Auditing - Verification of Current Liabilities | 12th Auditing : Chapter 6 : Verification of Liabilities

Chapter: 12th Auditing : Chapter 6 : Verification of Liabilities

Verification of Current Liabilities

Verification of Current Liabilities

Current

liabilities are those liabilities which are payable within one year. This

includes bank overdraft, sundry creditors, bills payable and outstanding

expenses.

1. Sundry Creditors

MEANING

A person

who gives a benefit without receiving money or money’s worth immediately but to

claim in future is a creditor. The creditors are shown as a current liability

in the Balance Sheet.

AUDITOR’S DUTY

1. Verify Books of Prime Entry:

The

postings in purchase ledger are to be checked by verifying the books of prime entry.

The postings may be checked for part of a year.

2. Verify Statement of Accounts:

The

balances shown in credit of suppliers account are to be verified with the

statement of accounts obtained from the creditors.

3. Verify Credit Entries:

The

credit entries relating to discounts, returns, rebates etc. made in the

suppliers account are to be verified with the statement of accounts obtained

from them.

4. Accounting of Purchase Returns:

The

return outwards book is to be compared with the ledger accounts and confirm

that all the returns are supported by the credit notes of the suppliers.

5. Purchases of Subsequent Year:

The

purchase invoices relating to the period immediately following the close of the

year, are to be verified to ensure that they do not relate to the period under

audit.

6. Obtain Reasons for Outstanding Balance

The

balances outstanding for a long period is to be probed and reasons for the same

are to be found out.

7. Comparison of Gross Profit:

Percentage

of gross profits of the previous years is to be compared with the gross profits

of the year under audit. Variation if any, found to be unreasonable or omission

of purchase or inclusion of fictitious purchases are to be considered.

8. Confirmation from Management

The

auditor shall obtain from the management a certificate that all liabilities

that had accrued till the close of the accounting year are carefully accounted

for.

2. Bills Payable

MEANING

Bill

refers to bill of exchange. Bills payable means bills acccepted for the credit

purchases made. The amounts on bills are payable at the due dates. It is a

current liability.

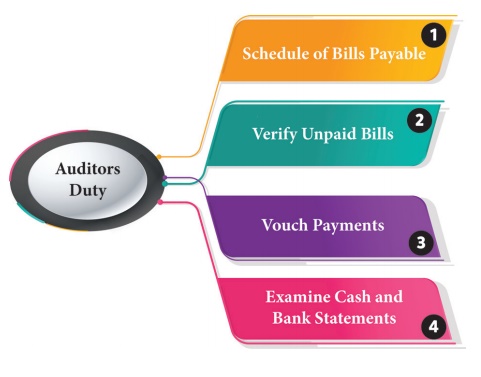

AUDITOR’S DUTY

1. Schedule of Bills Payable: The

auditor should get a schedule of

bills payable and compare with the Bills Payable Book and Account.

2. Verify Unpaid Bills: He

should verify unpaid bills and check

the subsequent payments with the cash book.

3. Vouch Payments: He should vouch the payments made against bills payable.

4. Examine Cash and Bank Statements: He

should examine cash and bank statements for the bills which are met after the

date of Balance Sheet but before the date of audit.

3. Bank Overdraft

MEANING

It is a

line of credit extended by a bank to its account holder to withdraw money in

excess of the balance in his account up to a specified limit. It is a current

liability as the business concern, i.e., being an account holder is liable to

repay the amount to the bank.

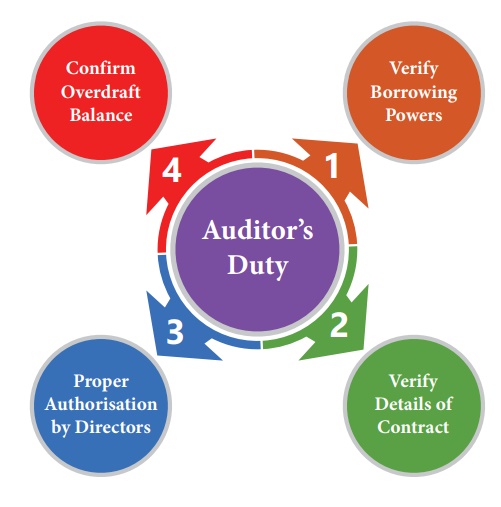

AUDITOR’S DUTY

1. Verify Borrowing Powers: The

auditor should examine the

Memorandum and Articles of Association to know the borrowing powers of the

company.

2. Verify Details of Contract: He

should study the loan contract,

terms and conditions of loan, rate of interest, nature of security, type of

pledge, etc.

3. Proper Authorisation by Directors: He should refer the minute book of

directors to know the bank overdraft is duly authorised.

4. Confirm Overdraft Balance: He

should confirm the amount of

overdraft from the bank at the close of the year.

4. Outstanding Expenses

MEANING

Expenses

which have been incurred but not yet paid during the accounting period for

which the final accounts are being prepared are called as Outstanding Expenses.

AUDITOR'S DUTY

1. Verify list of Outstanding Expenses: The

auditor should ask for a list of outstanding expenses certified by a

responsible officer from the client with classification as per the nature of

expenses.

2. Very Cash Book: He should check the next year cash book to confirm that

they have been paid off by the time of audit.

3. Compare Expenses with Previous year: He

should compare the list of outstanding

expenses of the current year with that of the previous year to identify

deviations, if any.

4. Verify Provision Created: He

should see whether necessary

provision for all outstanding expenses has been made by checking relevant

receipts and vouchers.

Related Topics