Meaning, Types, Auditor's Duty - Auditing - Verification of Debentures | 12th Auditing : Chapter 6 : Verification of Liabilities

Chapter: 12th Auditing : Chapter 6 : Verification of Liabilities

Verification of Debentures

Verification of Debentures

Debentures ‚Äď Meaning

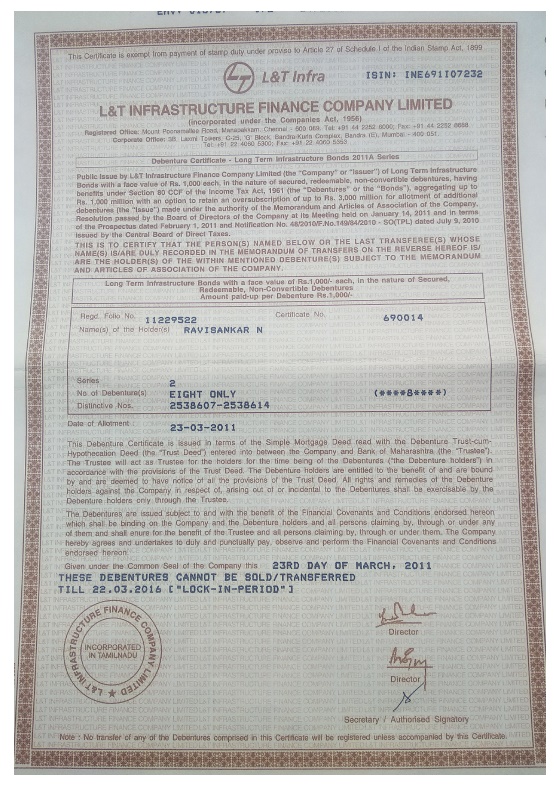

Debenture

means a document issued by a company to raise finance. It is an acknowledgement

of a debt which is given under the common seal of the company.

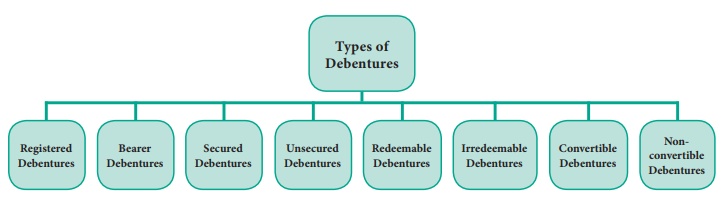

Types of Debentures

1. Registered Debentures: Registered Debentures are those which are

transferable only by transfer deed names, address and particulars of the

debentures possessed by holders are entered in the register. Interest is paid

to one whose name appears in the register.

2. Bearer Debentures: Bearer

Debentures are those which are

transferred by mere delivery and company does not keep any record of debenture

holders name and address. Payment of interest is made on submission on coupons

attached to the debentures.

3. Secured Debentures or Mortgage Debentures: Mortgage

debentures are those debentures that

are secured either on a particular asset called fixed charge or on general

assets of the company called floating charge. Mortgage debentures are also

called collateral debentures. In this case, debentures may also be issued to

banks and financial institutions as addition or subsidiary security along with

certain principal security. Lending institutions can exercise their right as

debenture-holders, if the company does not pay its loan and the principal

security falls short.

4. Un-secured or Naked Debentures: Naked

debentures are those which are not secured, companies of very good standing are

able to issue Debentures of this type. They are not very common.

5. Redeemable Debentures: Redeemable Debentures are those debentures which

are redeemed or the payment of which is made after a specified time.

Debentures

are redeemable in the following manner:

(i) At

the expiry of a specified period at par or at a premium.

(ii) Through

purchase in the open market any time, at the price prevailing in the market.

(iii) By

annual drawings.

6. Irredeemable Debentures: Irredeemable Debentures are those for which the

issuing company does not fix any date by when they should be redeemed and the

holders of such Debentures cannot demand payment from the company so long as it

is going concern. Usually such Debentures are repayable after a long period of

time or when the company is winding up.

7. Convertible Debentures: Convertible Debentures are those whose holders are

given the option to convert the debentures fully or partly in to equity shares

after a specified time. Those which are fully convertible are called fully

Convertible Debentures and those which are partly Convertible are called partly

convertible debentures.

8. Non-convertible Debentures: Non-convertible

debentures are those whose holders have no right to convert them into equity

shares.

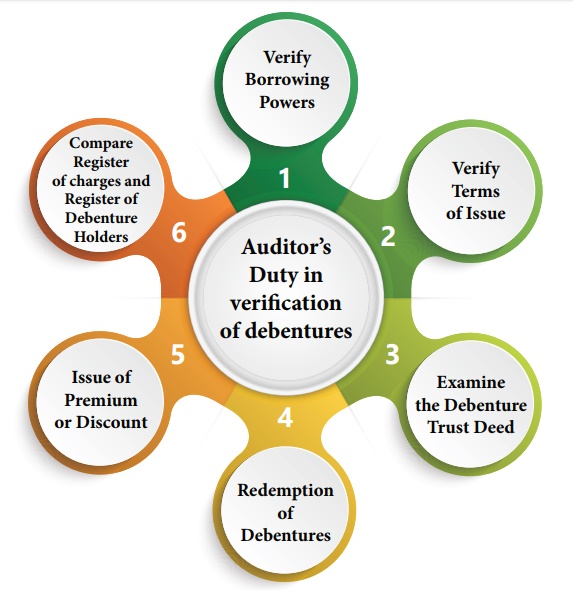

Auditor's Duty in Verification of Debentures

The

auditor should note the following points while verifying debentures:

1. Verify Borrowing Powers: The auditor should verify the Memorandum and Articles of Association of the company and verify whether the company has got the power to issue debentures and ascertain the borrowing limits of the company.

2. Verify Terms of Issue: He

should ensure that the terms of the

issue have been complied with.

3. Examine Debenture Trust Deed: He should examine the Debentures Trust

Deed to know the amount of debenture issued and securities offered and he

should obtain a certificate from the debenture holder to confirm the debenture

amount.

4. Redemption of Debentures: He should make an inquiry regarding Debenture

redemption and verify the Articles of Association for the Debenture redemption

fund.

5. Issue at Premium or Discount: He should examine whether premium or

discount on issue of Debentures are properly disclosed in the Balance Sheet.

6. Compare Register of Charges and Register of

Debenture Holders: He should

compare the register of charges and register of debenture holders and check

whether it is recorded correctly and verify that the assets mortgaged or

charged are clearly indicated in the Balance Sheet.

Related Topics