Chapter: Business Science : Banking Financial Services Management : Mergers, Diversification and Performance Evaluation

Mergers, Diversification and Performance Evaluation

MERGERS, DIVERSIFICATION AND PERFORMANCE EVALUATION

1 Mergers

2 Recent trends in Merger

3 Diversification of banks into securities market

4 Underwriting

1 Underwriting Process

5 Mutual funds

5.1 Types of mutual funds

6 Insurance Business

7 Performance analysis of banks

8 Ratio analysis

9 CAMELS

1 MERGERS

Voluntary amalgamation of two

firms on roughly equal terms into one

new legal entity. Mergers

are effected by exchange of the

pre-merger stock (shares) for the

stock of the new firm. Owners of each

pre-merger firm continue as owners, and the resources of the

merging entities are pooled for the benefit of the

new entity. If the merged entities were competitors, the

merger is called horizontal

integration, if they were supplier or customer of one

another, it is called vertical

integration.

2 RECENT TRENDS OF MERGERS IN

BANKS

Earnings

pressure increasing

Regulartory

scrutiny on the rise

Attractiveness

of federal deposit insurance corporation

Valuation

stabilising

Investor

groups looking for bank transactions

3 Diversification of banks

A portfolio strategy designed to reduce exposure to risk by combining a variety of investments, such as stocks, bonds, and real estate, which are

unlikely to all move in the same direction. The goal of diversification is to reduce

the risk in a portfolio. Volatility is

limited by the fact that not all asset classes or industries or individual companies move up and down in value at the same time or at the same rate. Diversification reduces both the upside and downside potential and allows for more consistent performance under a

wide range of economic conditions.

Benefits of diversification

Lower

cost of capital

Economic

gain

Increases

managerial efficiency

Increase in

market power

Reduce

earnings volatility

3.1Securities market/capital

market

According

to khan it is a market for a long term funds.it focus is on financing of fixed

investments in contrast to money market which is the institutional source of

working capital finance.

NSE

BSE

SEBI

Regulators

Department

of economic affair(DEA)

Department

of company affair(DCA)

RBI

SEBI

TYPES OF

SECURITIES MARKET

Primary

market/new issue market

Secondary

market/ Stock exchange Functions of SE

Trading

procedure in stock exchanges

Finding a

broker

• provide information

• Supply investment literature

• Availability of competent

representatives

Opening a

n account with broker

Placing

the order

Mkt order

Limit

order

Stop loss

order

Stop

order

Cancel

order/immediate order

Discretionary

order

Open

order

Fixed

price order

Other

order

Day order

Good till

cancelled (gtc)

Not held

order

Participate

but do not initiate(PNI)

All or

none order(AON)

Fill or

kill order(FOK)

Immediate

or cancel order(IOC) Making the contract

Preparing

contract note Settlement of transactions

Ready

delivery contracts

for ward

delivery contracts

Other

order

Day order

Good till

cancelled (gtc)

Not held

order

Participate

but do not initiate(PNI)

All or

none order(AON)

Fill or

kill order(FOK)

Immediate

or cancel order(IOC) Making the contract

Preparing

contract note

Settlement

of transactions

Ready

delivery contracts

for ward

delivery contracts

4 Underwriting

MEANING

Underwriting

is an agreement entered into before the shares are brought before the public

that in the events of the public not taking up the whole of them the

underwriter will take an allotment of such part of the shares as the public has

not applied for .

TYPES OF

UNDERWRITERS

Property

& casually underwriters

Liability

underwriters

Group

Underwriters

Classification of Risk in

Underwriting

Preferred

Risks

Standard

Lives

Sub-standard

Lives

Declined

Lives

4.1 Process of underwriting

Application

Medical

Examinations

Inspection

Reports

Medical

Information Bureau

Underwriting

in the Field

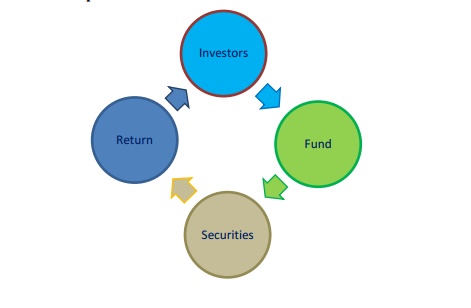

5 MUTUAL FUND

ü A Mutual Fund is a trust that

pools the savings of a number of investors who share a common financial goal.

The money

thus collected is then invested in capital market instruments such as shares,

debentures and other securities.

The

income earned through these investments and the capital appreciation realised

are shared by its unit holders in proportion to the number of units owned by

them.

Mutual Fund Operation Flow Chart

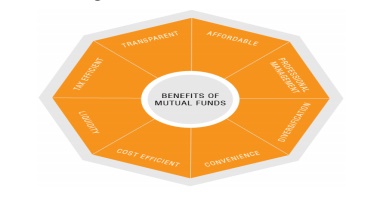

Advantages of Mutual Funds

Disadvantages of mutual fund

No control over costs: The

investor pays investment management fees as long as he remains with the fund, even while the value of

his investments are declining. He also pays for funds distribution charges

which he would not incur in direct investments.

No tailor-made portfolios: The

very high net-worth individuals or large corporate investors may find this to be a constraint as

they will not be able to build their own portfolio of shares, bonds and other

securities.

Managing a portfolio of funds:

Availability of a large number of funds can actually mean too much choice for the investor. So, he may again need advice on

how to select a fund to achieve his objectives.

Delay in redemption: It

takes 3-6 days for redemption of the units and the money to flow back into the investor‘s account.

5.1 TYPES OF MUTUAL FUNDS

On the basis of Structure

Open

ended Schemes

Closed

ended Schemes.

OPEN ENDED SCHEMES

Open

ended Schemes are schemes which offers unit for sale without specifying any

duration for redemption.

They sell

and repurchase schemes on a continuous basis.

The main

feature of such kind of scheme is liquidity

CLOSED ENDED SCHEMES

These are

the schemes in which redemption period is specified.

Once the

units are sold by mutual funds, then any transaction takes place in secondary

market only i.e stock exchange.

Price is

determined by forces of market.

On the basis of growth objective

GROWTH FUND

The aim

of growth funds is to provide capital appreciation over the medium to long-

term. Such schemes normally invest a major part of their corpus in equities.

Such funds havecomparatively high risks

INCOME FUNDS

Funds that invest in medium to long-term debt

instruments issued by private companies, banks, financial institutions,

governments and other entities belonging to various sectors (like

infrastructure companies etc.) are known as Debt / Income Funds

BALANCED FUND

These

funds provide both growth and regular income as these schemes invest in debt

and equity.The NAV of these schemes is less volatile as compared pure equity

funds.

MONEY MARKET FUNDS

Money

market / liquid funds invest in short-term (maturing within one year) interest

bearing debt instruments. These securities are highly liquid and provide safety

of investment, thus making money market / liquid funds the safest investment

option when compared with other mutual fund types.

On the basis of Special Schemes

INDUSTRY SPECIFIC SCHEMES

Industry

Specific Schemes invest only in the industries specified in the offer document.

The investment of these funds is limited to specific industries like Infotech,

FMCG, Pharmaceuticals etc

INDEX SCHEMES

In this

schemes, the funds collected by mutual funds are invested in shares forming the

Stock Exchange Index.

Example-

Nifty Index Scheme of UTI Mutual Fund and Sensex Index Scheme of Tata Mutual

Fund.

SECTORAL SCHEMES

Sectoral funds are those mutual funds which invest

in a particular sector of the market, e.g. banking, information technology etc.

Sector funds are riskier than equity diversified funds since they invest in

shares belonging to a particular sector which gives them fewer diversification

opportunities

OTHER SCHEMES

Gilt

Security Schemes

Funds of

Funds

Domestic

Funds

Tax

Saving Schemes.

Insurance

business

6 INSURANCE BUSINESS

Meaning

―The

undertaking by one person to another person against loss or liability for loss

in respect of a certain risk or peril to which the object of the insurance may

be exposed, or to pay a sum of money or other thing of value upon the happening

of a certain event and includes life insurance‖.

Characteristics of insurance

Risk

sharing

Risk

assessment

Co-operation

Payment

at the time of contingency

Larger

the number, better the care

Significance

of insurance

Protection

against risk of loss

Distribution

of risk

Specialization

of labours

Formation

of capital

Advance

of loans

Trading

and foreign operations.

7 Performance

analysis of banks BASEL norms

These

rule written by the bank of international settlements committee of banking

supervision (BCBS)

How to

assess risks, and how much capital to set aside for banks in keeping with their

risk profile.

o tier one capital + tier two capital

Ø CAR= risk

weighted assets

Objectives

To

strength soundness and stability of banking system

To

protect depositors and promote the stability and efficiency of financial

systems around the world.

Basel I Norms

Ø Maintain minimum capital adequacy requirement.

Basel II Norms

Ø banking laws and regulation.

Risk based capital(pillar I)

The first

pillar sets out minimum capital requirement.

Measurement

and risk.

Measure

operational risk and market risk.

2.Risk

based supervision

To help

better management technique.

Assess

overall capital adequacy.

Supervisor

evaluate capital adequacy.

Banks to

operate minimum capital adequacy.

Preventing measures.

Risk to

disclosure to enforce market discipline (pillar III)

It

imposes strong incentives to banks to conduct their business in a safe , sound

,and effective manner.

Criticism of Basel II norm

Not suit

for difficult situation

Examination

or evaluation and supervisors.

Developing

countries.

Face

difficulties.

BASEL III NORMS

To create

an international standard that banking regulators can use when creating

regulationabout how much capital banks need to put aside to guard against the

types of financial and operational risks banks face.

Basel III

is a comprehensive set of reform measures, developed by the Basel committee on

banking supervision, to strengthen the regulation, supervision and risk

management of the banking sector.

Improve

the banking sectors ability to absorb shocks arising financial and economic

stress whatever the sources

Improve

risk management and governance

Strengthen

banks transparency and disclosures.

The reforms target:

Micro

prudential

Macro

prudential..

The overall goals of basel III

norms are:

To refine

the definition of bank capital

Quantify

further classes of risk

To further

improve the sensitivity of the risk measures

Measurement of operational risk:

The frame work from the committee presents three

methods for calculating minimum capital charge operational risk under pillar1:

The basic

indicator approach

The

standardised approach, and

The

advanced measurement approach(AMA)

Basic

indicator approach:

Average

annual gross income (net interest income+ net non interest income )

Fixed

percentage

KBIA=[∑(GI1.n

*α)]/

Advantages:

Simple

and transparent

readily

available

Risk.

Standardised

approach:

Annual

gross income per business line

Several

indicators – size or volume of banks activities in a business line, where banks

activities

are divided into eight business lines:

HISTORICAL

SIMULATION:

Risk

factor level

Replacing

the security

Measure VAR

MONTE

CARLO SIMULATION:

Estimate

VAR

Revaluating

the all position of portfolio

More time

consuming.

PARAMETRIC

SIMULATION:

VAR

estimation directly from the standard deviation

VaR=market

price *volatility

Volatilities

and correlations are calculated directly from users specified start and end

dates Stress testing

Marketing value of a portfolio varies due to

movement of market parameters such as interests rates ,market liquidity,

inflation , exchange rate , stock prices , etc…….,

Techniques

of stress testing

Simple

sensitivity test:-

Short

term impact of portfolio value.

Scenario

analysis:-

Risk

factors simultaneously.

Maximum

loss:-

identifying

the most potentially damaging combination of moves of market risk factors

STEPS FOR STRESS TESTING

Step-1:

Generate Scenarios`

Step-2:

Revalue portfolio.

Step-3:

Summarize results.

8 Ratio Analysis

It‘s a

tool which enables the banker or lender to arrive at the following factors :

Liquidity

position

Profitability

Solvency

Financial

Stability

Quality

of the Management

Safety

& Security of the loans & advances to be or already been provided

Current Ratio : It is the relationship between

the current assets and current liabilities of a concern.

Current

Ratio = Current Assets/Current Liabilities

If the

Current Assets and Current Liabilities of a concern are Rs.4,00,000 and

Rs.2,00,000 respectively, then the Current Ratio will be :

Rs.4,00,000/Rs.2,00,000 = 2 : 1

The ideal Current Ratio preferred by Banks is 1.33 : 1

Net Working Capital : This is

worked out as surplus of Long Term Sources over Long Tern Uses, alternatively it is the difference of Current Assets and

Current Liabilities.

NWC = Current Assets – Current Liabilities

ACID TEST or QUICK RATIO : It is the

ratio between Quick Current Assets and Current Liabilities. The should be at least equal to 1.

Quick

Current Assets : Cash/Bank

Balances + Receivables upto 6 months +

Quickly

realizable

securities such as Govt. Securities or quickly marketable/quoted shares and

Bank Fixed Deposits

Acid Test

or Quick Ratio = Quick Current Assets/Current Liabilities

DEBT EQUITY RATIO : It is the relationship between

borrower‘s fund (Debt) and Owner‘s

Capital

(Equity).

Long Term

Outside Liabilities / Tangible Net Worth

Liabilities

of Long Term Nature

Total of

Capital and Reserves & Surplus Less Intangible Assets

OPERATING PROFIT RATIO :

It is expressed as => (Operating Profit / Net Sales ) x 100

Higher

the ratio indicates operational efficiency

NET PROFIT RATIO :

It is expressed as => ( Net Profit / Net Sales ) x 100

It

measures overall profitability.

9 CAMELS

Camels rating is a

supervisory rating system originally developed in the U.S. to classify a bank's overall condition. It's

applied to every bank and credit union in the U.S. (approximately 8,000

institutions) and is also implemented outside the U.S. by various banking

supervisory regulators.

The

ratings are assigned based on a ratio analysis of the financial statements,

combined with on-site examinations made by a designated supervisory regulator.

In the U.S. these supervisory regulators include the Federal Reserve, the Office of the

Comptroller of the Currency, the National Credit

Union Administration, and the Federal Deposit

Insurance Corporation.Ratings are not released to the public

but only to the top management to prevent a possible bank run on an institution which receives

a CAMELS rating downgrade. Institutions with deteriorating situations and

declining CAMELS ratings are subject to ever increasing supervisory scrutiny.

Failed institutions are eventually resolved via a formal resolution process

designed to protect retail depositors.

The components of a bank's

condition that are assessed:

(A)ssets

(E)arnings

(L)iquidity (also called

asset liability management)

(S)ensitivity (sensitivity to market risk, especially

interest rate risk)

Capital

level and trend analysis;

Compliance

with risk-based net worth requirements;

Composition

of capital;

Interest

and dividend policies and practices;

Adequacy

of the Allowance for Loan and Lease Losses account;

Quality,

type, liquidity and diversification of assets, with particular reference to

classified assets;

Loan and

investment concentrations;

Growth

plans;

Volume

and risk characteristics of new business initiatives;

Ability

of management to control and monitor risk, including credit and interest rate

risk;

Earnings.

Good historical and current earnings performance enables a credit union to fund

its growth, remain competitive, and maintain a strong capital position;

Liquidity

and funds management;

Extent of

contingent liabilities and existence of pending litigation;

Field of

membership; and

Economic

environment.

Asset Quality

Asset

quality is high loan concentrations that present undue risk to the credit

union;

The

appropriateness of investment policies and practices;

The

investment risk factors when compared to capital and earnings structure; and

The

effect of fair (market) value of investments vs. book value of investments.

(M)anagement

Management

is the most forward-looking indicator of condition and a key determinant of

whether a credit union possesses the ability to correctly diagnose and respond

to financial stress. The management component provides examiners with

objective, and not purely subjective, indicators. An assessment of management

is not solely dependent on the current financial condition of the credit union

and will not be an average of the other component ratings.

(E)arnings

The

continued viability of a credit union depends on its ability to earn an

appropriate return on its assets which enables the institution to fund

expansion, remain competitive, and replenish and/or increase capital.In

evaluating and rating earnings, it is not enough to review past and present

performance alone. Future performance is of equal or greater value, including

performance under various economic conditions. Examiners evaluate

"core" earnings: that is the long-run earnings ability of a credit

union discounting temporary fluctuations in income and one-time items. A review

for the reasonableness of the credit union's budget and underlying assumptions

is appropriate for this purpose. Examiners also consider the interrelationships

with other risk areas such as credit and interest rate.

L)iquidity - asset/liability

management

Asset/liability

management (ALM) is the process of evaluating, monitoring, and controlling

balance sheet risk (interest rate risk and liquidity risk). A sound ALM process

integrates strategic, profitability, and net worth planning with risk

management. Examiners review (a) interest rate risk sensitivity and exposure;

(b) reliance on short-term, volatile sources of funds, including any undue

reliance on borrowings; (c) availability of assets readily convertible into

cash; and (d) technical competence relative to ALM, including the management of

interest rate risk, cash flow, and liquidity, with a particular emphasis on

assuring that the potential for loss in the activities is not excessive

relative to its capital. ALM covers both interest rate and liquidity risks and

also encompasses strategic and reputation risks.

Related Topics