Auditing - Verification of Capital | 12th Auditing : Chapter 6 : Verification of Liabilities

Chapter: 12th Auditing : Chapter 6 : Verification of Liabilities

Verification of Capital

Verification of Capital

The

amount invested by the owner in a business concern is called as Capital. The

owner may be a sole proprietor or partner or shareholder. It is an internal

liability of the business concern and the auditor is required to verify the

genuiness and correctness of it in the Balance Sheet.

1. Verification of Capital in a Partnership Firm

The

auditor should take into consideration the following while verifying capital of

a partnership firm.

Verify Partnership Deed:

The

auditor should verify the partnership deed to find out the original capital

contributed by each partner and the rate of interest payable on capital.

Verify Capital Accounts:

He

should verify all the transactions affecting the capital accounts of the

partner.

Examine Books of Accounts:

He

should examine the cash book, pass book and withdrawals of the partner.

2. Verification of Capital in a Company

While

verifying the capital of a company, the auditor should verify the share capital

Meaning of Share Capital

Share

capital means the capital raised by issue of shares. It is the amount invested

by shareholders towards the face value of shares are collectively known as

Share Capital.

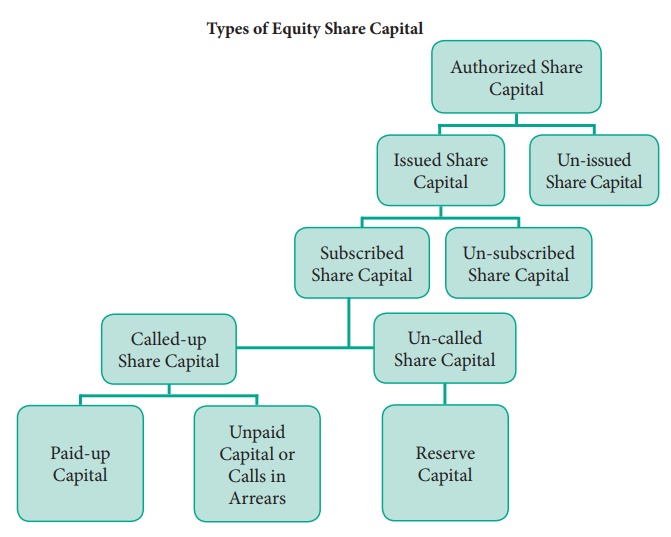

Types of Equity Share Capital

Authorised Capital: It is

the maximum amount of capital which

a company is authorised to raise and is stated in the Memorandum of

Association. It can also be called as ŌĆ£Registered CapitalŌĆØ or ŌĆ£Nominal

CapitalŌĆØ.

Issued Capital: This represents a part of the authorized capital, which is

issued to public for subscription.

Unissued Capital: The difference between authorised capital and the

issued capital represents unissued capital.

Subscribed Capital: It refers

to that part of the issued capital

which has been subscribed by the public.

Unsubscribed Capital: The

difference between issued capital

and subscribed capital represents unsubscribed capital.

Called-up Capital: This refers to that part of the subscribed capital which

has been called up by the company for payment.

Un-called Capital: The difference between subscribed and called-up capital is

called un-called capital.

Paid-up Capital: It is that part of called-up capital which has been

actually paid-up by shareholders.

Unpaid Capital: The un-paid balance in the called-up capital

Reserve Capital: A company can reserve part of its un-called capital and will

be called only at the time of winding up. A special resolution has to be passed

for this purpose. It is not disclosed in the companyŌĆÖs balance sheet.

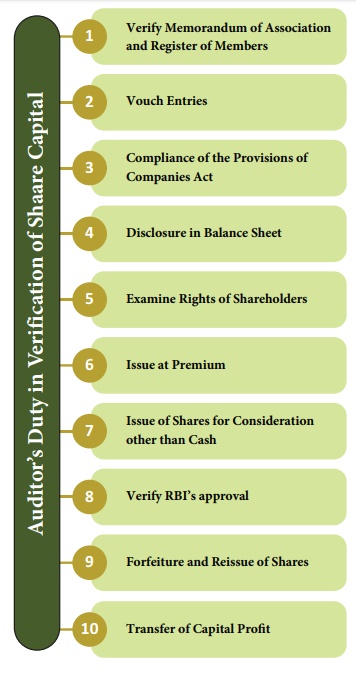

Auditor's Duty in Verification of Share Capital

The

auditorŌĆÖs role in verifying the Share Capital is listed below:

1. Verify Memorandum of Association and

Register of Members: In case of

first audit the auditor should check the Memorandum of Association, list of

share holders and register of members for verification of share capital.

2. Vouch Entries: He should examine the pass book, cash book, and Minute

book of directors in order to find out the number of shares issued, different

types of shares issued and the amount received on each shares.

3. Compliance with the Provisions of Companies

Act: In case of subsequent audits,

the auditor should ensure that share capital balance is the same as at the end

of last year. If he finds that the capital stands altered by fresh issue of

shares, the auditor should ensure that relevant provisions of the Companies Act

have been complied with.

4. Disclosure in Balance Sheet: He

should ensure that ŌĆśauthorised

capitalŌĆÖ and each class of issued and subscribed capital has been shown

separately in the Balance Sheet.

5. Examine Rights of Shareholders: He should examine the rights attached to

various shares in the Articles of the company.

6. Issue at Premium: Where the shares are

issued at premium, he should verify that they are shown separately in the

Balance Sheet.

7. Issue of Shares for Consideration other than Cash: Where the shares were allotted for consideration other

than cash, he

should examine the contract constituting with the vendor

share and minutes book of the board.

8. Verify RBIŌĆÖs Approval: Where shares are

allotted to foreign nationals, the auditor should verify RBI's permission in

this regard.

9. Forfeiture and Reissue of Shares: The

auditor should ensure that Articles of Association permit for forfeiture shares

of and check the entries regarding forfeiture and reissue of shares.

10. Transfer of Capital Profit: He

should verify that capital profit if

any on reissue of forfeited shares has been transferred to Capital Reserve.

3. Verification of Reserves and Surplus

Meaning

Reserves

and Surplus is that portion of current profits or of accumulated profits which

is not distributed as dividend, but is kept separate for purposes of meeting

some known or unknown liabilities or for fulfillment of future needs.

Auditor's Duty

Reserves

and surplus are appropriation out of profits. The auditor should verify that

the reserves and surplus are

shown on

the liability side of Balance Sheet with footnotes and verify entries in the

Profit and Loss Appropriation Account.

Related Topics