Chapter: Business Science : Banking Financial Services Management

Evolution , Definition and functions of Banking

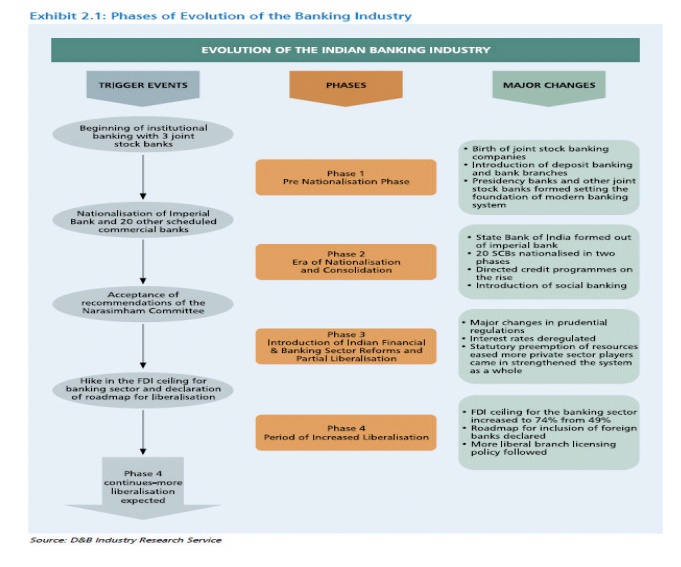

OVERVIEW OF INDIAN BANKING SYSTEM

EVOLUTION OF BANKING SECTOR

Phase I-

Pre-Nationalisation Phase (prior to 1955)

Phase II-

Era of Nationalisation and Consolidation (1955-1990)

Phase

III- Introduction of Indian Financial & Banking Sector Reforms and Partial

Liberalisation (1990-2004)

Phase IV-

Period of Increased Liberalisation (2004 onwards)

1991-1992

Ø Sub

phases 1) 1991-92 to 1997-1998 2)

1997-98 beyond

Ø Balance of payment problem

Narasimham committee I

There is

no bar to new banks being set up in private sector.

No

treatment between public & private sector sectors.

Asset

reconstruction fund

Recover

bad debts through tribunals

Branch

licensing should be abolished

Narasimham committee II

Rehabitalization

of weak banks

2 or 3

large indian banks should be given an international character.

Formulation

of corporate strategy

Capital

adequacy

Speed up

of computerization &relationship banking

Review

the recruitment procedure

Raghuram Rajan committee(committee

on financial sector reforms-2009)

Macro

economic framework and financial sector development

Broadening

access of finance

Creating

more efficient and liquid market

Creating

a growth friendly & regulatory framework

Creating

a robust infrastructure for credit.

Definition of Banking

According to the Indian Banking Companies Act , ―Banking Company is one which

transacts the business of banking which means the accepting for the purpose of

lending or investment of deposits money from the public repayable on demand or

otherwise and withdrawable by cheque, draft, order or otherwise‖.

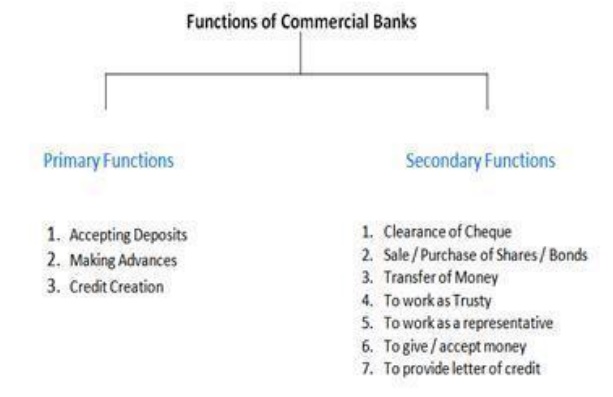

FUNCTIONS OF BANKS

The

functions of a bank may broadly be divided into two parts.

Basic or

primary functions.

Secondary

functions.

Bank

offers to deposit money in any of the following accounts:

Current or

Demand Account(one where

the amount can

be withdrawn at

any time by

the

depositor.)

Saving Account (helps in

mobilization of the saving of low income people)

Fixed Deposit Account or Term

Deposit Account:(which amounts are deposited for a certain fixed period of time. The deposits

cannot be withdrawn before the expiry of this fixed period)

Foreign Currency Account(foreign

currency saving account or foreign currency term deposit

account)

Advancing Loans:

Banks

grant loan in any of the following forms:

Overdraft

is a short-term loan granted by commercial banks to their account holders.

Under this type of loan, the customers are allowed to draw more than what they

have in their current account up to a certain limit. The excess amount

overdrawn is called overdraft.

Cash Credit:

Cash

credit is a very common form of loan granted by commercial banks to businessmen

and industrial units against the security of goods. The loan granted under this

head is credited to current account opened in the name of borrower. The

borrower can withdraw money through cheques according to his requirement. The

interest is charged on the amount actually withdrawn by the borrower.

Loans:

Commercial

banks grant loans for short and medium-term to individuals and traders against

the security of movable and immovable property. The amount of loan is credited

to the borrower's account. Interest is charged on the entire loan sanctioned.

Agency functions

General

utility functions

Miscellaneous

functions

Agency

Functions:

The banks

render important services as agent on behalf of their customers in return for a

small commission. When banks act as agent, law of agency applies. The agency

functions or services of bank are as follows:

Collection of Cheques:

Ø The commercial banks collect

dividends, interest on investment, pension and rent of property due to the

customers. When any income is collected by the bank, a credit voucher is sent

to the customer for information.

Acts as trustee:

Ø The banks act as trustee to

manage trust property as per instructions of property owners. Banks are

required to follow the terms and conditions of trust deed.

Acts as an agent:

Ø Commercial bank sometimes acts

as an agent on behalf of its customers at home or abroad in dealing with other

banks or financial institutions.

Obeys standing instructions:

Ø Sometimes, customer may order

his bank to do something on his behalf regarding the conduct of his account.

This written order is called standing instruction. The bank being the agent of

its customer obeys the standing instructions.

Acts as tax consultant:

Commercial

bank acts as tax consultant to its client. The commercial bank prepares general

sales tax return, income tax return, etc. Tiles the same with tax authorities.

General

Utility Functions:

Provides

lockers facilities:

Issue of

traveler's cheque(customers for traveling in and outside the country.)

Foreign

exchange:exchange of their home currency

Transfer

of money:provide facilities for the transfer of money to any place within and

outside the country

Finances

foreign trade:accepting foreign bills of exchange.

Trade

information:provide trade information and tender advice to its customers

Modaraba

Company:The commercial banks act as Modaraba and leasing companies under the

provisions of Modaraba Companies Ordinance, 1980.

Purchase PTCs:

Ø Commercial banks underwrite or

purchase Participation Term Certificate (PTCs), Term Finance Certificates

(TFCs) and Modaraba Certificates. This helps the companies to raise their

capital.

Financial standing:

Commercial

banks answer reference letters regarding the financial standing and business

reputation of customers. Banks provide this information with great care and

utmost secrecy.

Commercial

banks provide facilities for the collection of utility bills from general

public on behalf of government bodies. This facilitates the public to pay

utility bills in time.

Zakat Collection:

Ø Commercial banks collect Zakat

from their account holders and deposit the same into Central

Zakat

Fund, according to Zakat and Usher ordinance - 1980.

Hajj services:

Ø The commercial banks provide

free Hajj sendees to the intending pilgrims. Banks receive Hajj applications.

Banks also facilitate to form Hajj groups. Banks make necessary arrangements

for the training of intending pilgrims,

Qarz-e-Hasna:

Ø The commercial banks provide

Qarz-e-Hasna to deserving patients for medical treatment and to students for

higher studies within the country and abroad. The Qarz-e-Hasna is refund Ale in

easy installments,

Electronic banking and E-banking:

Electronic

banking is offering improved services to the customers as fellows:

ATM Cards

Credit

Cards

Electronic

transfer of money

Related Topics