Chapter: Business Science : Security Analysis and Portfolio Management : Securities Markets

Participants in Financial Market

PARTICIPANTS IN FINANCIAL MARKET:

In the financial markets, there is a flow of funds from one group of parties (funds-surplus units) known as investors to another group (funds-deficit units) which require funds. However, often these groups do not have direct link. The link is provided by market intermediaries such as brokers, mutual funds, leasing and finance companies, etc. In all, there is a very large number of players and participants in the financial market.

Brokers:

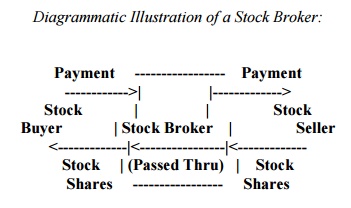

A broker is a commissioned agent of a buyer (or seller) who facilitates trade by locating a seller (or buyer) to complete the desired transaction. A broker does not take a position in the assets he or she trades -- that is, the broker does not maintain inventories in these assets. The profits of brokers are determined by the commissions they charge to the users of their services (the buyers, the sellers, or both). Examples of brokers include real estate brokers and stock brokers.

Diagrammatic Illustration of a Stock Broker:

Dealers:

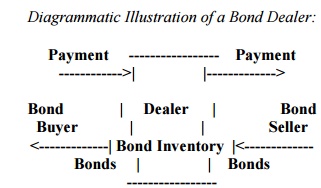

Like brokers, dealers facilitate trade by matching buyers with sellers of assets; they do not engage in asset transformation. Unlike brokers, however, a dealer can and does "take positions" (i.e., maintain inventories) in the assets he or she trades that permit the dealer to sell out of inventory rather than always having to locate sellers to match every offer to buy. Also, unlike brokers, dealers do not receive sales commissions. Rather, dealers make profits by buying assets at relatively low prices and reselling them at relatively high prices (buy low - sell high). The price at which a dealer offers to sell an asset (the "asked price") minus the price at which a dealer offers to buy an asset (the "bid price") is called the bid-ask spread and represents the dealer's profit margin on the asset exchange. Real-world examples of dealers include car dealers, dealers in U.S. government bonds, and NASDAQ stock dealers.

Diagrammatic Illustration of a Bond Dealer:

Investment Banks:

An investment bank assists in the initial sale of newly issued securities (i.e., in IPOs = Initial Public Offerings) by engaging in a number of different activities:

∑ Advice: Advising corporations on whether they should issue bonds or stock, and, for bondissues, on the particular types of payment schedules these securities should offer;

∑ Underwriting: Guaranteeing corporations a price on the securities they offer, eitherindividually or by having several different investment banks form a syndicate to underwrite the issue jointly;

∑ Sales Assistance: Assisting in the sale of these securities to the public.

Some of the best-known U.S. investments banking firms are Morgan Stanley, Merrill Lynch, Salomon Brothers, First Boston Corporation, and Goldman Sachs.

Financial Intermediaries:

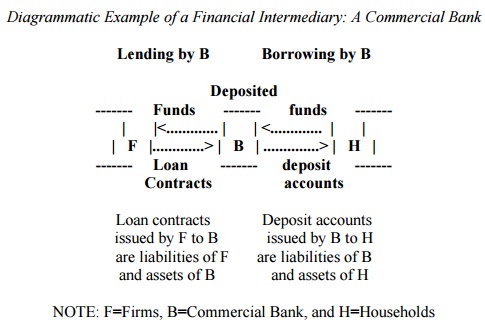

Unlike brokers, dealers, and investment banks, financial intermediaries are financial institutions that engage in financial asset transformation. That is, financial intermediaries purchase one kind of financial asset from borrowers -- generally some kind of long-term loan contract whose terms are adapted to the specific circumstances of the borrower (e.g., a mortgage) -- and sell a different kind of financial asset to savers, generally some kind of relatively liquid claim against the financial intermediary (e.g., a deposit account). In addition, unlike brokers and dealers, financial intermediaries typically hold financial assets as part of an investment portfolio rather than as an inventory for resale. In addition to making profits on their investment portfolios, financial intermediaries make profits by charging relatively high interest rates to borrowers and paying relatively low interest rates to savers.

Types of financial intermediaries include: Depository Institutions (commercial banks, savings and loan associations, mutual savings banks, credit unions);Contractual Savings Institutions(life insurance companies, fire and casualty insurance companies, pension funds, government retirement funds); and Investment Intermediaries (finance companies, stock and bond mutual funds, money market mutual funds).

Diagrammatic Example of a Financial Intermediary: A Commercial Bank

NOTE: F=Firms, B=Commercial Bank, and H=Households

These can be grouped as follows :

The individuals: These are net savers and purchase the securities issued by corporates.Individuals provide funds by subscribing to these security or by making other investments.

The Firms or corporates: The corporates are net borrowers. They require funds for differentprojects from time to time. They offer different types of securities to suit the risk preferences of investors Sometimes, the corporates invest excess funds, as individuals do. The funds raised by issue of securities are invested in real assets like plant and machinery. The income generated by these real assets is distributed as interest or dividends to the investors who own the securities. Government: Government may borrow funds to take care of the budget deficit or as a measure of controlling the liquidity, etc. Government may require funds for long terms (which are raised by issue of Government loans) or for short-terms (for maintaining liquidity) in the money market. Government makes initial investments in public sector enterprises by subscribing to the shares, however, these investments (shares) may be sold to public through the process of disinvestments.

Regulators: Financial system is regulated by different government agencies. The relationships among other participants, the trading mechanism and the overall flow of funds are managed, supervised and controlled by these statutory agencies. In India, two basic agencies regulating the financial market are the Reserve Bank of India (RBI ) and Securities and Exchange Board of India (SEBI). Reserve Bank of India, being the Central Bank, has the primary responsibility of maintaining liquidity in the money market It undertakes the sale and purchase of T-Bills on behalf of the Government of India. SEBI has a primary responsibility of regulating and supervising the capital market. It has issued a number of Guidelines and Rules for the control and supervision of capital market and investors protection. Besides, there is an array of legislations and government departments also to regulate the operations in the financial system. Market Intermediaries: There are a number of market intermediaries known as financial intermediaries or merchant bankers, operating in financial system. These are also known as investment managers or investment bankers. The objective of these intermediaries is to smoothen the process of investment and to establish a link between the investors and the users of funds. Corporations and Governments do not market their securities directly to the investors. Instead, they hire the services of the market intermediaries to represent them to the investors. Investors, particularly small investors, find it difficult to make direct investment. A small investor desiring to invest may not find a willing and desirable borrower. He may not be able to diversify across borrowers to reduce risk. He may not be equipped to assess and monitor the credit risk of borrowers. Market intermediaries help investors to select investments by providing investment consultancy, market analysis and credit rating of investment instruments. In order to operate in secondary market, the investors have to transact through share brokers. Mutual funds and investment companies pool the funds(savings) of investors and invest the corpus in different investment alternatives. Some of the market intermediaries are:

∑ Lead Managers

∑ Bankers to the Issue

∑ Registrar and Share Transfer Agents

∑ Depositories

∑ Clearing Corporations

∑ Share brokers

∑ Credit Rating Agencies

∑ Underwriters

∑ Custodians

∑ Portfolio Managers

∑ Mutual Funds

∑ Investment Companies

These market intermediaries provide different types of financial services to the investors. They provide expertise to the securities issuers. They are constantly operating in the financial market. Small investors in particular and other investors too, rely on them. It is in their (market intermediaries) own interest to behave rationally, maintain integrity and to protect and maintain reputation, otherwise the investors would not be trusting them next time. In principle, these intermediaries bring efficiency to corporate fund raising by developing expertise in pricing new issues and marketing them to the investors.

Related Topics