for Mannan and ₹ 60,000 for Ramesh and

their current accounts show a credit balance of ₹ 10,000 and ₹

5,000 respectively. Calculate interest on capital at 5% p.a. for the year

ending 31st March 2018 and show the journal entries.

Solution

Calculation of interest

on capital:

Interest on capital =

Amount of capital x Rate of interest

Interest on Mannan’s

capital = 80,000 x 5/100 = ₹

4,000

Interest on Ramesh’s

capital = 60,000 x 5/100 = ₹

3,000

Note: Balance of current

account will not be considered for calculation of interest on capital.

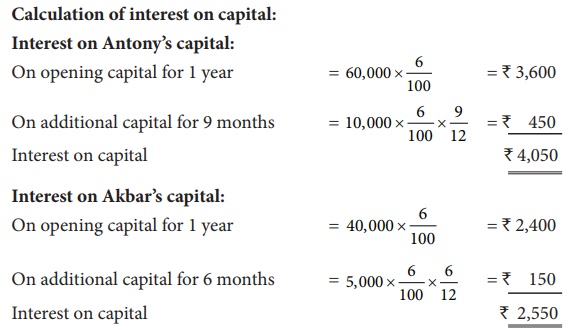

Illustration 6

Antony and Akbar were

partners who share profits and losses in the ratio of 3:2. Balance in their

capital account on 1st January 2018 was Antony ₹ 60,000 and Akbar ₹ 40,000. On 1st April 2018 Antony introduced

additional capital of ₹

10,000. Akbar introduced additional capital of ₹ 5,000 during the year. Calculate interest on

capital at 6% p.a. for the year ending 31st December 2018.

Solution

Note:

Since the date of additional capital

introduced by Akbar is not given, interest on additional capital is calculated

for an average period of 6 months.

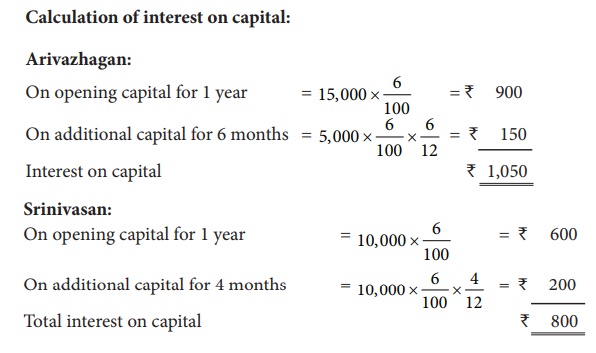

Illustration 7

The capital account of

Arivazhagan and Srinivasan on 1st January 2017 showed a balance of 15,000 and ₹ 10,000 respectively. On

1st July 2017, Arivazhagan introduced an additional capital of ₹ 5,000 and on 1st

September 2017 Srinivasan introduced an additional capital of ₹ 10,000.

Calculate interest on

capital at 6% p.a. for the year ending 31st December 2017.

Solution

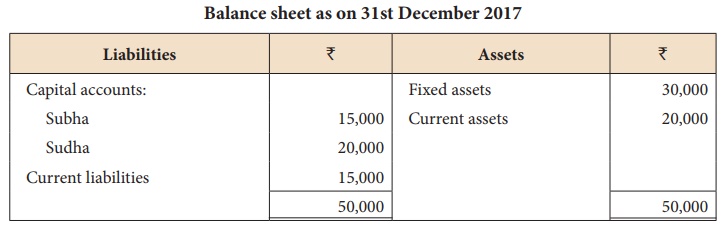

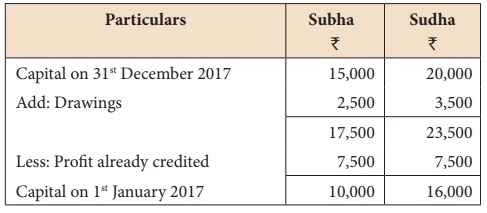

Illustration 8

From the following balance sheets of Subha and Sudha who share profits and losses equally, calculate interest on capital at 6% p.a. for the year ending 31st December 2017.

Drawings of Subha and Sudha during the year were ₹ 2,500 and ₹ 3,500 respectively. Profit earned during the year was ₹ 15,000.

Solution

Calculation of interest on capital:

Subha:

On opening capital = 10,000×[6/100] = ₹ 600

Sudha:

On opening capital = 16,000×[6/100] = ₹ 960

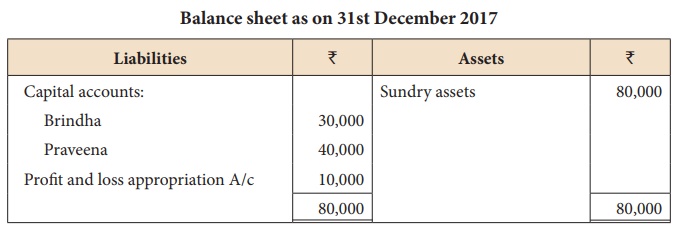

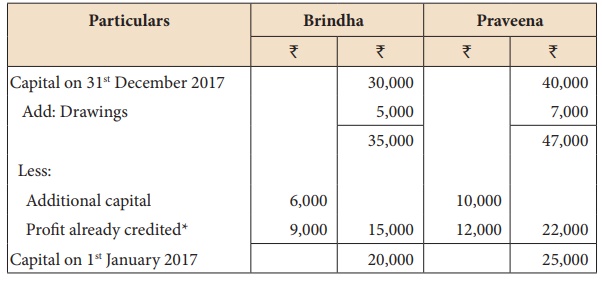

Illustration 9

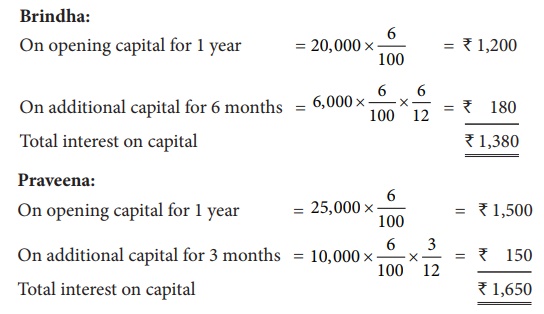

From the following

balance sheets of Brindha and Praveena who share profits and losses in the

ratio of 3:4, calculate interest on capital at 6% p.a. for the year ending 31st

December 2017.

On 1st July 2017,

Brindha introduced an additional capital of ₹

6,000 and on 1st October 2017, Praveena introduced ₹ 10,000. Drawings of

Brindha and Praveena during the year were ₹ 5,000 and ₹

7,000 respectively. Profit earned during the year was ₹ 31,000.

Solution

* Profit credited = Profit earned ₹ 31,000 – Balance profit as per balance sheet ₹ 10,000 = ₹ 21,000. This amount is distributed in their profit sharing ratio of 3:4.

Calculation of interest on capital:

Illustration 10

A and B contribute ₹ 4,00,000 and ₹ 2,00,000 respectively

as capital. Their respective share of profit is 3:2 and the profit before

interest on capital for the year is ₹

27,000. Compute the amount of interest on capital in each of the following

situations:

(i) if the partnership deed is silent as to the

interest on capital

(ii) if interest on

capital @ 3% is allowed as per the partnership deed

(iii) if the partnership

deed allows interest on capital @ 5% p.a.

Solution

(i) Interest on capital

will not be allowed as the partnership deed is silent as to the interest on

capital.

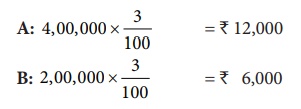

(ii) Profit before interest on capital is ₹ 27,000.

Computation of interest on capital:

Since there is sufficient profit,

interest on capital will be provided.

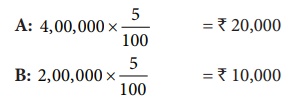

(iii) Profit before interest on

capital is ₹ 27,000.

Computation of interest on capital:

Since the profit is insufficient,

interest on capital will not be provided. Profit of ₹ 27,000 will be

distributed to the partners in their capital ratio of 2:1.

Related Topics