Chapter: Business Science : Security Analysis and Portfolio Management : Investment Setting

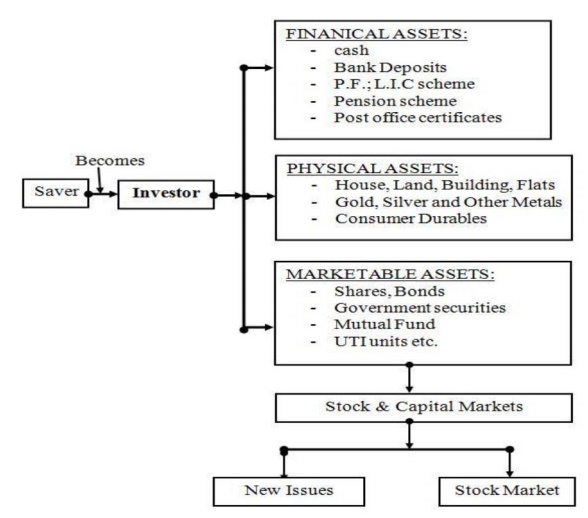

Types of investment: or various investment alternatives /avenues

Types

of investment: or various investment alternatives /avenues

Non-marketable Financial Assets:

A good

portion of financial assets is represented by non-marketable financial assets.

A distinguishing feature of these assets is that they represent personal

transactions between the investor and the issuer. For example, when you open a

savings bank account at a bank you deal with the bank personally. In contrast

when you buy equity shares in the stock market you do not know who the seller

is and you do not care. These can be classified into the following broad

categories:

∑ Post office deposits

∑ Company deposits

∑ Provident fund deposits

∑ Bank deposits

Equity Shares:

∑ Equities are a type of security that represents the ownership in a

company. Equities are traded (bought and sold) in stock markets. Alternatively,

they can be purchased via the Initial Public Offering (IPO) route, i.e.

directly from the company. Investing in equities is a good long-term investment

option as the returns on equities over a long time horizon are generally higher

than most other investment avenues. However, along with the possibility of

greater returns comes greater risk. Equity shares are classified into the

following broad categories by stock market analysts:

∑ Blue chip shares

∑ Growth shares

∑ Income shares

∑ Cyclical shares

∑ Speculative shares

Bonds:

Bond is a debt instrument issued for a period of more than one year with

the purpose of raising capital by borrowing.

It is

certificates acknowledging the money lend by a bondholder to the company. It

states it maturity date, interest rate, and par value.

The Federal government, states, cities, corporations, and many

other types of institutions sell bonds. When an investor buys a bond, he/she

becomes a creditor of the issuer. However, the buyer does not gain any kind of ownership rights to the issuer,

unlike in the case of equities. On the hand, a bond holder has a greater claim on an issuer's income than a shareholder in the case of financial distress (this is true

for all creditors). The yield from a bond is made up of

three components: coupon interest, capital gains and interest on

interest (if a bond pays no coupon interest, the only yield will be capital

gains). A bond might be sold at above or below par (the amount paid out at maturity), but

the market price will approach par value as the bond approaches

maturity. A riskier bond has to provide a higher payout to compensate for that additional risk. Some bonds are tax-exempt, and these are typically

issued by municipal, county or state governments, whose interest payments are not subject to federal income tax, and sometimes also

state or local income tax.

Bonds may be classified into the

following categories:

∑ Government securities

∑ Government of India relief bonds

∑ Government agency securities

∑ PSU bonds

∑ Debentures of private sector companies

∑ Preference shares

Money Market Instruments:

Debt

instruments which have a maturity of less than one year at the time of issue

are called money market instruments. The important money market instruments

are:

∑ Treasury bills

∑ Commercial paper

∑ Certificates of deposits

Mutual Funds:

Instead of

directly buying equity shares and/or fixed income instruments, you can

participate in various schemes floated by mutual funds which, in turn, invest

in equity shares and fixed income securities.

A mutual

fund is made up of money that is pooled together by a large number of investors

who give their money to a fund manager to invest in a large portfolio of stocks

and / or bonds

Mutual fund

is a kind of trust that manages the pool of money collected from various

investors and it is managed by a team of professional fund managers (usually

called an Asset Management Company) for a small fee. The investments by the Mutual Funds are

made in equities, bonds, debentures, call money etc., depending on the terms of

each scheme floated by the Fund. The current value of such investments is now a

day is calculated almost on daily basis and the same is reflected in the Net

Asset Value (NAV) declared by the funds from time to time. This NAV keeps on

changing with the changes in the equity and bond market. Therefore, the

investments in Mutual Funds is not risk free, but a good managed Fund can give

you regular and higher returns than when you can get from fixed deposits of a

bank etc.

There are three broad types of mutual

fund schemes:

∑ Equity schemes

∑ Debt schemes

∑ Balanced schemes

Life Insurance:

In a broad

sense, life insurance may be viewed as an investment. Life insurance is

a contract between the policy holder and the insurer, where the insurer

promises to pay a designated beneficiary a sum of money (the

"benefits") upon the death of the insured person. Depending on the

contract, other events such as terminal illness or critical illness may also

trigger payment. In return, the policy holder agrees to pay a stipulated amount

(the "premium") at regular intervals or in lump sums. The important

types of insurance policies in India are:

∑ Endowment assurance policy

∑ Money back policy

∑ Whole life policy

∑ Term assurance policy

Real Estate:

For the

bulk of the investors the most important asset in their portfolio is a

residential house. In addition to a residential house, the more affluent

investors are likely to be interested in the following types of real estate:

∑ Agricultural land

∑ Semi-urban land

∑ Time share in a holiday

resort

Precious Objects:

Precious

objects are items that are generally small in size but highly valuable in

monetary terms. Some important precious objects are:

Gold and silver Precious stones Art

objects

Financial Derivative:

A financial

derivative is an instrument whose value is derived from the value of an

underlying asset. It may be viewed as a side bet on the asset. The most

important financial derivatives from the point of view of investors are:

∑ Options

∑ Futures

Non-financial

Instruments

Real

estate

∑ With the ever-increasing cost of land, real estate has come up as

a profitable investment proposition.

Gold

∑ The 'yellow metal' is a preferred investment option, particularly

when markets are volatile. Today, beyond physical gold, a number of products

which derive their value from the price of gold are available for investment.

These include gold futures and gold exchange traded funds.

Related Topics