Chapter: Business Science : Security Analysis and Portfolio Management : Investment Setting

Types of Risks in Investment

TYPES OF RISKS:

Personal Risks

This

category of risk deals with the personal level of investing. The investor is

likely to have more control over this type of risk compared to others.

Timing risk

is the risk of buying the right security at the wrong time. It

also refers to selling the right security at the wrong time. For

example, there is the chance that a few days after you sell a stock it will go

up several dollars in value. There is no surefire way to time the market.

Tenure risk

is the risk of losing money while holding onto a security. During

the period of holding, markets may go down, inflation may worsen, or a

company may go bankrupt. There is always the possibility of loss on the

company-wide level, too.

Company Risks

There are

two common risks on the company-wide level. The first, financial risk is

the danger that a corporation will not be able to repay its debts. This has a

great affect on its bonds, which finance the company's assets. The more assets

financed by debts (i.e., bonds and money market instruments), the greater the

risk. Studying financial risk involves looking at a company's management, its

leadership style, and its credit history.

Management

risk is the risk that a company's management

may run the company so poorly that it is unable to grow in value or pay

dividends to its shareholders. This greatly affects the value of its stock and

the attractiveness of all the securities it issues to investors.

Market Risks

Fluctuation in the market as a whole may

be caused by the following risks:

Market risk

is the chance that the entire market will decline, thus affecting

the prices and values of securities. Market risk, in turn, is influenced

by outside factors such as embargoes and interest rate changes. See Political

risk below.

Liquidity

risk is the risk that an investment, when

converted to cash, will experience loss in its value. When you want to

sell the stock you are currently holding, there is nobody there to buy your

stock, meaning that there is no volume in that stock.

Interest

rate risk is the risk that interest rates will

rise, resulting in a current investment's loss of value. A bondholder,

for example, may hold a bond earning 6% interest and then see rates on that

type of bond climb to 7%.

Inflation

risk is the danger that the dollars one

invests will buy less in the future because prices of consumer goods

rise. When the rate of inflation rises, investments have less purchasing power.

This is especially true with investments that earn fixed rates of return. As

long as they are held at constant rates, they are threatened by inflation.

Inflation risk is tied to interest rate risk, because interest rates often rise

to compensate for inflation. Return of investment (ROI) is less than

the market inflation rate. e.g. Return of investment (ROI) : 5%; Market

Inflation rate (IR) : 8.5%

Exchange

rate risk is the chance that a nation's currency

will lose value when exchanged for foreign currencies.

Reinvestment

risk is the danger that reinvested money will

fetch returns lower than those earned before reinvestment. Individuals

with dividend-reinvestment plans are a group subject to this risk. Bondholders

are another.

National And International

Risks

National and world events can profoundly

affect investment markets.

Economic

risk is the danger that the economy as a

whole will perform poorly. When the whole economy experiences a

downturn, it affects stock prices, the job market, and the prices of consumer

products.

Industry

risk is the chance that a specific industry

will perform poorly. When problems plague one industry, they affect the

individual businesses involved as well as the securities issued by those

businesses. They may also cross over into other industries. For example, after

a national downturn in auto sales, the steel industry may suffer financially.

Tax risk is the danger that rising taxes will make investing less

attractive. In general, nations with relatively low tax rates, such as

the United States, are popular places for entrepreneurial activities.

Businesses that are taxed heavily have less money available for research,

expansion, and even dividend payments. Taxes are also levied on capital gains,

dividends and interest. Investors continually seek investments that provide the

greatest net after-tax returns.

Political

risk is the danger that government

legislation will have an adverse affect on investment. This can be in

the form of high taxes, prohibitive licensing, or the appointment of

individuals whose policies interfere with investment growth. Political risks

include wars, changes in government leadership, and politically motivated

embargoes.

Investors and speculators:

Investors:

The

investors buy the securities with a view to invest their savings in profitable

income earning securities. They generally retain the securities for a

considerable length of time. They are assured of a profit in cash. They are

also called genuine investors.

Speculators:

The

speculators buy securities with a hope to sell them at a profit in future. They

do not retain their holdings for a longer period. They buy the securities with

the object of selling them and not to retain them. They are interested only in

price differentials. They are not genuine investors.

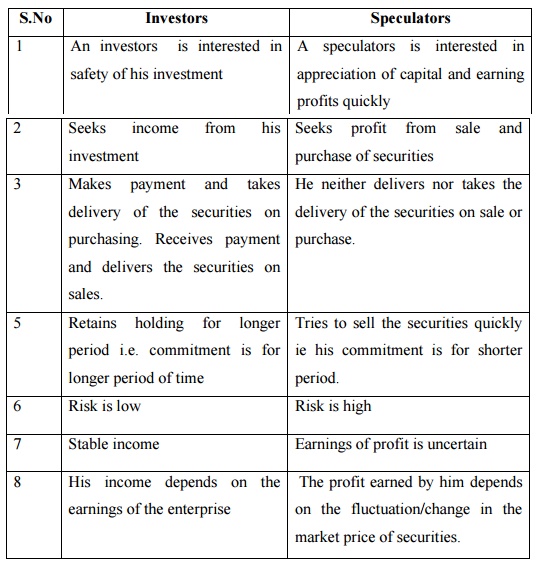

Differences between

investors and speculators:

Investors

1 An investors is

interested in safety of his investment

2 Seeks income from his

investment

3 Makes payment and

takes delivery of the securities on purchasing. Receives payment and delivers

the securities on sales.

4 Retains holding for

longer period i.e. commitment is for longer period of time

5 Risk is low

6 Stable income

7 His income depends on

the earnings of the enterprise

Speculators

1 A speculators is

interested in appreciation of capital and earning profits quickly

2 Seeks profit from

sale and purchase of securities

3 He neither delivers

nor takes the delivery of the securities on sale or purchase.

4 Tries to sell the

securities quickly ie his commitment is for shorter period.

5 Risk is high

6 Earnings of profit is

uncertain

7 The profit earned by

him depends on the fluctuation/change in the market price of securities.

Speculation:

Speculation

refers to the buying and selling of securities in the hope of making a profit

from expected change in the price of securities. Those who engage in such

activity are known as speculators.

A

speculator may buy securities in expectation of rise in price. If his

expectation comes true, he sells the securities for a higher price and makes a

profit. Similarly a speculator may expect a price to fall and sell securities

at the current high price to buy again when prices decline. He will make a

profit if prices decline as expected. The benefits of speculation are:

1. It leads to smooth change and prevents wide fluctuations in

security prices at different times and places

2. Speculative activity and the resulting effect in the prices of

securities provided a guidance to the public about the market situation.

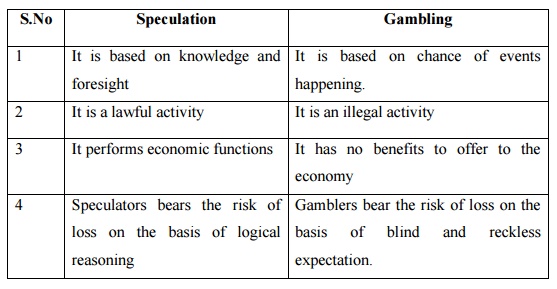

Differences between speculation and gambling:

Speculation

1 It is based on

knowledge and foresight

2 It is a lawful

activity

3 It performs economic

functions

4 Speculators bears the

risk of loss on the basis of logical reasoning

Gambling

1 It is based on chance

of events happening.

2 It is an illegal

activity

3 It has no benefits to

offer to the economy

4 Gamblers bear the

risk of loss on the basis of blind and reckless expectation.

Related Topics