Chapter: Business Science : Security Analysis and Portfolio Management : Investment Setting

Basic Investment Objectives

Basic Investment Objectives

Investment

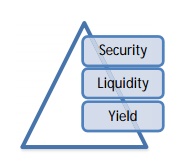

triangle three compromising objectives

Any

investment decision will be influenced by three objectives security, liquidity

and yield. A best investment decision will be one, which has the best possible

compromise between these three objectives.

∑ Security:

Central to any investment

objective, we have to basically ensure the safety of the principal. One can

afford to lose the returns at any given point of time but s/he can ill afford

to lose the very principal itself. By identifying the importance of security,

we will be able to identify and select the instrument that meets this

criterion. For example, when compared with corporate bonds, we can vouch safe

the safety of return of investment in treasury bonds as we have more faith in

governments than in corporations. Hence, treasury bonds are highly secured

instruments. The safest investments are usually found in the money market and include such

securities as Treasury bills (T-bills), certificates of deposit (CD), commercial paper or bankers' acceptance slips; or in

the fixed income (bond) market in the form of municipal and other government

bonds, and in corporate bonds

∑ Liquidity:

Because we may have to convert our

investment back to cash or funds to meet our unexpected demands and needs, our

investment should be highly liquid. They should be en cashable at short notice,

without loss and without any difficulty. If they cannot come to our rescue, we

may have to borrow or raise funds externally at high cost and at unfavorable

terms and conditions. Such liquidity can be possible only in the case of

investment, which has always-ready market and willing buyers and sellers. Such

instruments of investment are called highly liquid investment.

∑ Yield:

Yield is best described as the net

return out of any investment. Hence given the level or kind of security and

liquidity of the investment, the appropriate yield should encourage the investor

to go for the investment. If the yield is low compared to the expectation of

the investor, s/he may prefer to avoid such investment and keep the funds in

the bank account or in worst case, in cash form in lockers. Hence yield is the

attraction for any investment and normally deciding the right yield is the key

to any investment.

Relationship:

∑ There is a tradeoff between risk (security) and return (yield) on

the one hand and liquidity and return (yield) on the other.

∑ Normally, higher the risk any investment carries, the greater will

be the yield, to compensate the possible loss. That is why, fly by night

operators, offer sky high returns to their investors and naturally our gullible

investors get carried away by such returns and ultimately lose their

investment. Highly secured investment does not carry high coupon, as it is safe

and secured.

∑ When the investment is illiquid, (i.e. one cannot get out of such

investment at will and without any loss) the returns will be higher, as no

normal investor would prefer such investment.

∑ These three points security, liquidity and yield in any investment

make an excellent triangle in our investment decision-making. Ideally, with

given three points of any

triangle, one can say the center of the

triangle is fixed. In our investment decision too, this center the best meeting

point for S, L and Y is important for our consideration.

∑ However,

if any one or two of these three points are disturbed security, liquidity and yield in any investment the center of

the triangle would be disturbed and one may have to revisit the investment

decision either to continue the investment or exit the investment.

∑ All these points security, liquidity and yield are highly dynamic

in any market and they are always subject to change and hence our investor has

to periodically watch his/her investment and make appropriate decisions at the

right time.

∑ If our investor fails to monitor her / his investment, in the

worst circumstances, s/he may lose the very investment.

∑ Thus, we will return to our original statement - A best investment decision will be one, which has the best possible compromise between these three objectives security, liquidity and yield.

Related Topics