Chapter: Business Science : Banking Financial Services Management : Mergers, Diversification and Performance Evaluation

Important Short Questions and Answers: Mergers, Diversification and Performance Evaluation

MERGERS,DIVERSIFICATION AND

PERFORMANCE EVALUATION

1.Define merger

It is a voluntary

amalgamation of two banks on roughly equal terms into one new legal entity.

2.Write about diversification.

Spreading

a banks assets(loans)over a wider assortment of quality borrowers,to maintain

or improve earning levels while maintaining of same level of exposure

3.What is volatility

Volatility

is limited by the fact that not all asset classes or industries or individual

companies move up and down in value at the same time or at the same rate.

4.List out the Benefits of

diversification

Lower cost of capital

Economic gain

Increases managerial efficiency

Increase in market power

Reduce earnings volatility

5.write a note on Securities

market/capital market

According to khan it is fixed a market for a long term funds.it focus is on

financing of investments in contrast to

money market

which is the institutional source of working capital finance.

6.list out the regulators of

securities market

Department of economic affair(DEA)

Department of company affair(DCA)

RBI

SEBI

7. Write about Day order

Order to

buy or sell at a specific price or better,the order expires at the end of the

day unless executed.

8.What is Good till cancelled

(gtc)

This

orders are must be confirmed semi annually,the dates on which the confirmation

periods end shall be prescribed by the exchange.

9. Write a note on Not held order

This type

of order gives discretion to the floor brokers as to time and price.the floor

broker uses his best judgement concerning the proper time to bid for stock(buy)

or offer stock(sell)during the auction process.

10,Describe the term Participate

but do not initiate(PNI)

The

customer usually gives this type of order to the broker when she has a large

order to buy or sell.

11.What is Primary market/new

issue market

The

primary market represents the new issue market where new securities.Both new

companies &existing ones can raise capital on the new issue market.

12.Write a note on Secondary

market/ Stock exchange

It is one

important constitute of capital market.stock exchange is an organized market

for purchase &sale of industrial &financial security.

13 What do you meant by

underwriting?

Underwriting

is an agreement entered into before the shares are brought before the public

that in the events of the public not taking up the whole of them the

underwriter will take an allotment of such part of the shares as the public has

not applied for .

14. List out the Types of risks

under underwriting

Preferred Risks

Standard Lives

Sub-standard Lives

Declined Lives

15.Define mutual fund.

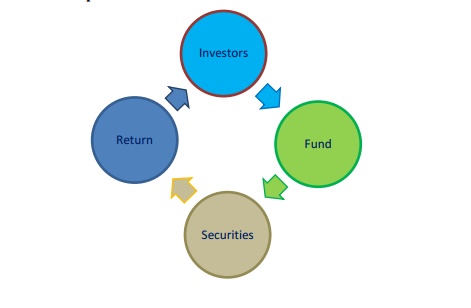

A Mutual

Fund is a trust that pools the savings of a number of investors who share a

common financial goal.The money thus collected is then invested in capital

market instruments such as shares, debentures and other securities.

16.Draw a diagram on Mutual fund

flow chart

17.Write about Open&closed

ended Schemes

Open ended Schemes are schemes which

offers unit for sale without specifying any duration for redemption. They sell

and repurchase schemes on a continuous basis.

Closed ended schemes are the schemes in

which redemption period is specified.Once the units are sold by mutual funds,

then any transaction takes place in secondary market only i.e stock exchange.Price

is determined by forces of market.

18. What is Money market Funds?

• Money

market / liquid funds invest in short-term (maturing within one year) interest

bearing debt instruments. These securities are highly liquid and provide safety

of investment, thus making money market / liquid funds the safest investment

option when compared with other mutual fund types.

19.Write about ISS

•

Industry Specific Schemes invest only in the industries specified in the offer

document. The investment of these funds is limited to specific industries like

Infotech, FMCG, Pharmaceuticals etc

20.What is sectorial funds?

Sectoral

funds are those mutual funds which invest in a particular sector of the market,

e.g. banking, information technology etc.

21.Write a note on insurance.

The

undertaking by one person to another person against loss or liability for loss

in respect of a certain risk or peril to which the object of the insurance may

be exposed, or to pay a sum of money or other thing of value upon the happening

of a certain event and includes life insurance”.

29.How to calculate CAR?

CAR= tier one capital + tier two capital / risk

weighted assets

30.Write a note on Stress testing

Marketing

value of a portfolio varies due to movement of market parameters such as

interests rates ,market liquidity, inflation , exchange rate , stock prices ,

etc…….,

31.List out the Techniques of

stress testing

Simple sensitivity test:- short term

impact of portfolio value.

scenario analysis:- Risk factors

simultaneously.

Maximum loss:-identifying the most

potentially damaging combination of moves of market risk factors

32.write a note on bancassurance?

It

meaning selling the insurance products through banks.banks and insurance come

up in a partnership wherein the bank sells the tied insurance company‟s

insurance products to its clients.

Related Topics