Depreciation Accounting | Accountancy - Calculation of profit or loss on sale of asset | 11th Accountancy : Chapter 10 : Depreciation Accounting

Chapter: 11th Accountancy : Chapter 10 : Depreciation Accounting

Calculation of profit or loss on sale of asset

Calculation of profit or loss on sale

of asset

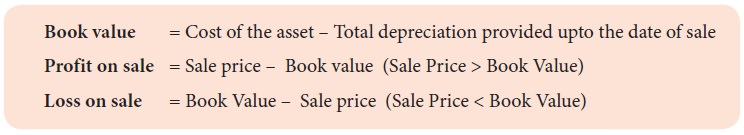

Sometimes, a business may sell an asset. In that case, the profit or

loss on sale is to be calculated and accounted in the books. To find the profit

or loss on sale of asset, the book value of the asset on the date of sale and

the sale price are to be compared. Book value of the asset on the date of sale

is calculated by subtracting the total depreciation provided on the asset from

the date of its purchase or construction to the date of sale from the original

cost of the asset. If the sale price is more than the book value of the asset,

the difference is profit. On the other hand, if the book value of the asset is

more than the sale price, the difference is loss.

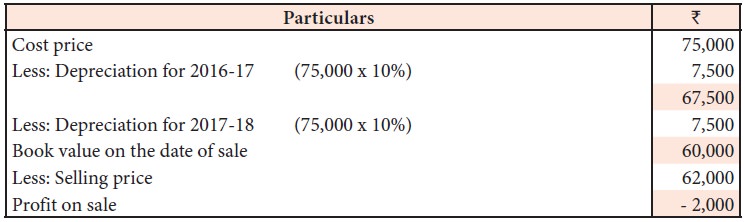

Illustration 9

Joy and Co. purchased machinery on 1st April 2016 for Rs. 75,000. On 31st March 2018, it sold the

machinery for Rs. 62,000. Depreciation is to be provided every

year at 10% per annum on the fixed instalment method. Accounts are closed on

31st March every year. Find out the profit or loss on sale of machinery.

Solution

Calculation of profit or loss on

sale of machinery

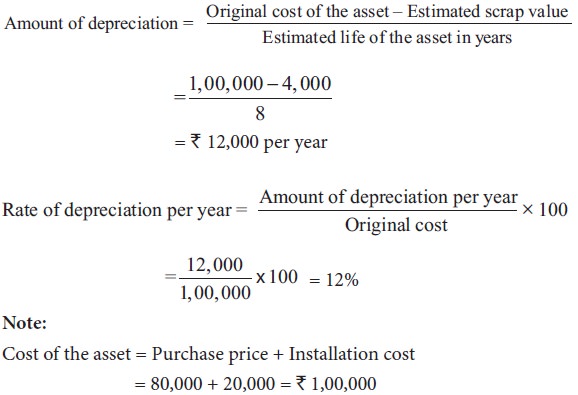

Illustration 10

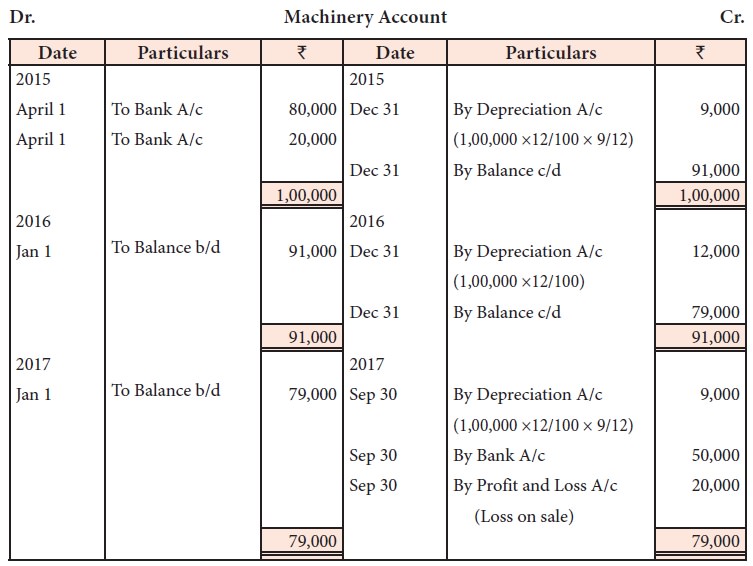

On 1st April 2015, Kumar purchased a machine for Rs. 80,000 and spent Rs. 20,000 on its installation. The residual value at the end of its expected useful life of 8 years is estimated at Rs. 4,000. On 30th September 2017, the machine is sold for Rs. 50,000. Depreciation is to be provided according to straight line method. Prepare Machinery Account. Accounts are closed on 31st December every year.

Solution

Note:

Cost of the asset = Purchase price + Installation cost = 80,000 + 20,000 = Rs. 1,00,000

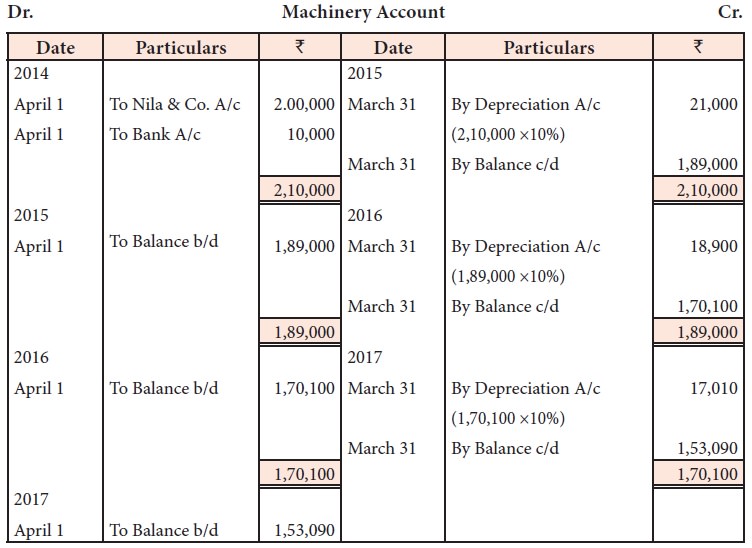

Illustration 11

M/s Ramco textile mills purchased machinery on 1st April 2014 for Rs. 2,00,000 on credit from M/s. Nila & Co.

and spent Rs. 10,000 on its installation. Depreciation is

provided at 10% per annum on the written down value method. Prepare machinery

account and depreciation account for the first three years. Books are closed on

31st March every year.

Solution

Ledger accounts

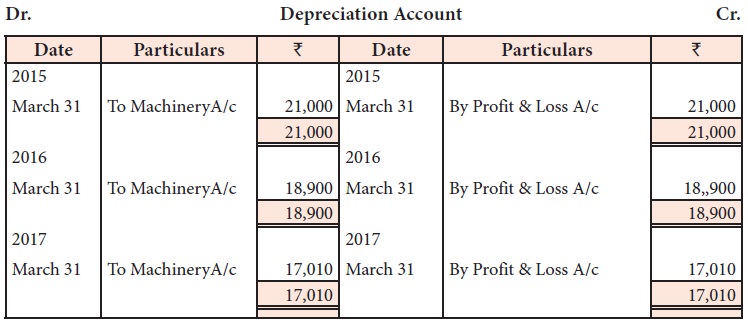

Illustration 12

A company purchased machinery costing Rs. 90,000 on

January1, 2015 and spent Rs. 10,000 on

its erection. On July 1, 2017, the machinery was sold for Rs. 58,000. The company writes off depreciation at

20% p.a. under written down value method. Prepare machinery account. The books

are closed on 31st December every year.

Solution

Ledger accounts

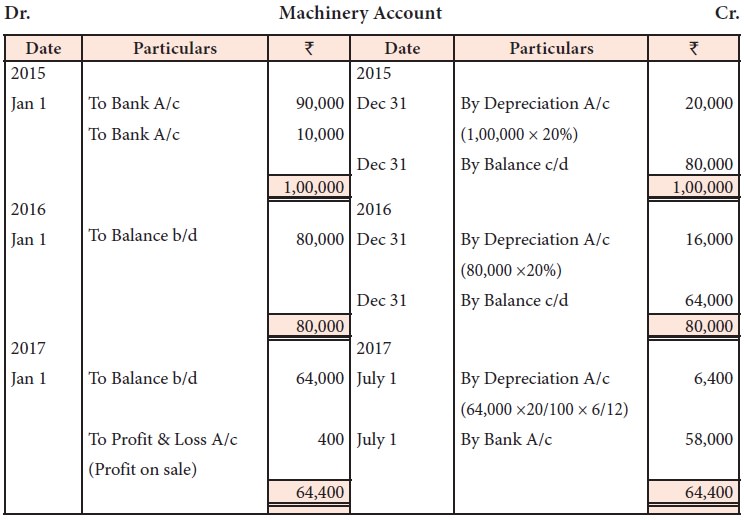

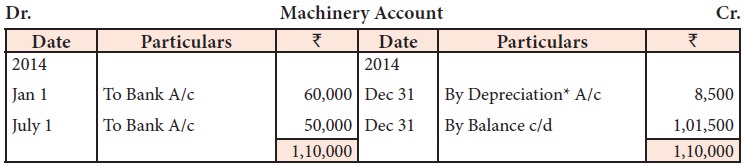

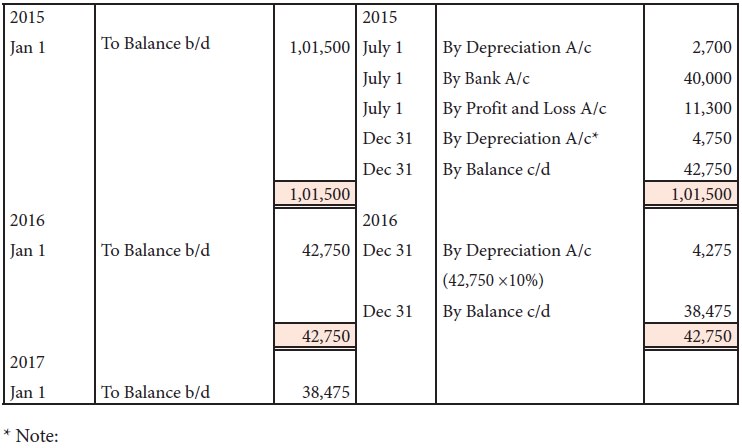

Illustration 13

A Ltd., purchased a machine on

1st January 2014 for Rs. 60,000. On 1st July 2014, it purchased another

machine for Rs. 50,000. On

1st July 2015, the company sold the machine purchased on 1st January 2014 for Rs. 40,000. It was decided that the

machine be depreciated at 10% per annum on diminishing balance method. Show the

machinery account for the years 2014 to 2016. The accounts are closed on

December 31st, every year.

Solution

Ledger accounts

Asset purchased on 1.1.14: 60,000 x 10% = 6,000

Asset purchased on 1.7.14: 50,000 x 10%x6/12 = 2,500 Rs. 8,500

2. Computation of depreciation on the asset sold on 1.7.2015

Original cost on 1.1.2014 = 60,000

Less: Depreciation for 2014 (60,000 x 10%) = 6,000

Written down value on 1.1.2015 54,000

Less: Depreciation for 2015 upto 1.7.2015

(54,000 x 10%x6/12) = 2,700

Book value 51,300

Sale price 40,000

Loss on sale of asset 11,300

3. Depreciation for 2015 for the asset purchased on 1.7.2014

Original cost on 1.7.2014 = 50,000

Less: Depreciation for 2014 (50,000 x 10%x6/12) = 2,500

Written down value on 1.1.2015 47,500

Less: Depreciation for 2015 (47,500 x 10%) = 4,750

Related Topics