Chapter: Business Science : Banking Financial Services Management : Mergers, Diversification and Performance Evaluation

Mutual funds and Types of mutual funds

MUTUAL FUND

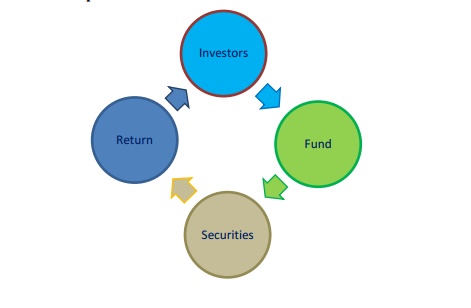

ü A Mutual Fund is a trust that

pools the savings of a number of investors who share a common financial goal.

The money

thus collected is then invested in capital market instruments such as shares,

debentures and other securities.

The

income earned through these investments and the capital appreciation realised

are shared by its unit holders in proportion to the number of units owned by

them.

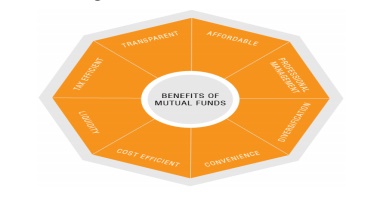

Advantages of Mutual Funds

Disadvantages of mutual fund

No control over costs: The

investor pays investment management fees as long as he remains with the fund, even while the value of

his investments are declining. He also pays for funds distribution charges

which he would not incur in direct investments.

No tailor-made portfolios: The

very high net-worth individuals or large corporate investors may find this to be a constraint as

they will not be able to build their own portfolio of shares, bonds and other

securities.

Managing a portfolio of funds:

Availability of a large number of funds can actually mean too much choice for the investor. So, he may again need advice on

how to select a fund to achieve his objectives.

Delay in redemption: It

takes 3-6 days for redemption of the units and the money to flow back into the investor‘s account.

1 TYPES OF MUTUAL FUNDS

On the basis of Structure

Open

ended Schemes

Closed

ended Schemes.

OPEN ENDED SCHEMES

Open

ended Schemes are schemes which offers unit for sale without specifying any

duration for redemption.

They sell

and repurchase schemes on a continuous basis.

The main

feature of such kind of scheme is liquidity

CLOSED ENDED SCHEMES

These are

the schemes in which redemption period is specified.

Once the

units are sold by mutual funds, then any transaction takes place in secondary

market only i.e stock exchange.

Price is

determined by forces of market.

On the basis of growth objective

GROWTH FUND

The aim

of growth funds is to provide capital appreciation over the medium to long-

term. Such schemes normally invest a major part of their corpus in equities.

Such funds havecomparatively high risks

INCOME FUNDS

Funds that invest in medium to long-term debt

instruments issued by private companies, banks, financial institutions,

governments and other entities belonging to various sectors (like

infrastructure companies etc.) are known as Debt / Income Funds

BALANCED FUND

These

funds provide both growth and regular income as these schemes invest in debt

and equity.The NAV of these schemes is less volatile as compared pure equity

funds.

MONEY MARKET FUNDS

Money

market / liquid funds invest in short-term (maturing within one year) interest

bearing debt instruments. These securities are highly liquid and provide safety

of investment, thus making money market / liquid funds the safest investment

option when compared with other mutual fund types.

On the basis of Special Schemes

INDUSTRY SPECIFIC SCHEMES

Industry

Specific Schemes invest only in the industries specified in the offer document.

The investment of these funds is limited to specific industries like Infotech,

FMCG, Pharmaceuticals etc

INDEX SCHEMES

In this

schemes, the funds collected by mutual funds are invested in shares forming the

Stock Exchange Index.

Example-

Nifty Index Scheme of UTI Mutual Fund and Sensex Index Scheme of Tata Mutual

Fund.

SECTORAL SCHEMES

Sectoral funds are those mutual funds which invest

in a particular sector of the market, e.g. banking, information technology etc.

Sector funds are riskier than equity diversified funds since they invest in

shares belonging to a particular sector which gives them fewer diversification

opportunities

OTHER SCHEMES

Gilt

Security Schemes

Funds of

Funds

Domestic

Funds

Tax

Saving Schemes.

Insurance

business

Related Topics