Chapter: Business Science : Banking Financial Services Management

Overview of Financial statement of banks

Overview of Financial statement of banks

OVERVIEW OF FINANCIAL STATEMENT

Balance sheet

Income statement

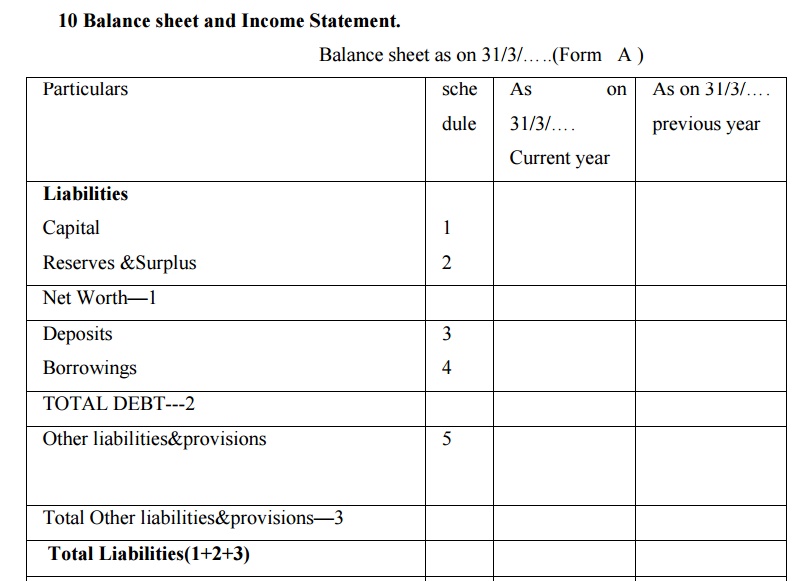

Balance sheet(banking regulation act ,1949,sec 29)

Every banking company is required to prepare with reference to that year a balance sheet & p/L account as on the last working day of the year in the form(a)&form(b) respectively set out in the third schedule .

New form

Assets &liabilities are shown in vertical form

Liabilities are shown in top line

Assets are shown in bottom line

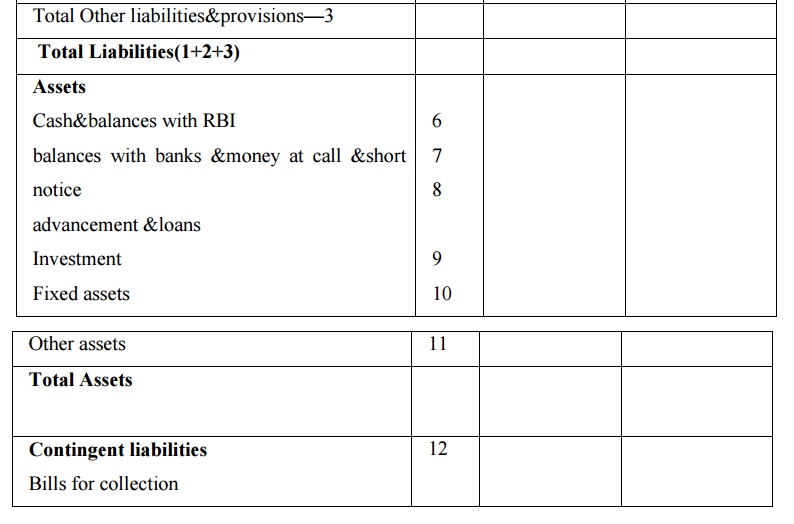

Income statement/profit &loss account statement

It is a statement which shows the incomes &expenses of the bank.

It is a type of flow report, as compared to the balance sheet, which is a status report .

It is perpared in vertical form. Focuses on

Inflows(income)

Outflows(expenses)

Net income/profit/net earning:(revenues exceeds the expenses)

Net loss:(expenses exceeds the revenues)

Form‘b‘ of the Third schedule of the banking regulation Act 1949 is used.

Sections

Income

Expenditure

Profit/loss

Appropriations

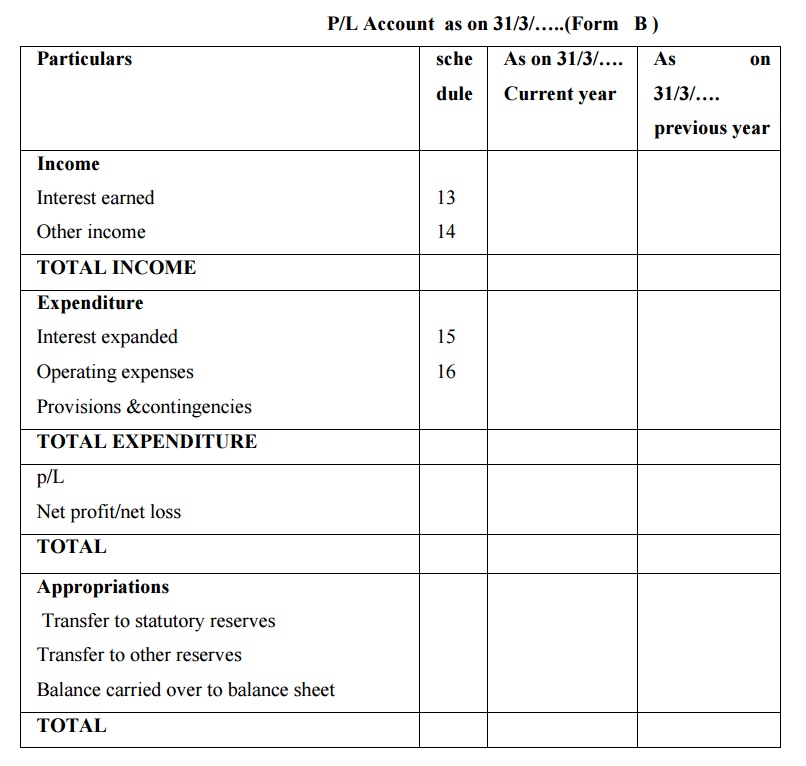

Relationship between balance sheet & income statement

Authorized capital

It is the total of the share capital which altd company is allowed to issue.it presents the upper boundary for the actually issued share capital.

Issued share capital

The total of share capital allocated to shareholders. less than authorised capital.

Subscribed capital

it is the portion of the issued capital which has been subscribed by all the investors including the public.

Called up share capital

It is the total amount of issued capital for which the shareholders are required to pay.this

may be less than the subscribed capital Paid up share capital

Is the amount of share capital paid by the shareholders. This may be less than the called

up capital as payments may be in instalments.

Reserves

Capital reserves:

These are created in particular situation such as revaluation of assets,issue of shareas and debentures at premium.

Statutory reserves

Reserves(profit) appropriate for compliance of any law. Share premium:

Amount paid by shareholders for shares in excess of their nominal value

Related Topics