Chapter: Business Science : Security Analysis and Portfolio Management : Investment Setting

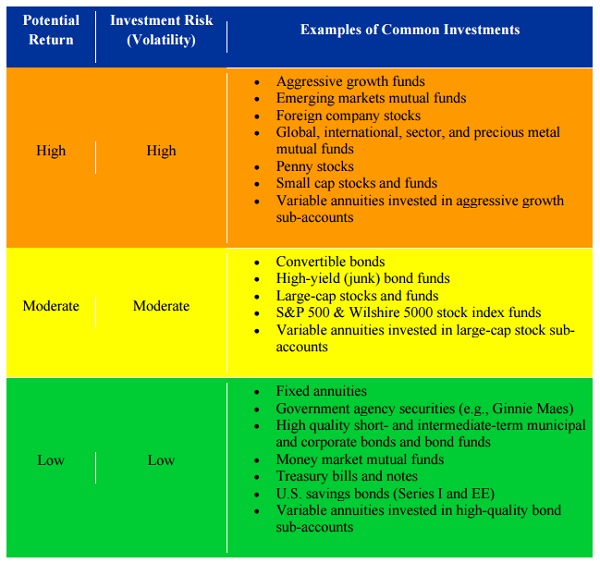

Investment Risk and Return Characteristics

Investment

Risk and Return Characteristics

The chart

below provides some examples of common types of investments classified

according to their potential return and investment risk.

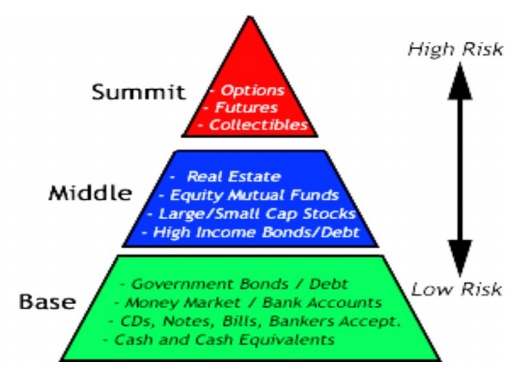

Investment Risk Pyramid

After deciding on how

much risk is acceptable in your portfolio by acknowledging your time horizon

and bankroll, you can use the risk pyramid approach for balancing your assets.

This

pyramid can be thought of as an asset allocation tool that investors can use to

diversify their portfolio investments according to the risk profile of each

security. The pyramid, representing the investor's portfolio, has three

distinct tiers:

Base of the Pyramid The foundation of the pyramid represents the strongest portion,

which supports everything above it. This area should be comprised of

investments that are low in risk and have foreseeable returns. It is the

largest area and composes the bulk of your assets.

Middle Portion This area should be made up of medium-risk investments that offer

a stable return while still allowing for capital appreciation.

Although more risky than the assets creating the base, these investments should

still be relatively safe.

Summit Reserved specifically for high-risk investments, this is the

smallest area of the pyramid (portfolio) and should be made up of

money you can lose without any serious repercussions. Furthermore, money in the

summit should be fairly disposable so that you don't have to sell prematurely

in instances where there are capital losses.

Related Topics