Chapter: Business Science : Security Analysis and Portfolio Management : Securities Markets

Financial market and Types of Financial market

FINANCIAL MARKETS

∑ In economics, a financial market is a mechanism that allows people to buy and sell (trade) financial securities (such as stocks and bonds), commodities (such as precious metals or agricultural goods), and other fungible items of value at low transaction costs and at prices that reflect the efficient-market hypothesis. Financial markets can be domestic or they can be international.

∑ In finance, financial markets facilitate:

The raising of capital (in the capital markets)

The transfer of risk (in the derivatives markets)

International trade (in the currency markets)

- And are used to match those who want capital to those who have it.

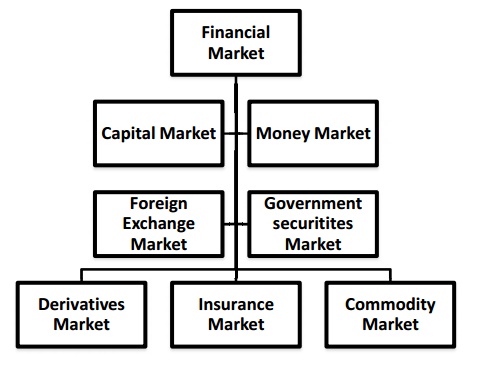

TYPES OF FINANCIAL MARKETS

The financial markets can be divided into different subtypes:

(A)Capital Market:

∑ The capital market deals in long term funds (shares and debentures). Companies raise their capital through the issue of shares and debentures.

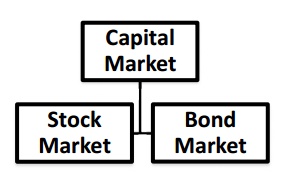

∑ Capital markets which consist of:

¸ Stock markets, which provide financing through the issuance of shares orcommon stock, and enable the subsequent trading thereof.

¸ Bond markets, which provide financing through the issuance of bonds, andenable the subsequent trading thereof.

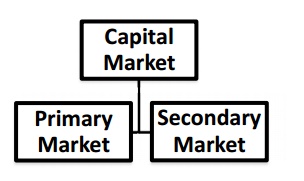

Another classification of capital market is as follows:

Primary Market:

∑ Primary market refers to the sale of shares, directly by the company at the time of promotion and the investors directly buy the shares from the company through application.

∑ Newly formed (issued) securities are bought or sold in primary markets.

∑ The share price will be mostly at par.

Secondary Market:

∑ Secondary markets allow investors to sell securities that they hold or buy existing securities.

∑ Here sale and purchase of securities will take place through the recognized stock exchanges.

∑ Only authorized persons are allowed to deal in the securities in the secondary market, who are known as brokers.

∑ Only listed securities will be traded in the stock exchanges.

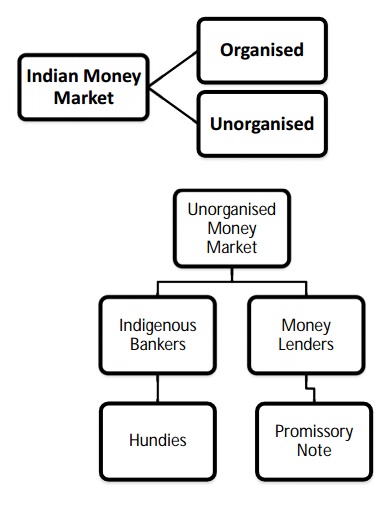

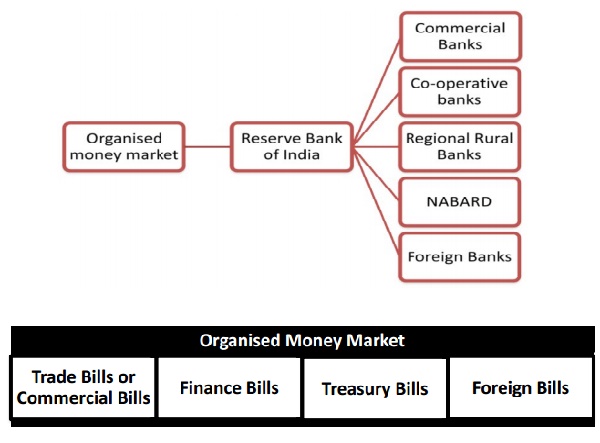

(B)Money markets:

∑ Money market deals in short term funds which provide short term debt financing and investment.

∑ In fact there is no fixed place as money market.

∑ The term money market refers to a collective name given to all the institutions which are dealing in short term funds.

∑ Money market provides working capital.

(C)Commodity Market & Derivative market& Insurance Market:

∑ Commodity markets, which facilitate the trading of commodities

∑ Derivatives markets, which provide instruments for the management of financial risk. oFutures markets, which provide standardized forward contracts for trading

products at some future date; see also forward market.

∑ Insurance markets, which facilitate the redistribution of various risks.

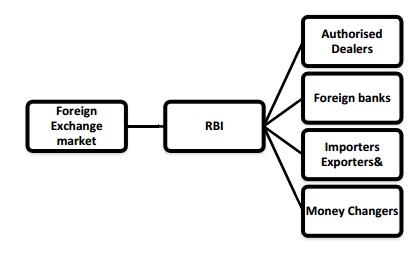

(D)Foreign exchange markets

∑ Foreign exchange markets, which facilitate the trading of foreign exchange. Foreign exchange is bought and sold and the different forms of foreign currency are dealt. InIndia, foreign exchange is held by Reserve bank of India which is the exchange control authority. We have then Foreign Exchange Regulation Act which is now renamed as Foreign Exchange Management Act (FEMA) to deal with Foreign exchange.

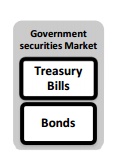

(E)Government Securities Market:

It can be divided as follows:

When government is in need of funds to meet its budgetary deficits, it goes for the issue of treasury bills and bonds.

Treasury bills and bonds:

Treasury bills are issued for raising short term funds and mainly to meet revenue expenditure. Bonds are issued for raising long term loans and these are repayable over a period of 15 or 20 years. Normally they are subscribed by financial institutions as these securities carry attractive interest rates and they can be sold easily in the market. It is for this reason; they are called as liquid assets.

The main functions of financial market are:

1) To facilitate creation and allocation of credit and liquidity.

2) To serve as intermediaries for mobilization of savings

3) To assist process of balanced economic growth;

4) To provide financial convenience

Financial market functions:

Financial markets serve six basic functions. These functions are briefly listed below:

∑ Borrowing and Lending: Financial markets permit the transfer of funds (purchasingpower) from one agent to another for either investment or consumption purposes.

∑ Price Determination: Financial markets provide vehicles by which prices are set both fornewly issued financial assets and for the existing stock of financial assets.

∑ Information Aggregation and Coordination: Financial markets act as collectors andaggregators of information about financial asset values and the flow of funds from lenders to borrowers.

∑ Risk Sharing: Financial markets allow a transfer of risk from those who undertakeinvestments to those who provide funds for those investments.

∑ Liquidity: Financial markets provide the holders of financial assets with a chance to resellor liquidate these assets.

∑ Efficiency: Financial markets reduce transaction costs and information costs.

Related Topics